Question: PLEASE ANSWER IT ON PAPER (show formulas along with step by step solution). Thanks There is a 5% coupon, $1000 face value, 5-year, risk-free government

PLEASE ANSWER IT ON PAPER (show formulas along with step by step solution).

Thanks

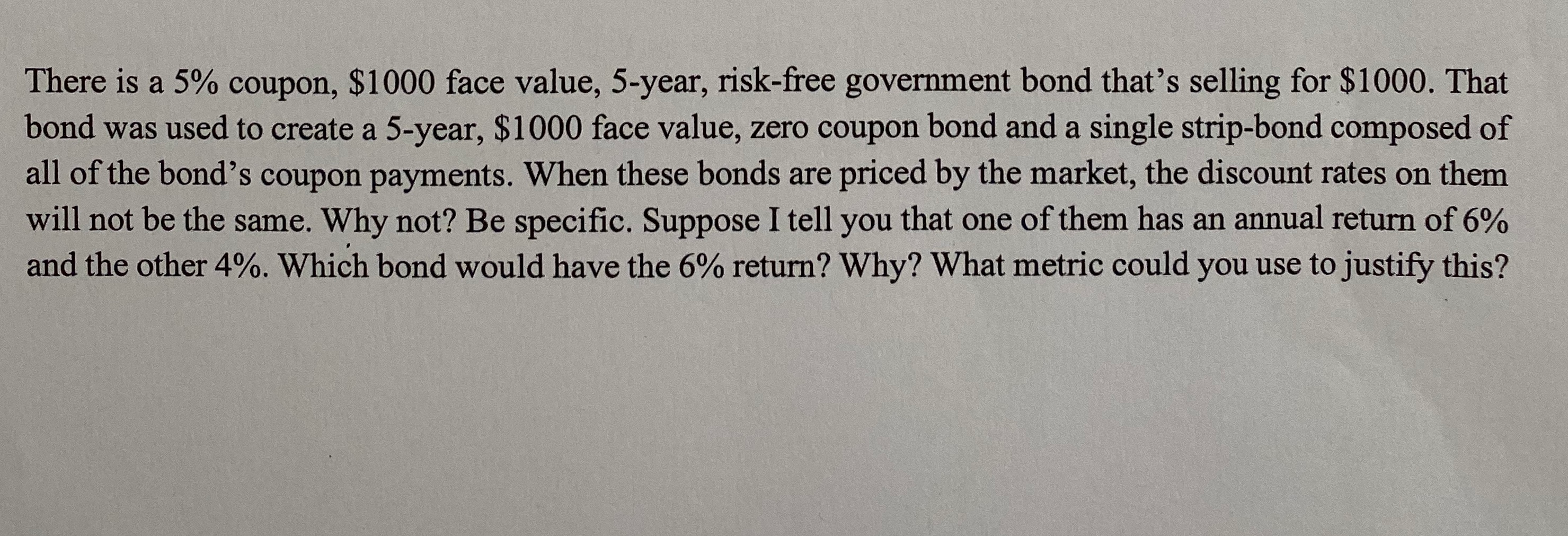

There is a 5% coupon, $1000 face value, 5-year, risk-free government bond that's selling for $1000. That bond was used to create a 5-year, $1000 face value, zero coupon bond and a single strip-bond composed of all of the bond's coupon payments. When these bonds are priced by the market, the discount rates on them will not be the same. Why not? Be specific. Suppose I tell you that one of them has an annual return of 6% and the other 4%. Which bond would have the 6% return? Why? What metric could you use to justify this? There is a 5% coupon, $1000 face value, 5-year, risk-free government bond that's selling for $1000. That bond was used to create a 5-year, $1000 face value, zero coupon bond and a single strip-bond composed of all of the bond's coupon payments. When these bonds are priced by the market, the discount rates on them will not be the same. Why not? Be specific. Suppose I tell you that one of them has an annual return of 6% and the other 4%. Which bond would have the 6% return? Why? What metric could you use to justify this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts