Question: Please answer it if you are 100% sure thanks! A firm is undertaking a project with the following details provided. - The project costs $1.9

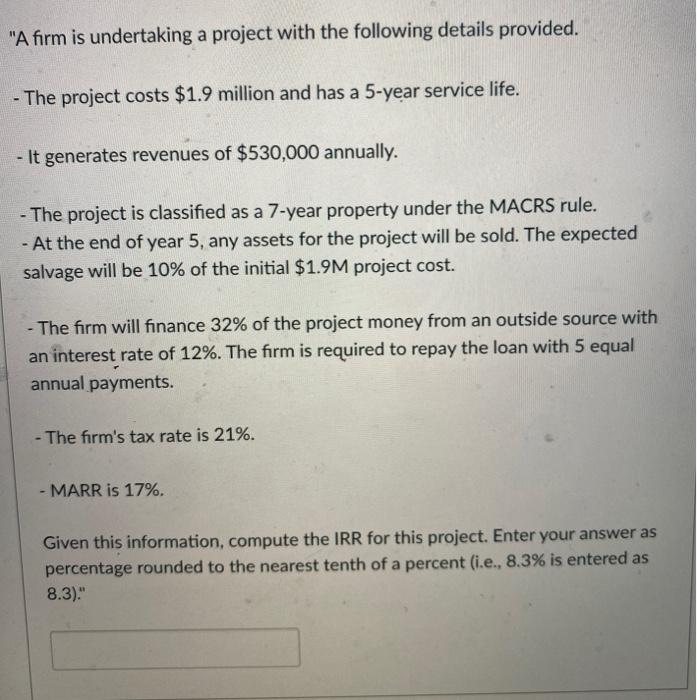

"A firm is undertaking a project with the following details provided. - The project costs $1.9 million and has a 5-year service life. - It generates revenues of $530,000 annually. - The project is classified as a 7-year property under the MACRS rule. - At the end of year 5, any assets for the project will be sold. The expected salvage will be 10% of the initial $1.9M project cost. - The firm will finance 32% of the project money from an outside source with an interest rate of 12%. The firm is required to repay the loan with 5 equal annual payments. - The firm's tax rate is 21%. - MARR is 17%. Given this information, compute the IRR for this project. Enter your answer as percentage rounded to the nearest tenth of a percent (i.e., 8.3% is entered as 8.3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts