Question: Please answer letter E (12) only. Thank you Chapter 26 Financial Statements (7) What is the correct amount of inventories at December 31. 20217 a.

Please answer letter E (12) only. Thank you

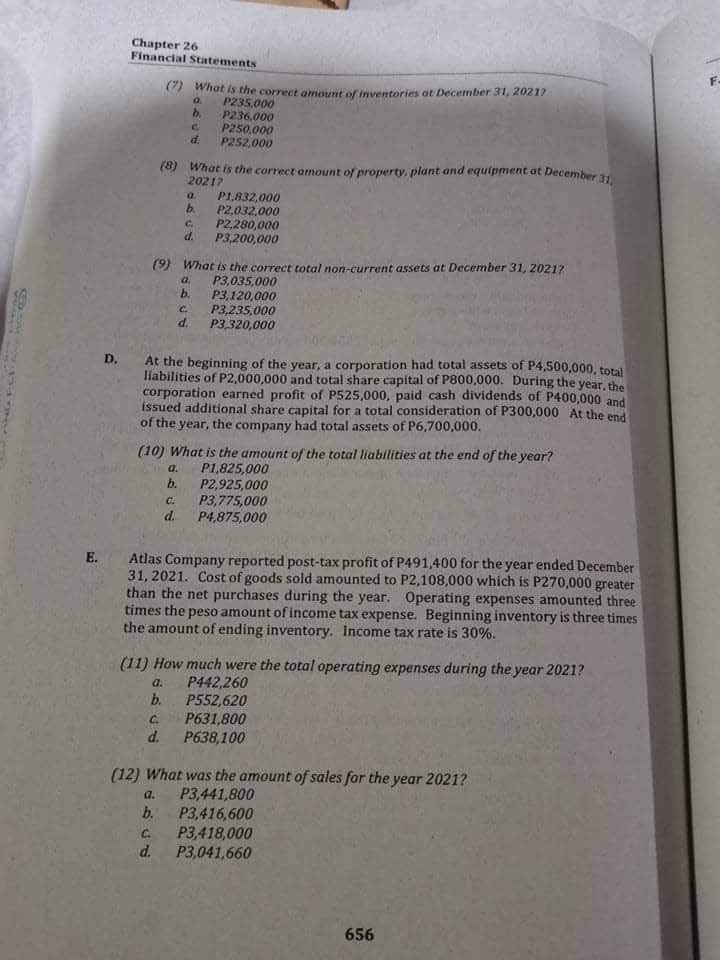

Chapter 26 Financial Statements (7) What is the correct amount of inventories at December 31. 20217 a. P235,000 P236,000 P250,000 P252,000 (8) What is the correct amount of property, plant and equipment at December 31 20217 P1,832,000 b. P2,032,000 P2,280,090 P3,200,090 (9) What is the correct total non-current assets at December 31, 20217 P3,035,000 b. P3,120,090 C. P3,235,000 d P3 320,000 D. At the beginning of the year, a corporation had total assets of P4,500,000, total liabilities of P2,000,000 and total share capital of P800,000. During the year, the corporation earned profit of P525,000, paid cash dividends of P400,000 and issued additional share capital for a total consideration of P300,000 At the end of the year, the company had total assets of P6,700,000. (10) What is the amount of the total liabilities at the end of the year? P1.825,000 b. P2,925,000 C. P3,775,000 d. P4,875,000 E. Atlas Company reported post-tax profit of P491,400 for the year ended December 31, 2021. Cost of goods sold amounted to P2,108,000 which is P270,000 greater than the net purchases during the year. Operating expenses amounted three times the peso amount of income tax expense. Beginning inventory is three times the amount of ending inventory. Income tax rate is 30%. (1 1) How much were the total operating expenses during the year 2021? a. P442,260 b. P552,620 C. P631,800 d. P638,100 (12) What was the amount of sales for the year 2021? a. P3,441,800 b. P3,416,600 C. P3,418,000 d. P3,041,660 656

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts