Question: Please answer it in 3 hours, its emergency! (Before 23th May 3:30am) and Please give me step by step solution Ill give you a upvote

Please answer it in 3 hours, its emergency! (Before 23th May 3:30am)

and Please give me step by step solution

Ill give you a upvote

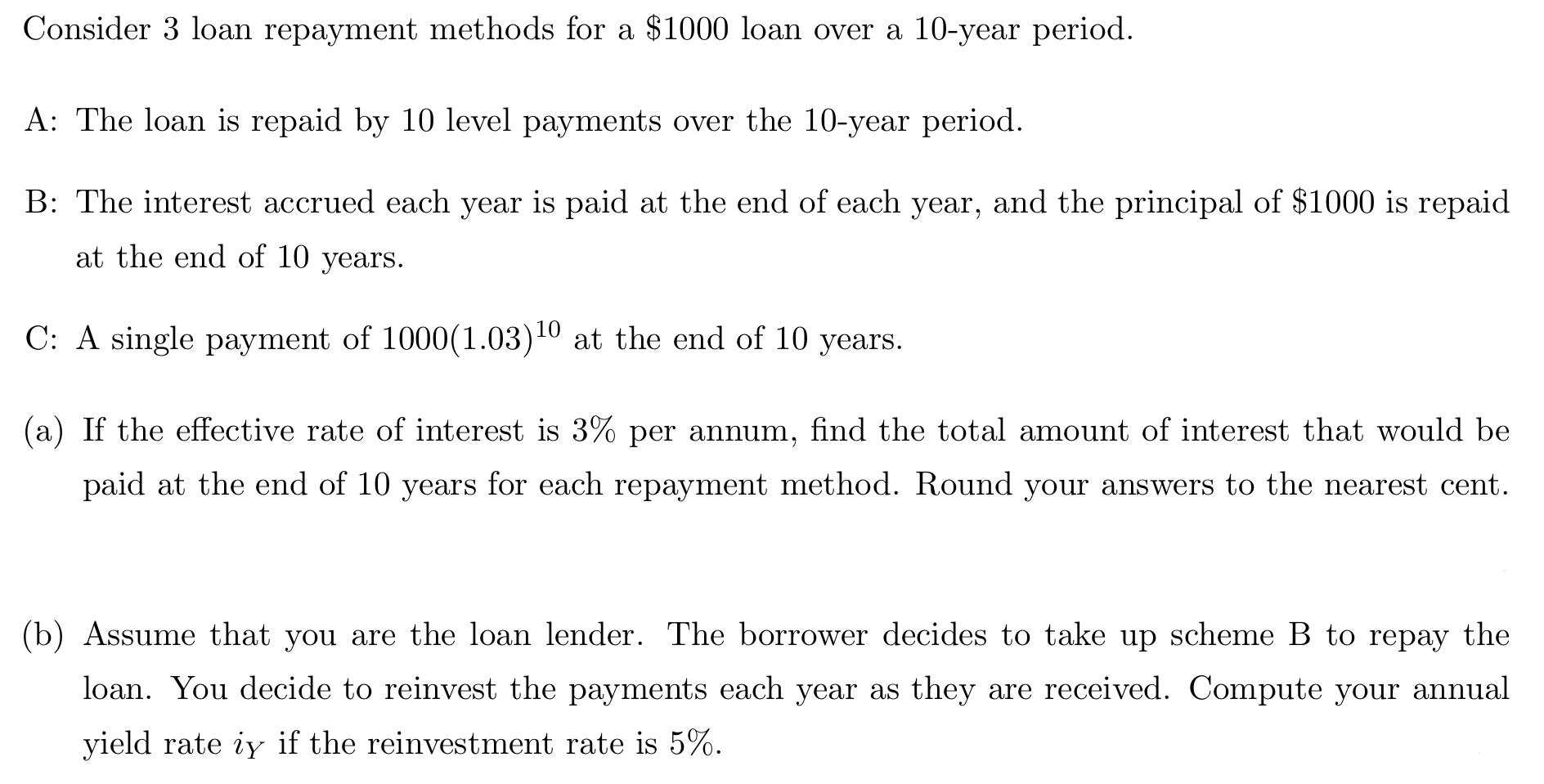

Consider 3 loan repayment methods for a $1000 loan over a 10-year period. A: The loan is repaid by 10 level payments over the 10-year period. B: The interest accrued each year is paid at the end of each year, and the principal of $1000 is repaid at the end of 10 years. C: A single payment of 1000(1.03)0 at the end of 10 years. (a) If the effective rate of interest is 3% per annum, find the total amount of interest that would be paid at the end of 10 years for each repayment method. Round your answers to the nearest cent. (b) Assume that you are the loan lender. The borrower decides to take up scheme B to repay the loan. You decide to reinvest the payments each year as they are received. Compute your annual yield rate iy if the reinvestment rate is 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts