Question: Please answer it with in one hour HWU plc has a capital budget of 17m for new investment projects at time 0. Four proposals have

Please answer it with in one hour

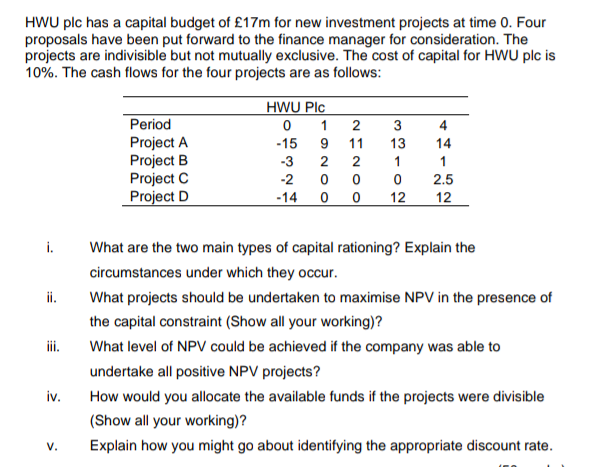

HWU plc has a capital budget of 17m for new investment projects at time 0. Four proposals have been put forward to the finance manager for consideration. The projects are indivisible but not mutually exclusive. The cost of capital for HWU plc is 10%. The cash flows for the four projects are as follows: Period Project A Project B Project Project D HWU PIC 0 1 2 -15 9 11 -3 2 2 -2 0 0 -14 0 0 3 13 1 0 12 4 14 1 2.5 12 i. ii. iii. What are the two main types of capital rationing? Explain the circumstances under which they occur. What projects should be undertaken to maximise NPV in the presence of the capital constraint (Show all your working)? What level of NPV could be achieved if the company was able to undertake all positive NPV projects? How would you allocate the available funds if the projects were divisible (Show all your working)? Explain how you might go about identifying the appropriate discount rate. iv. V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts