Question: please answer it Unanswered Save Question 2 (25 marks) David Ltd enters into a five-year lease agreement with Brothers Ltd on 1 July 2023 for

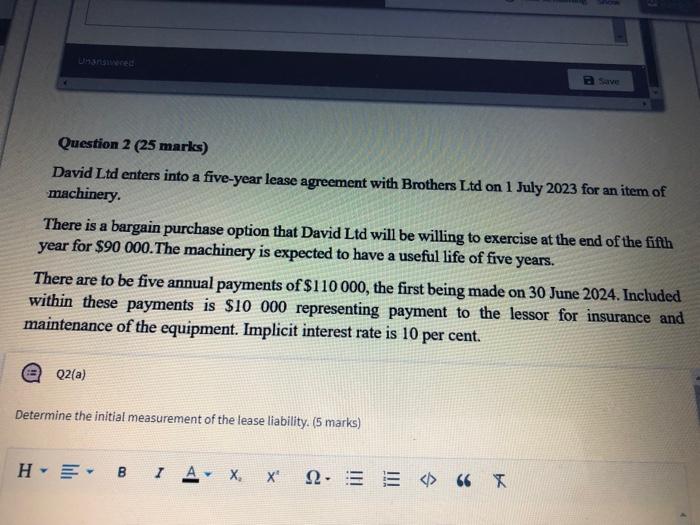

Unanswered Save Question 2 (25 marks) David Ltd enters into a five-year lease agreement with Brothers Ltd on 1 July 2023 for an item of machinery. There is a bargain purchase option that David Ltd will be willing to exercise at the end of the fifth year for $90 000. The machinery is expected to have a useful life of five years. There are to be five annual payments of $110 000, the first being made on 30 June 2024. Included within these payments is $10 000 representing payment to the lessor for insurance and maintenance of the equipment. Implicit interest rate is 10 per cent. Q2(a) Determine the initial measurement of the lease liability. (5 marks) HE B I A X, * 4 within these payments is $10 000 representing payment to the lessor maintenance of the equipment. Implicit interest rate is 10 per cent. Q2(a) Determine the initial measurement of the lease liability. (5 marks) HE B I AX, X 2 66 X Q2(b) Determine the initial measurement of right-of-use asset cost. (5 marks) HE- B I A X X" NE E 66 O O D Unanswered Q2(c) Prepare a lease payment schedule. (10 marks) HE B I . . Unanswered x 66 Unanswered Q2(d) Provide the necessary accounting journal entries for the year ended 30 June 2024. (5 marks) H B I A- X, X 66 X Unanswered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts