Question: Please answer it correctly, or I'll give a thumbs down Your company has been approached to bid on a contract to sell 18,000 voice recognition

Please answer it correctly, or I'll give a thumbs down

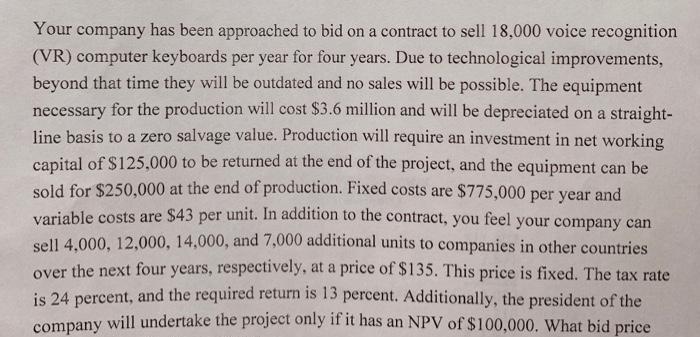

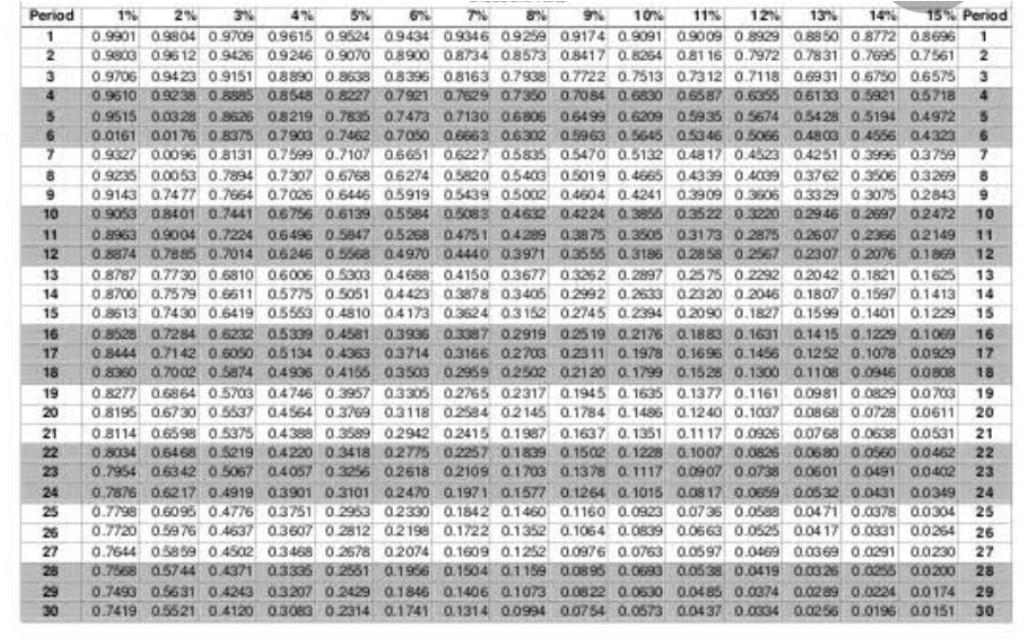

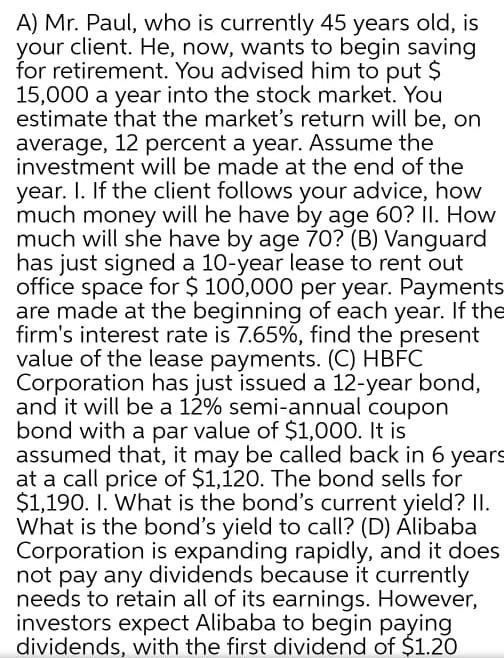

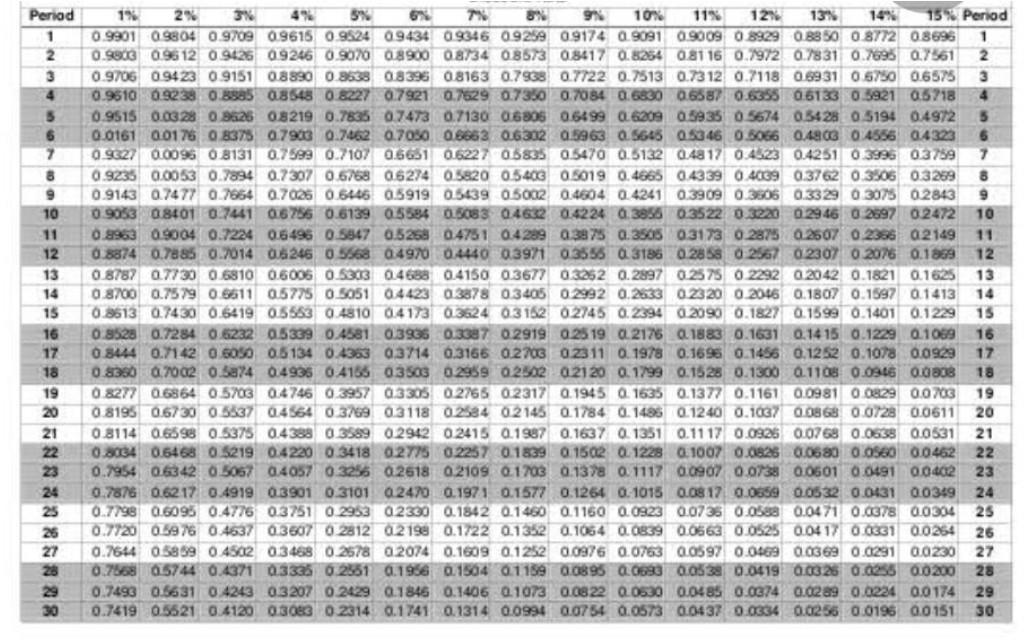

Your company has been approached to bid on a contract to sell 18,000 voice recognition (VR) computer keyboards per year for four years. Due to technological improvements, beyond that time they will be outdated and no sales will be possible. The equipment necessary for the production will cost $3.6 million and will be depreciated on a straight- line basis to a zero salvage value. Production will require an investment in net working capital of $125,000 to be returned at the end of the project, and the equipment can be sold for $250,000 at the end of production. Fixed costs are $775,000 per year and variable costs are $43 per unit. In addition to the contract, you feel your company can sell 4,000, 12,000, 14,000, and 7,000 additional units to companies in other countries over the next four years, respectively, at a price of $135. This price is fixed. The tax rate is 24 percent, and the required return is 13 percent. Additionally, the president of the company will undertake the project only if it has an NPV of $100,000. What bid price Period 1 2 4 5 6 7 8 10 11 12 13 14 15 16 17 18 19 20 21 22 1% 5% 8% 10% 11% 12 13% 15 Period 0.9901 03804 0.9709 09615 0.9524 09434 09346 0.9259 0.9174 0.9091 0.9009 0 8929 0.8850 0.8772 0.8696 1 0.9806 09612 0.3426 0.9246 0.9076 0.8900 08/34 08573 0.8417 0.8254 0.8116 0.1972 0.7831 0.7695 0.7561 2 0.9706 0.9423 0.9151 0.8890 0.8633 0.8396 08163 0.7938 0.7722 0.7513 0.7312 0.7118 0.6931 0.5750 0.6575 3 0.961009238 0.8585 08548 08227 0.7921 0.7529 0.7350 0.7084 0.6830 0.6587 0.6355 0.5133 0.5921 0.5718 4 0.9515 0.0328 0.96.25 08219 0.7835 0.7473 0.713006806 0.6499 0.6209 0.3935 0 5674 0.5428 0.519: 0.4972 5 0.0161 00176 08375 0.7923 0.7462 0.7050 0.5863 0.6302 0.5963 0.5645 0 5346 0.5066 0.4863 0.4556 0.4323 5 0.9627 0.0096 0.8131 0.7599 0.7107 0.5651 0.6227 05835 0.5470 0.3132 0.4817 0.4523 0.4251 0.3996 0.3759 7 0.9235 0.0053 0.7894 0.7307 0.6768 06274 0.5820 0.5403 0.5019 0.4665 0.4339 0.4039 0.3762 0.3506 0.3259 0.9143 0.7477 0.7654 0.7025 0.6146 0.5919 0.5439 0.5002 0.4604 0.4241 0.3909 0.3506 0.3329 0 3075 0.2843 9 0.9053 0.8401 0.7441 0.5756 0.6139 05584 05083 04632 0.4224 0.3858 0.3522 0.3220 0.2946 0.2897 0.2472 10 0.8963 09004 0.7224 0.6496 0.5947 0.5258 0.4751 0.4289 0.3875 0.3505 0.3173 0.2875 0.2507 0.2386 02149 11 0.8874 0.7885 0.7014 06246 0 5568 04970 0.4440 0.3971 03556 03186 0.2858 0.2567 0.2307 0.2076 0.1969 12 0.8787 0.7730 0.6810 0.6006 0.5303 0.4688 0.4150 0.3677 0.3252 0.2897 0.2575 0 2292 0.2042 0.1821 0.1625 13 0.8700 0.7579 0.8611 05775 0.5051 04423 0.3878 03405 0.2992 0.2633 0.23.20 0.2046 0.1007 0.1597 0.1413 14 0.3613 0.7430 0.5419 0.5563 0.4810 0.4173 0.3624 0.3162 0.2745 0.2394 0.2090 0.1827 0.1599 0.1401 0.1229 15 0.8528 0.7284 0.6232 0.5339 0.4581 0.3935 0.3387 0.2919 0.25 19 0.2176 0.1883 0.1631 0.14 15 0.1229 0.1089 16 08144 0.7142 0.6050 05134 0.4363 03714 0.3166 0.2705 02311 0.1978 0.1696 0.1456 0.1252 0.1078 0.09.29 17 0.8350 0.7002 0.5874 0.4936 0.4155 03503 0.2959 0.25020 2120 0.1799 0.1528 0.1300 0.1108 0.0946 0.0838 18 0.8277 06864 0.5703 0.4746 0.3957 03305 0.2765 0.2317 0.1945 0.1535 0.1377 0.1161 0.0981 0.0829 0.0703 19 0.8195 0.67 30 0.5537 0.4564 0 3769 0.3118 0.2584 0.2145 0.1784 0.1485 0.1240 0.1037 0.8868 0.0728 0.0611 20 0.8114 0.6598 0.5375 0.4388 0.3589 0.2942 0.2415 0.1987 0.1637 0.1351 0.1117 0.0926 0.0768 0.0538 0.0531 21 0.8034 0.5468 0.5219 0.4220 0.3418 0.2775 0.2257 0.1839 0.1502 0.1228 0.1007 0.0826 0.0680 0.0580 0.0462 22 0.7954 0.6342 0.5067 0.4057 0.3256 0.2518 0.2109 0.1703 0.1378 0.1117 0.0907 0.0738 0.0601 0.0491 0.0402 23 0.7876 0.62 17 0.4919 0.3901 0.3101 02470 0.1971 0.1577 0.1264 0.1015 0.0817 0.0559 0.0532 0.0431 0.0349 24 0.7798 0.6095 0.4776 0.3751 0.2953 0.2330 0.1842 0.1450 0.1160 0.0923 0.0736 0.05 0.0471 0.0378 0.0304 25 0.7720 0.59 76 0.4637 03607 02812 02199 0.1722 0.1352 0.1064 0.0839 0.0663 0.0525 0.0417 0.0331 0.0264 26 0.7644 0.5859 0.4502 0.3458 0.2578 0.2074 0.1609 0.1252 0.0976 0.0763 0.0597 0.0469 0.0369 0.0291 00230 27 0.7668 0.5744 0.4371 0.3335 0.2851 0.1956 0.1504 0.1159 0.0895 0.0633 0.0338 0.0419 0.03.25 0.0255 0.0200 28 0.7493 0.5631 0.4243 0.3 207 0.2429 0.1846 0.1406 0.1073 0.0822 0.0530 0.0485 0.0374 0.02 99 0.0224 0.0174 29 0.7419 0.5521 0.4120 0.3083 0 2314 0.1741 0.1314 0.0994 0.0754 0.0573 0.0437 0.0334 0.0256 0.0196 0.0 151 30 A) Mr. Paul, who is currently 45 years old, is your client. He, now, wants to begin saving for retirement. You advised him to put $ 15,000 a year into the stock market. You estimate that the market's return will be, on average, 12 percent a year. Assume the investment will be made at the end of the year. I. If the client follows your advice, how much money will he have by age 60? II. How much will she have by age 70? (B) Vanguard has just signed a 10-year lease to rent out office space for $ 100,000 per year. Payments are made at the beginning of each year. If the firm's interest rate is 7.65%, find the present value of the lease payments. (C) HBFC Corporation has just issued a 12-year bond, and it will be a 12% semi-annual coupon bond with a par value of $1,000. It is assumed that, it may be called back in 6 years at a call price of $1,120. The bond sells for $1,190. 1. What is the bond's current yield? II. What is the bond's yield to call? (D) Alibaba Corporation is expanding rapidly, and it does not pay any dividends because it currently needs to retain all of its earnings. However, investors expect Alibaba to begin paying dividends, with the first dividend of $1.20 Period 1 2 4 5 6 7 8 10 11 12 13 14 15 16 17 18 19 20 21 22 1% 5% 8% 10% 11% 12 13% 15 Period 0.9901 03804 0.9709 09615 0.9524 09434 09346 0.9259 0.9174 0.9091 0.9009 0 8929 0.8850 0.8772 0.8696 1 0.9806 09612 0.3426 0.9246 0.9076 0.8900 08/34 08573 0.8417 0.8254 0.8116 0.1972 0.7831 0.7695 0.7561 2 0.9706 0.9423 0.9151 0.8890 0.8633 0.8396 08163 0.7938 0.7722 0.7513 0.7312 0.7118 0.6931 0.5750 0.6575 3 0.961009238 0.8585 08548 08227 0.7921 0.7529 0.7350 0.7084 0.6830 0.6587 0.6355 0.5133 0.5921 0.5718 4 0.9515 0.0328 0.96.25 08219 0.7835 0.7473 0.713006806 0.6499 0.6209 0.3935 0 5674 0.5428 0.519: 0.4972 5 0.0161 00176 08375 0.7923 0.7462 0.7050 0.5863 0.6302 0.5963 0.5645 0 5346 0.5066 0.4863 0.4556 0.4323 5 0.9627 0.0096 0.8131 0.7599 0.7107 0.5651 0.6227 05835 0.5470 0.3132 0.4817 0.4523 0.4251 0.3996 0.3759 7 0.9235 0.0053 0.7894 0.7307 0.6768 06274 0.5820 0.5403 0.5019 0.4665 0.4339 0.4039 0.3762 0.3506 0.3259 0.9143 0.7477 0.7654 0.7025 0.6146 0.5919 0.5439 0.5002 0.4604 0.4241 0.3909 0.3506 0.3329 0 3075 0.2843 9 0.9053 0.8401 0.7441 0.5756 0.6139 05584 05083 04632 0.4224 0.3858 0.3522 0.3220 0.2946 0.2897 0.2472 10 0.8963 09004 0.7224 0.6496 0.5947 0.5258 0.4751 0.4289 0.3875 0.3505 0.3173 0.2875 0.2507 0.2386 02149 11 0.8874 0.7885 0.7014 06246 0 5568 04970 0.4440 0.3971 03556 03186 0.2858 0.2567 0.2307 0.2076 0.1969 12 0.8787 0.7730 0.6810 0.6006 0.5303 0.4688 0.4150 0.3677 0.3252 0.2897 0.2575 0 2292 0.2042 0.1821 0.1625 13 0.8700 0.7579 0.8611 05775 0.5051 04423 0.3878 03405 0.2992 0.2633 0.23.20 0.2046 0.1007 0.1597 0.1413 14 0.3613 0.7430 0.5419 0.5563 0.4810 0.4173 0.3624 0.3162 0.2745 0.2394 0.2090 0.1827 0.1599 0.1401 0.1229 15 0.8528 0.7284 0.6232 0.5339 0.4581 0.3935 0.3387 0.2919 0.25 19 0.2176 0.1883 0.1631 0.14 15 0.1229 0.1089 16 08144 0.7142 0.6050 05134 0.4363 03714 0.3166 0.2705 02311 0.1978 0.1696 0.1456 0.1252 0.1078 0.09.29 17 0.8350 0.7002 0.5874 0.4936 0.4155 03503 0.2959 0.25020 2120 0.1799 0.1528 0.1300 0.1108 0.0946 0.0838 18 0.8277 06864 0.5703 0.4746 0.3957 03305 0.2765 0.2317 0.1945 0.1535 0.1377 0.1161 0.0981 0.0829 0.0703 19 0.8195 0.67 30 0.5537 0.4564 0 3769 0.3118 0.2584 0.2145 0.1784 0.1485 0.1240 0.1037 0.8868 0.0728 0.0611 20 0.8114 0.6598 0.5375 0.4388 0.3589 0.2942 0.2415 0.1987 0.1637 0.1351 0.1117 0.0926 0.0768 0.0538 0.0531 21 0.8034 0.5468 0.5219 0.4220 0.3418 0.2775 0.2257 0.1839 0.1502 0.1228 0.1007 0.0826 0.0680 0.0580 0.0462 22 0.7954 0.6342 0.5067 0.4057 0.3256 0.2518 0.2109 0.1703 0.1378 0.1117 0.0907 0.0738 0.0601 0.0491 0.0402 23 0.7876 0.62 17 0.4919 0.3901 0.3101 02470 0.1971 0.1577 0.1264 0.1015 0.0817 0.0559 0.0532 0.0431 0.0349 24 0.7798 0.6095 0.4776 0.3751 0.2953 0.2330 0.1842 0.1450 0.1160 0.0923 0.0736 0.05 0.0471 0.0378 0.0304 25 0.7720 0.59 76 0.4637 03607 02812 02199 0.1722 0.1352 0.1064 0.0839 0.0663 0.0525 0.0417 0.0331 0.0264 26 0.7644 0.5859 0.4502 0.3458 0.2578 0.2074 0.1609 0.1252 0.0976 0.0763 0.0597 0.0469 0.0369 0.0291 00230 27 0.7668 0.5744 0.4371 0.3335 0.2851 0.1956 0.1504 0.1159 0.0895 0.0633 0.0338 0.0419 0.03.25 0.0255 0.0200 28 0.7493 0.5631 0.4243 0.3 207 0.2429 0.1846 0.1406 0.1073 0.0822 0.0530 0.0485 0.0374 0.02 99 0.0224 0.0174 29 0.7419 0.5521 0.4120 0.3083 0 2314 0.1741 0.1314 0.0994 0.0754 0.0573 0.0437 0.0334 0.0256 0.0196 0.0 151 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts