Question: Please answer it in 45 minutes. and It's humble request answer all I don't have more questions to post. I will appreciate you. The following

Please answer it in 45 minutes. and It's humble request answer all I don't have more questions to post. I will appreciate you.

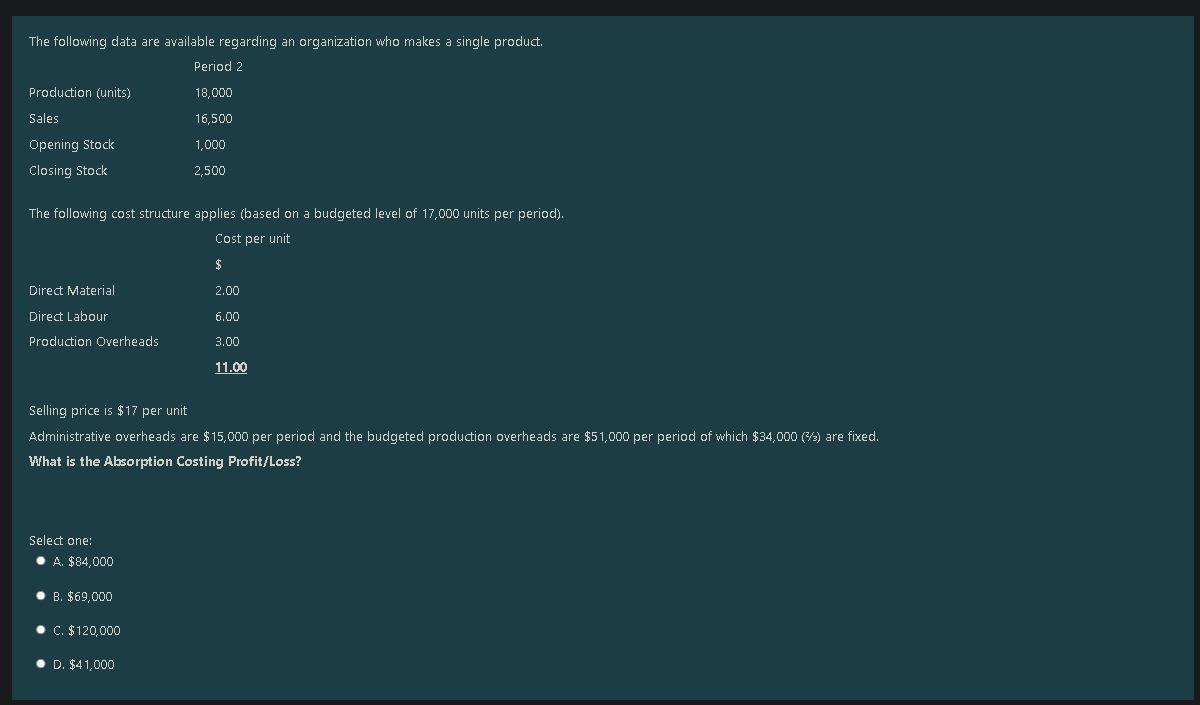

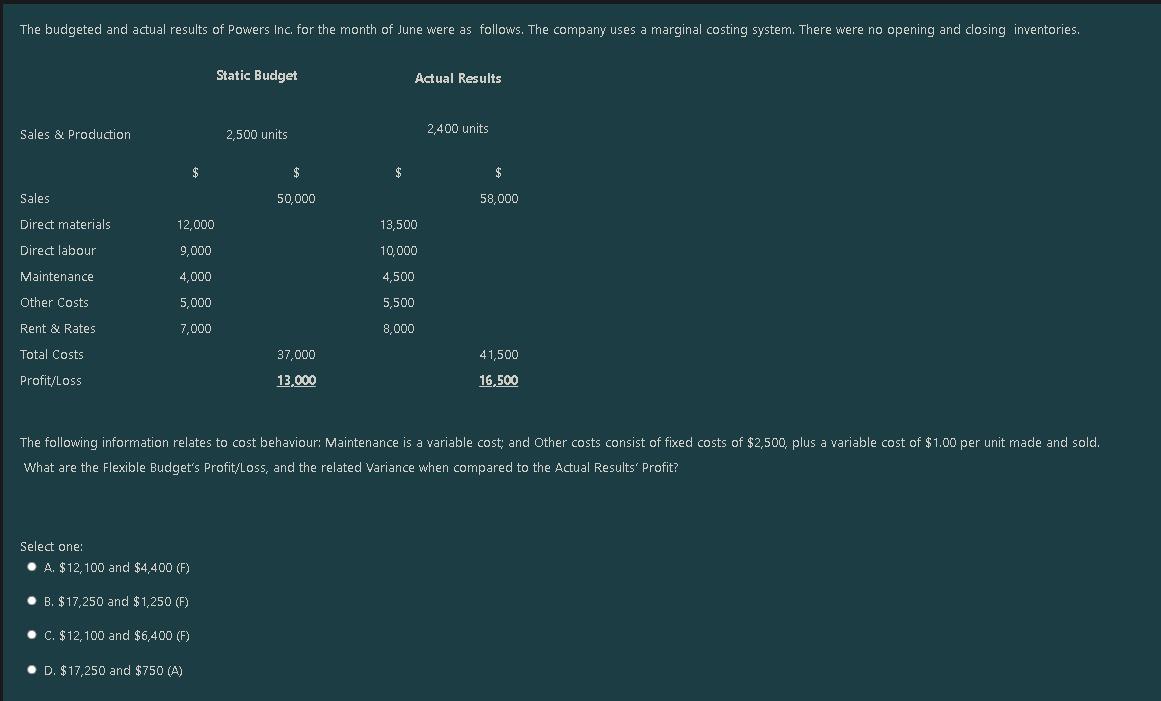

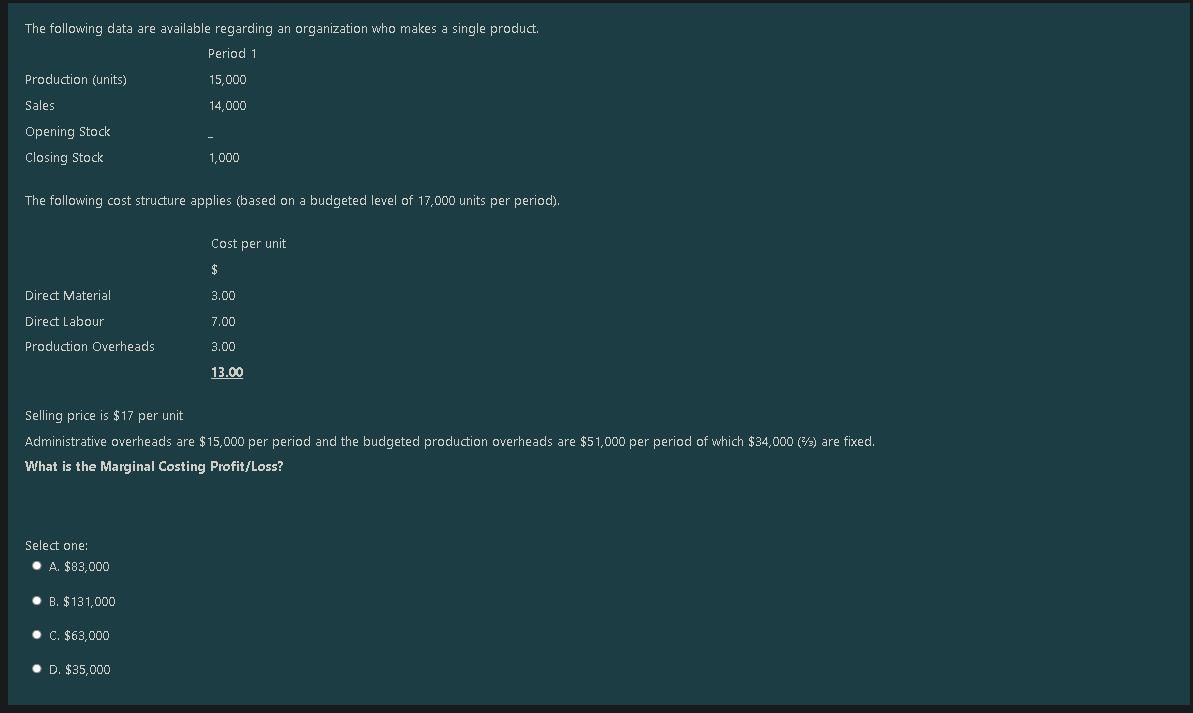

The following data are available regarding an organization who makes a single product. Period 2 Production (units) 18,000 Sales 16,500 1,000 Opening Stock Closing Stock 2,500 The following cost structure applies (based on a budgeted level of 17,000 units per period). Cost per unit $ Direct Material 2.00 Direct Labour 6.00 Production Overheads 3.00 11.00 Selling price is $17 per unit Administrative overheads are $15,000 per period and the budgeted production overheads are $51,000 per period of which $34.000 (19) are fixed. What is the Absorption Costing Profit/Loss? Select one: A $84,000 B. $69,000 . C. $120,000 D. $41,000 The budgeted and actual results of Powers Inc. for the month of June were as follows. The company uses a marginal costing system. There were no opening and closing inventories. Static Budget Actual Results Sales & Production 2,500 units 2,400 units $ $ $ Sales 50,000 58,000 Direct materials 12,000 13,500 Direct labour 9,000 10,000 Maintenance 4,000 4,500 Other Costs 5,000 5,500 Rent & Rates 7,000 8,000 Total Costs 37,000 41,500 16,500 Profit/Loss 13.000 The following information relates to cost behaviour: Maintenance is a variable cost; and Other costs consist of fixed costs of $2,500, plus a variable cost of $1.00 per unit made and sold. What are the Flexible Budget's Profit/Loss, and the related Variance when compared to the Actual Results' Profit? Select one: A. $12,100 and $4,400 (F) B. $17,250 and $1,250 (F) C. $12,100 and $6,400 (F) D. $17,250 and $750 (A) The following data are available regarding an organization who makes a single product. Period 1 Production (units) 15,000 Sales 14,000 Opening Stock Closing Stock 1,000 The following cost structure applies (based on a budgeted level of 17,000 units per period). Cost per unit $ Direct Material 3.00 Direct Labour 7.00 Production Overheads 3.00 13.00 Selling price is $17 per unit Administrative overheads are $15,000 per period and the budgeted production overheads are $51,000 per period of which $34,000 (4) are fixed. What is the Marginal Costing Profit/Loss? Select one: A $83,000 B. $131,000 C. $63,000 D. $35,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts