Question: please answer it right and quick please 5.Jack Whitcombe and Sons is a consultant engineering firm. The accounts for the firm are as follows. Bank

please answer it right and quick please

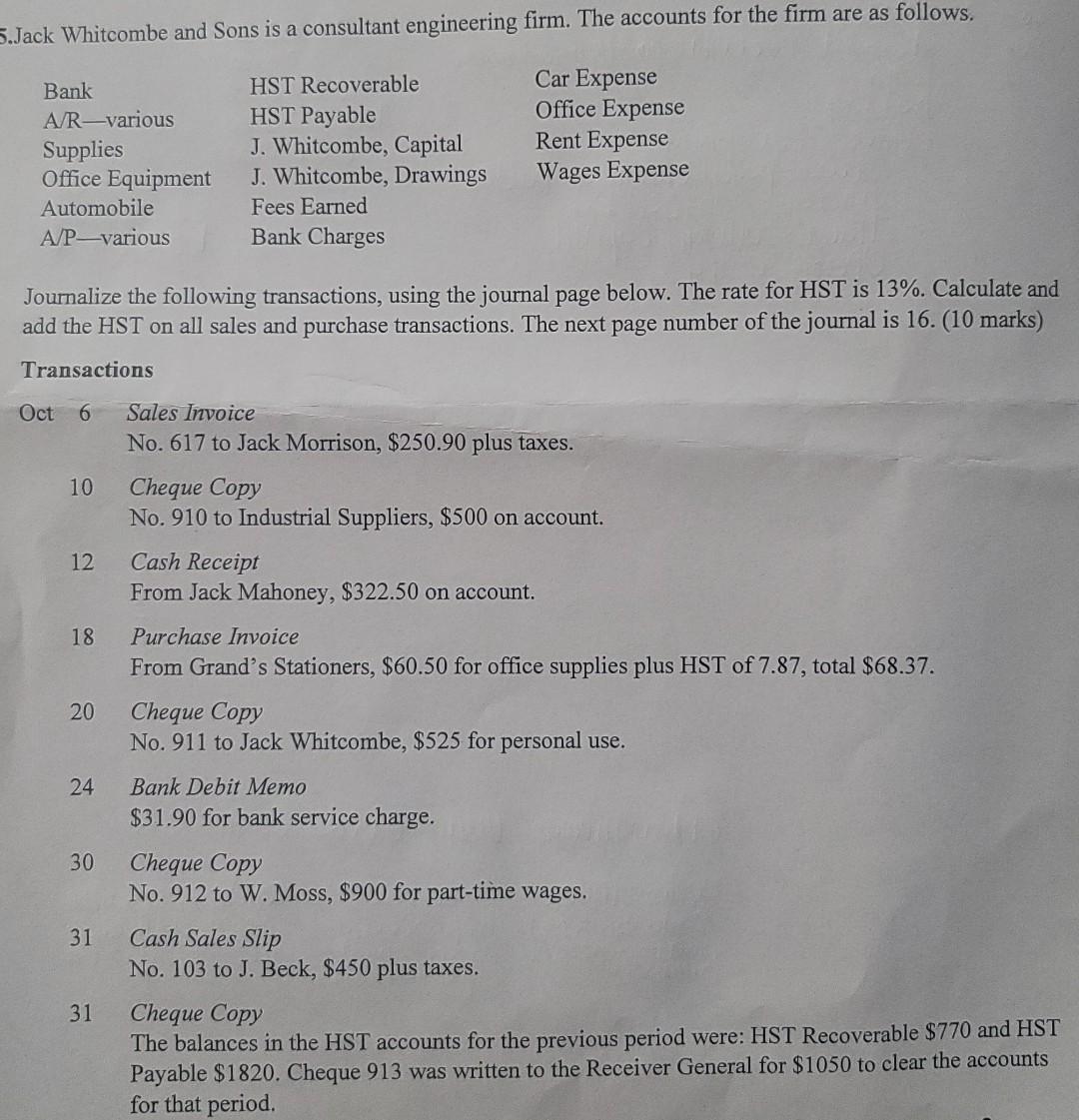

5.Jack Whitcombe and Sons is a consultant engineering firm. The accounts for the firm are as follows. Bank AR-various Supplies Office Equipment Automobile A/P-various HST Recoverable HST Payable J. Whitcombe, Capital J. Whitcombe, Drawings Fees Earned Bank Charges Car Expense Office Expense Rent Expense Wages Expense Journalize the following transactions, using the journal page below. The rate for HST is 13%. Calculate and add the HST on all sales and purchase transactions. The next page number of the journal is 16. (10 marks) Transactions Oct 6 10 12 Sales Invoice No. 617 to Jack Morrison, $250.90 plus taxes. Cheque Copy No. 910 to Industrial Suppliers, $500 on account. Cash Receipt From Jack Mahoney, $322.50 on account. Purchase Invoice From Grand's Stationers, $60.50 for office supplies plus HST of 7.87, total $68.37. Cheque Copy No. 911 to Jack Whitcombe, $525 for personal use. 18 20 24 Bank Debit Memo $31.90 for bank service charge. 30 31 Cheque Copy No. 912 to W. Moss, $900 for part-time wages. Cash Sales Slip No. 103 to J. Beck, $450 plus taxes. Cheque Copy The balances in the HST accounts for the previous period were: HST Recoverable $770 and HST Payable $1820. Cheque 913 was written to the Receiver General for $1050 to clear the accounts for that period. 31 PAGE GENERAL JOURNAL P.R. DEBIT CREDIT PARTICULARS DATE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts