Question: Please answer it for every ratio that is calculated and make it as long as possible Analyze the position of the firm and whether the

Please answer it for every ratio that is calculated and make it as long as possible

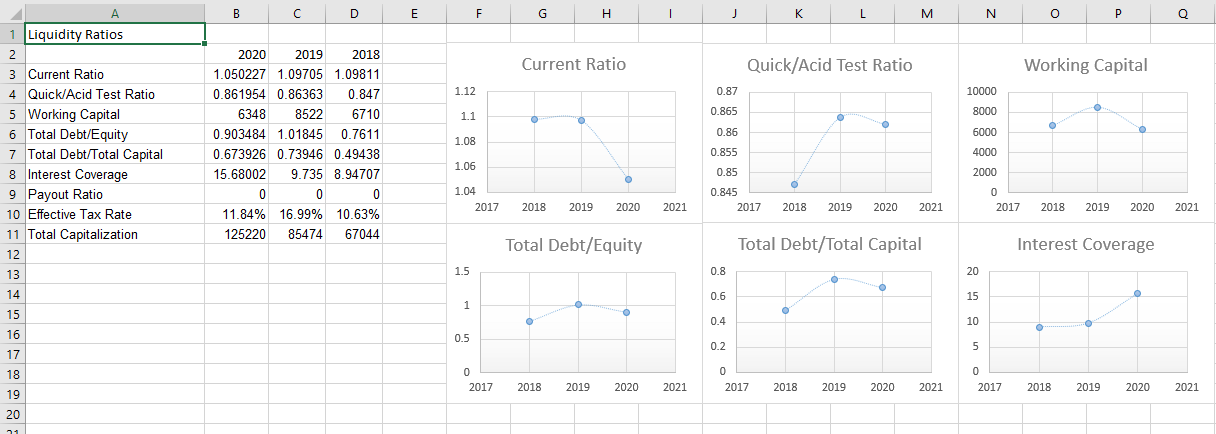

Analyze the position of the firm and whether the company regressed or improved financially over the past three years. Be sure to situate your company within the broader economy and its specific industry, particularly with respect to major competitors and industry and market trends.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts