Question: please answer it step by step with explanation if possible 1. The Mighty Mouse Computer company is considering whether or not to install a packaging

please answer it step by step with explanation if possible

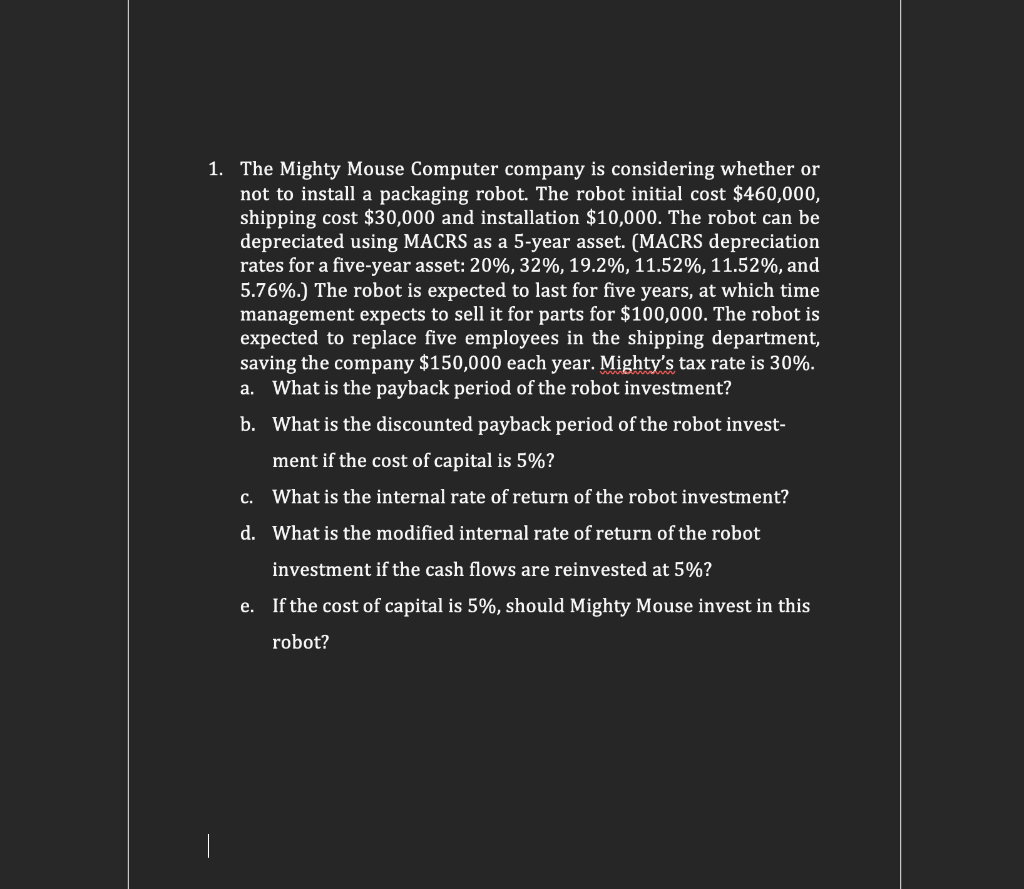

1. The Mighty Mouse Computer company is considering whether or not to install a packaging robot. The robot initial cost $460,000, shipping cost $30,000 and installation $10,000. The robot can be depreciated using MACRS as a 5-year asset. (MACRS depreciation rates for a five-year asset: 20%, 32%, 19.2%, 11.52%, 11.52%, and 5.76%.) The robot is expected to last for five years, at which time management expects to sell it for parts for $100,000. The robot is expected to replace five employees in the shipping department, saving the company $150,000 each year. Mighty's tax rate is 30%. What is the payback period of the robot investment? b. What is the discounted payback period of the robot invest- ment if the cost of capital is 5%? c. What is the internal rate of return of the robot investment? a. d. What is the modified internal rate of return of the robot investment if the cash flows are reinvested at 5%? e. If the cost of capital is 5%, should Mighty Mouse invest in this robot? 1. The Mighty Mouse Computer company is considering whether or not to install a packaging robot. The robot initial cost $460,000, shipping cost $30,000 and installation $10,000. The robot can be depreciated using MACRS as a 5-year asset. (MACRS depreciation rates for a five-year asset: 20%, 32%, 19.2%, 11.52%, 11.52%, and 5.76%.) The robot is expected to last for five years, at which time management expects to sell it for parts for $100,000. The robot is expected to replace five employees in the shipping department, saving the company $150,000 each year. Mighty's tax rate is 30%. What is the payback period of the robot investment? b. What is the discounted payback period of the robot invest- ment if the cost of capital is 5%? c. What is the internal rate of return of the robot investment? a. d. What is the modified internal rate of return of the robot investment if the cash flows are reinvested at 5%? e. If the cost of capital is 5%, should Mighty Mouse invest in this robot

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts