Question: please answer it in an excel file. Lambeth Cabinets-1. Using information in the case study below, please answer the questions below. 1-Create three inventory T-accounts

please answer it in an excel file.

Lambeth Cabinets-1.

Using information in the case study below, please answer the questions below.

1-Create three inventory T-accounts and a Cost of Goods Sold T-account. Show beginning balance, additions, reductions, and ending balance in each t-account. Make sure that you reconcile any under-applied or over-applied overhead to cost of goods sold.

2-In the greatest detail possible, prepare balance sheets as of September 1 and September 30 and an income statement for September (ignore taxes).

3-Without changing the expense figures of Mrs. Carter's job, under what conditions should Lambeth have accepted the job at a price of $1500? Based on these conditions, what is the maximum possible profit the company could have achieved from this job while charging only $1500? Explain.

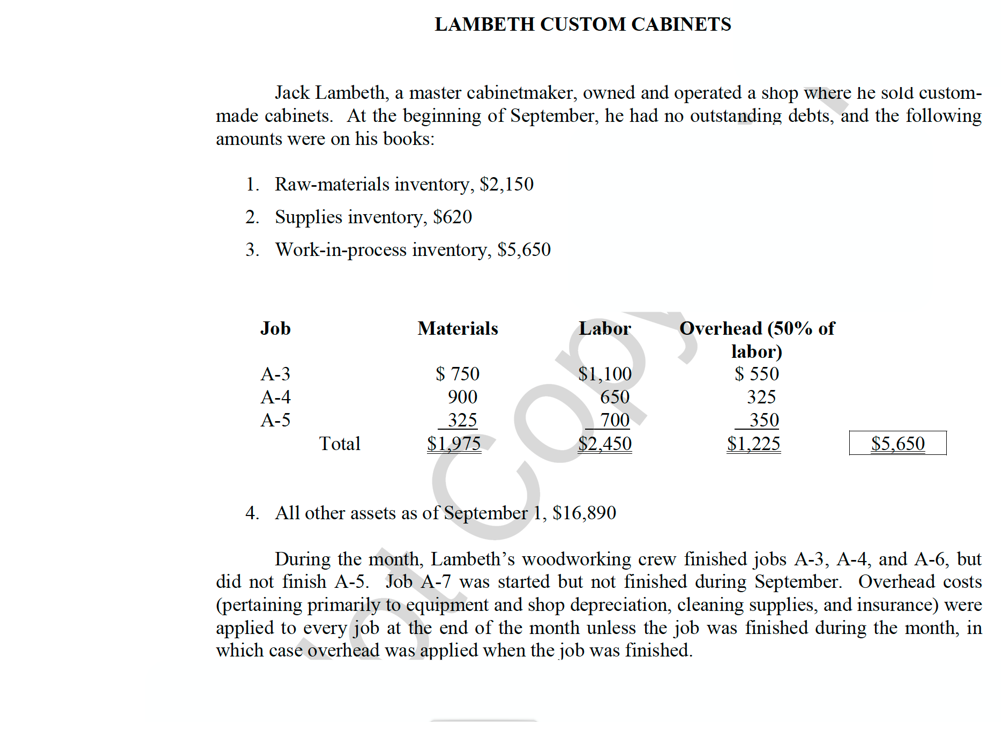

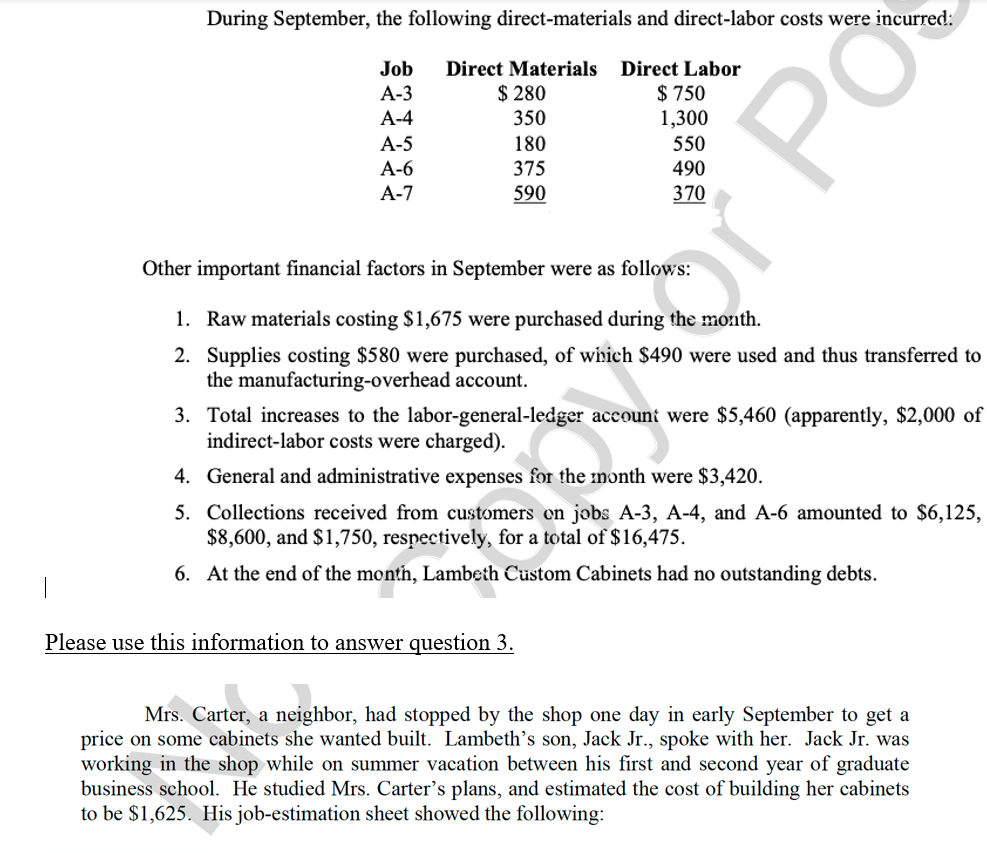

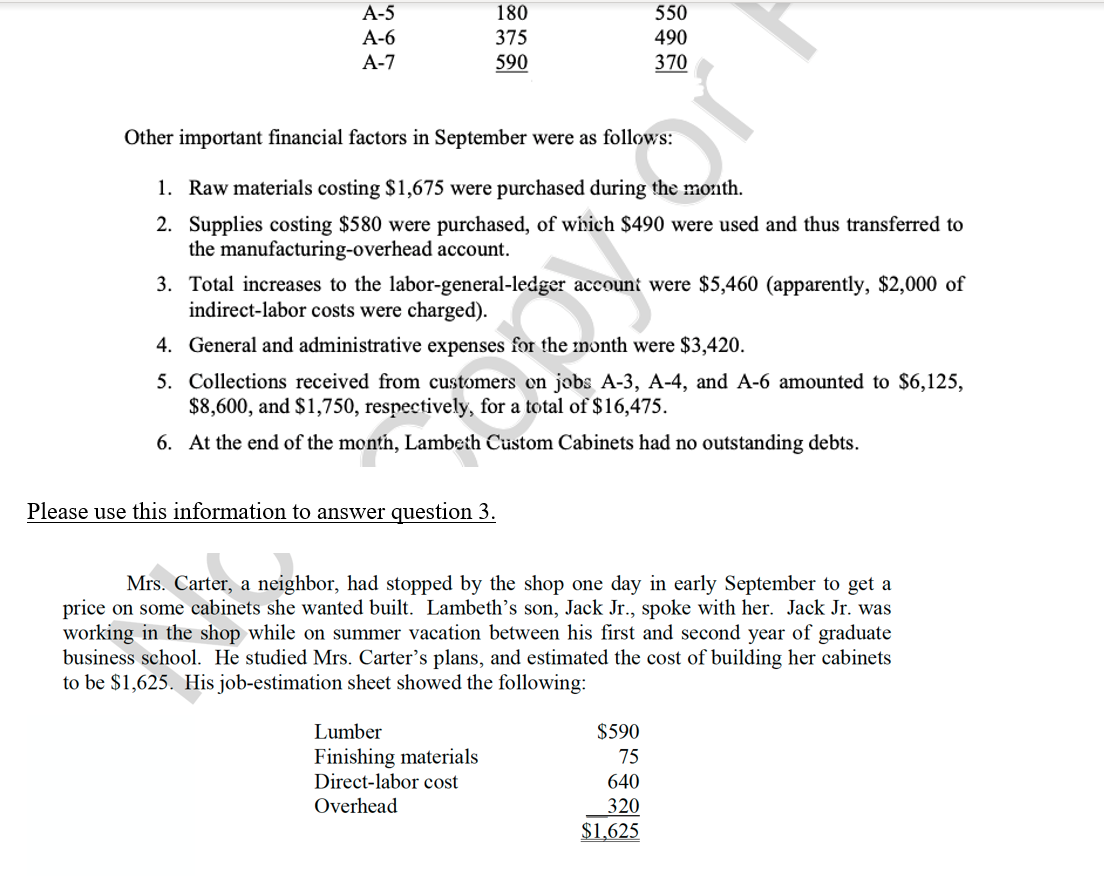

LAMBETH CUSTOM CABINETS Jack Lambeth, a master cabinetmaker, owned and operated a shop where he sold custom- made cabinets. At the beginning of September, he had no outstanding debts, and the following amounts were on his books: 1. Raw-materials inventory, $2,150 2. Supplies inventory, $620 3. Work-in-process inventory, $5,650 Job Materials Labor A-3 A-4 A-5 $1,100 650 700 $2,450 Overhead (50% of labor) $ 550 325 350 $1,225 Total $5,650 4. All other assets as of September 1, $16,890 co During the month, Lambeth's woodworking crew finished jobs A-3, A-4, and A-6, but did not finish A-5. Job A-7 was started but not finished during September. Overhead costs (pertaining primarily to equipment and shop depreciation, cleaning supplies, and insurance) were applied to every job at the end of the month unless the job was finished during the month, in which case overhead was applied when the job was finished. During September, the following direct-materials and direct-labor costs were incurred: Job A-3 A-4 A-5 A-6 A-7 Direct Materials Direct Labor $ 280 $ 750 350 1,300 180 550 375 490 590 PO 370 Other important financial factors in September were as follows: 1. Raw materials costing $1,675 were purchased during the month. 2. Supplies costing $580 were purchased, of which $490 were used and thus transferred to the manufacturing-overhead account. 3. Total increases to the labor-general-ledger account were $5,460 (apparently, $2,000 of indirect-labor costs were charged). 4. General and administrative expenses for the anonth were $3,420. 5. Collections received from customers on jobs A-3, A-4, and A-6 amounted to $6,125, $8,600, and $1,750, respectively, for a total of $16,475. 6. At the end of the month, Lambeth Custom Cabinets had no outstanding debts. Please use this information to answer question 3. Mrs. Carter, a neighbor, had stopped by the shop one day in early September to get a price on some cabinets she wanted built. Lambeth's son, Jack Jr., spoke with her. Jack Jr. was working in the shop while on summer vacation between his first and second year of graduate business school. He studied Mrs. Carter's plans, and estimated the cost of building her cabinets to be $1,625. His job-estimation sheet showed the following: A-5 A-6 A-7 180 375 590 Other important financial factors in September were as follows: 1. Raw materials costing $1,675 were purchased during the month. 2. Supplies costing $580 were purchased, of which $490 were used and thus transferred to the manufacturing-overhead account. 3. Total increases to the labor-general-ledger account were $5,460 (apparently, $2,000 of indirect-labor costs were charged). 4. General and administrative expenses for the month were $3,420. 5. Collections received from customers on jobs A-3, A-4, and A-6 amounted to $6,125, $8,600, and $1,750, respectively, for a total of $16,475. 6. At the end of the month, Lambeth Custom Cabinets had no outstanding debts. Please use this information to answer question 3. Mrs. Carter, a neighbor, had stopped by the shop one day in early September to get a price on some cabinets she wanted built. Lambeth's son, Jack Jr., spoke with her. Jack Jr. was working in the shop while on summer vacation between his first and second year of graduate business school. He studied Mrs. Carter's plans, and estimated the cost of building her cabinets to be $1,625. His job-estimation sheet showed the following: Lumber Finishing materials Direct-labor cost Overhead $590 75 640 320 $1,625 When Jack Jr. quoted a price of $1,900 ($1,625 cost plus $275 profit) to Mrs. Carter, she said that she could get the same thing built by Walworth Custom Kitchens for $1,500. Furthermore, she informed him, I would throw the dumb economics books away before I would pay a penny more than $1,500 for book cabinets to store them. Jack Jr. simply told her that his best price was $1,900. He explained all about labor, materials, profit, overhead, and competitive capitalism. In addition, he told Mrs. Carter that Walworth could not make money on a $1,500 price, and if Walworth was really willing to build the shelves for $1,500, she would be stealing from Mr. Walworth! Mrs. Carter was very angry when she left. Jack Jr. later told his father the whole story, and laughed as he said, Heck, we can't build stuff that costs $1,625 and sell it at a price of $1,600, let alone $1,500, can we? At the time, Lambeth did not think much about the incident, but he began to wonder whether Jack Jr. had learned anything at graduate business school. Lambeth became especially concerned when he saw Bob Walworth, who said, Mrs. Carter saved me last month. Walworth had just delivered Mrs. Carter's new cabinets, for which she paid $1,500. Lambeth wondered who was right: Jack Jr. or Walworth? LAMBETH CUSTOM CABINETS Jack Lambeth, a master cabinetmaker, owned and operated a shop where he sold custom- made cabinets. At the beginning of September, he had no outstanding debts, and the following amounts were on his books: 1. Raw-materials inventory, $2,150 2. Supplies inventory, $620 3. Work-in-process inventory, $5,650 Job Materials Labor A-3 A-4 A-5 $1,100 650 700 $2,450 Overhead (50% of labor) $ 550 325 350 $1,225 Total $5,650 4. All other assets as of September 1, $16,890 co During the month, Lambeth's woodworking crew finished jobs A-3, A-4, and A-6, but did not finish A-5. Job A-7 was started but not finished during September. Overhead costs (pertaining primarily to equipment and shop depreciation, cleaning supplies, and insurance) were applied to every job at the end of the month unless the job was finished during the month, in which case overhead was applied when the job was finished. During September, the following direct-materials and direct-labor costs were incurred: Job A-3 A-4 A-5 A-6 A-7 Direct Materials Direct Labor $ 280 $ 750 350 1,300 180 550 375 490 590 PO 370 Other important financial factors in September were as follows: 1. Raw materials costing $1,675 were purchased during the month. 2. Supplies costing $580 were purchased, of which $490 were used and thus transferred to the manufacturing-overhead account. 3. Total increases to the labor-general-ledger account were $5,460 (apparently, $2,000 of indirect-labor costs were charged). 4. General and administrative expenses for the anonth were $3,420. 5. Collections received from customers on jobs A-3, A-4, and A-6 amounted to $6,125, $8,600, and $1,750, respectively, for a total of $16,475. 6. At the end of the month, Lambeth Custom Cabinets had no outstanding debts. Please use this information to answer question 3. Mrs. Carter, a neighbor, had stopped by the shop one day in early September to get a price on some cabinets she wanted built. Lambeth's son, Jack Jr., spoke with her. Jack Jr. was working in the shop while on summer vacation between his first and second year of graduate business school. He studied Mrs. Carter's plans, and estimated the cost of building her cabinets to be $1,625. His job-estimation sheet showed the following: A-5 A-6 A-7 180 375 590 Other important financial factors in September were as follows: 1. Raw materials costing $1,675 were purchased during the month. 2. Supplies costing $580 were purchased, of which $490 were used and thus transferred to the manufacturing-overhead account. 3. Total increases to the labor-general-ledger account were $5,460 (apparently, $2,000 of indirect-labor costs were charged). 4. General and administrative expenses for the month were $3,420. 5. Collections received from customers on jobs A-3, A-4, and A-6 amounted to $6,125, $8,600, and $1,750, respectively, for a total of $16,475. 6. At the end of the month, Lambeth Custom Cabinets had no outstanding debts. Please use this information to answer question 3. Mrs. Carter, a neighbor, had stopped by the shop one day in early September to get a price on some cabinets she wanted built. Lambeth's son, Jack Jr., spoke with her. Jack Jr. was working in the shop while on summer vacation between his first and second year of graduate business school. He studied Mrs. Carter's plans, and estimated the cost of building her cabinets to be $1,625. His job-estimation sheet showed the following: Lumber Finishing materials Direct-labor cost Overhead $590 75 640 320 $1,625 When Jack Jr. quoted a price of $1,900 ($1,625 cost plus $275 profit) to Mrs. Carter, she said that she could get the same thing built by Walworth Custom Kitchens for $1,500. Furthermore, she informed him, I would throw the dumb economics books away before I would pay a penny more than $1,500 for book cabinets to store them. Jack Jr. simply told her that his best price was $1,900. He explained all about labor, materials, profit, overhead, and competitive capitalism. In addition, he told Mrs. Carter that Walworth could not make money on a $1,500 price, and if Walworth was really willing to build the shelves for $1,500, she would be stealing from Mr. Walworth! Mrs. Carter was very angry when she left. Jack Jr. later told his father the whole story, and laughed as he said, Heck, we can't build stuff that costs $1,625 and sell it at a price of $1,600, let alone $1,500, can we? At the time, Lambeth did not think much about the incident, but he began to wonder whether Jack Jr. had learned anything at graduate business school. Lambeth became especially concerned when he saw Bob Walworth, who said, Mrs. Carter saved me last month. Walworth had just delivered Mrs. Carter's new cabinets, for which she paid $1,500. Lambeth wondered who was right: Jack Jr. or Walworth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts