Question: Please answer just the questions, no explanation needed! 6. A firm has 6% coupon rate bonds outstanding with a current market price of $777. The

Please answer just the questions, no explanation needed!

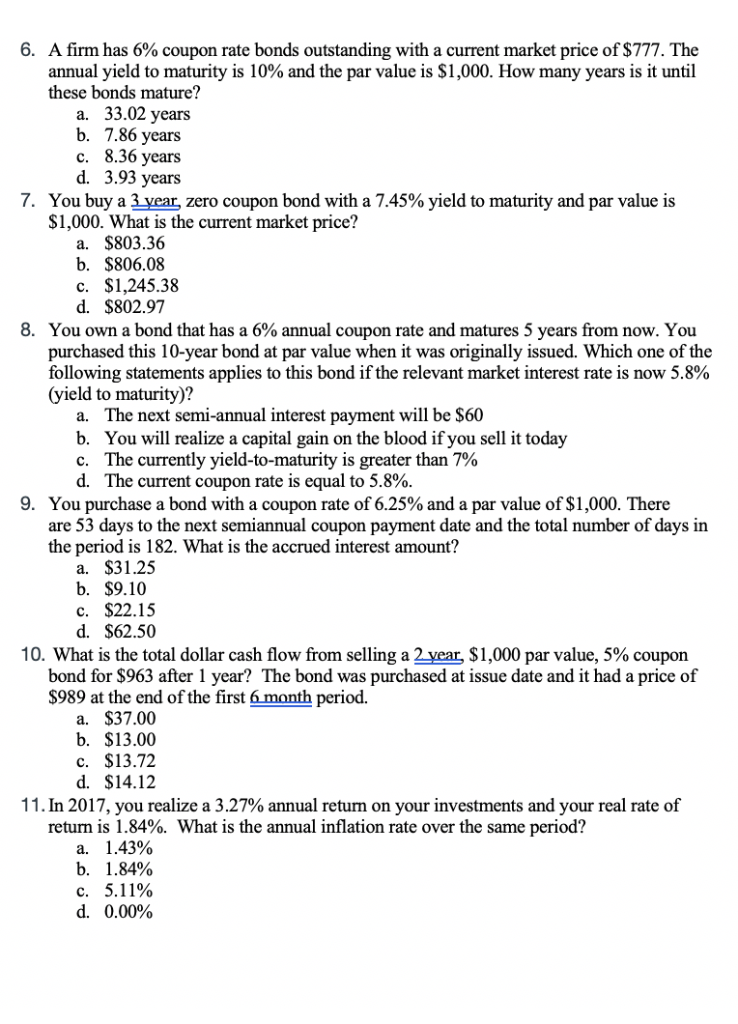

6. A firm has 6% coupon rate bonds outstanding with a current market price of $777. The annual yield to maturity is 10% and the par value is $1,000. How many years is it until these bonds mature? a. 33.02 years b. 7.86 years c. 8.36 years d. 3.93 years 7" You buy a 3vea, zero coupon bond with a 7.45% yield to maturity and par value is S1,000. What is the current market price? a. $803.36 b. $806.08 c. $1,245.38 d. $802.97 8. You own a bond that has a 6% annual coupon rate and matures 5 years from now. You purchased this 10-year bond at par value when it was originally issued. Which one of the following statements applies to this bond if the relevant market interest rate is now 5.8% (yield to maturity)? a. The next semi-annual interest payment will be $60 b. You will realize a capital gain on the blood if you sell it today C. The currently yield-to-maturity is greater than 7% d. The current coupon rate is equal to 5.8% 9. You purchase a bond with a coupon rate of 6.25% and a par value of $1,000. There are 53 days to the next semiannual coupon payment date and the total number of days in the period is 182. What is the accrued interest amount? a. $31.25 b. $9.10 c. $22.15 d. $62.50 10. What is the total dollar cash flow from selling a 2 year, $1,000 par value, 5% coupon bond for $963 after 1 year? The bond was purchased at issue date and it had a price of S989 at the end of the first 6 month period. a. $37.00 b. $13.00 c. $13.72 d. $14.12 11. In 2017, you realize a 3.27% annual retum on your investments and your real rate of retum is 1.84%. What is the annual inflation rate over the same period? a. b. c. d. 1.43% 1.84% 5.11% 0.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts