Question: please answer it correctly. this is my second post question already. what is the correct answer in equity method balansheet and in cost method what

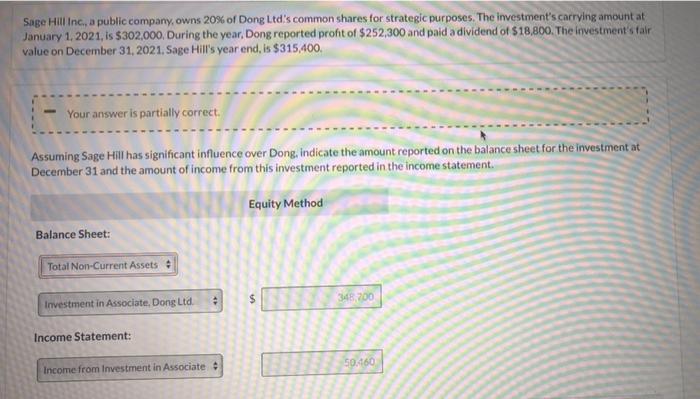

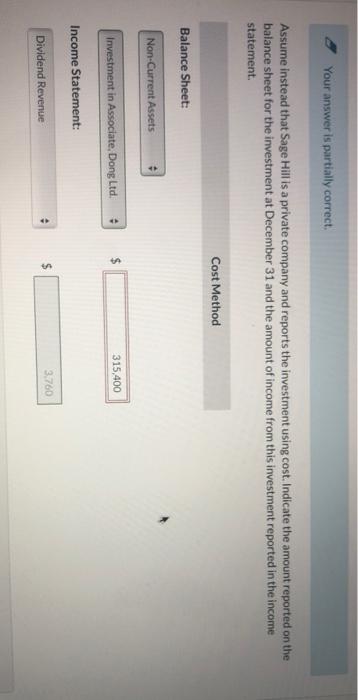

Sage Hillinc, a public company, owns 20% of Dong Lite's common shares for strategic purposes. The investment's carrying amount at January 1, 2021, is $302,000, During the year, Dong reported profit of $252,300 and paid a dividend of $18,800. The investment's talr value on December 31, 2021. Sage Hill's year end, is $315,400 Your answer is partially correct. Assuming Sage Hill has significant influence over Dong, indicate the amount reported on the balance sheet for the investment at December 31 and the amount of income from this investment reported in the income statement Equity Method Balance Sheet: Total Non-Current Assets $ 348 200 Investment in Associate, Dong Ltd Income Statement: 50,460 Income from Investment in Associate Your answer is partially correct. Assume instead that Sage Hill is a private company and reports the investment using cost. Indicate the amount reported on the balance sheet for the investment at December 31 and the amount of income from this investment reported in the income statement Cost Method Balance Sheet: Non-Current Assets A 315,400 Investment in Associate, Dong Ltd. Income Statement: 3.760 Dividend Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts