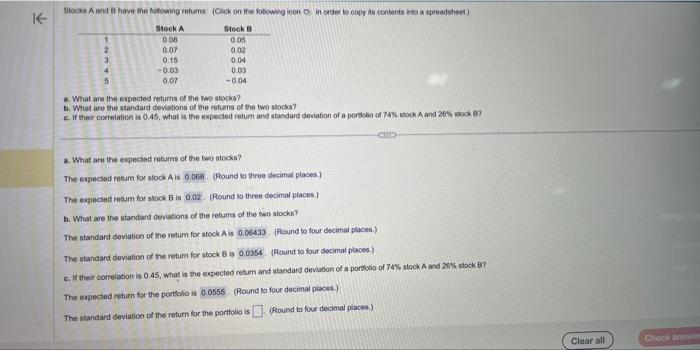

Question: Please answer last part, make sure I can see the answer. Will only upvote if correct a. What are the expected returns of the fwo

a. What are the expected returns of the fwo stocka? b. What are the standard deviations of the ceburns of the two socks? c. If their correlation is 0.45, what is the expected return and atandard deviation of a porbilio of 74N mack A and 265 , asck B? a. What are the expected reburns of the two stocks? The expected retum for stock. A is (Found so theee dedimal places.) The expected resum for stock B is (Round to three decimai places.) b. What are the atandard deviations of the retums of the two stocks? The standard deviation of the return for stock A is (Found to four decimal places.) The standard deviation of the return for atock 8 is (Round to four decimal places.) c. if their comelation is 0.45, what is the expected rehum and atandard deviafion of a portolio of 74% stock A and 26% stock B? The expected return for the portlolio is (Round to four decimal plabes) The standard deviation of the return for the portfoio is (Round to four decinial places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts