Question: Please answer letter E. Please show work, will thumbs up Problem 15.7 Pediatric Partners is evaluating a project with the following net cash flows and

Please answer letter E. Please show work, will thumbs up

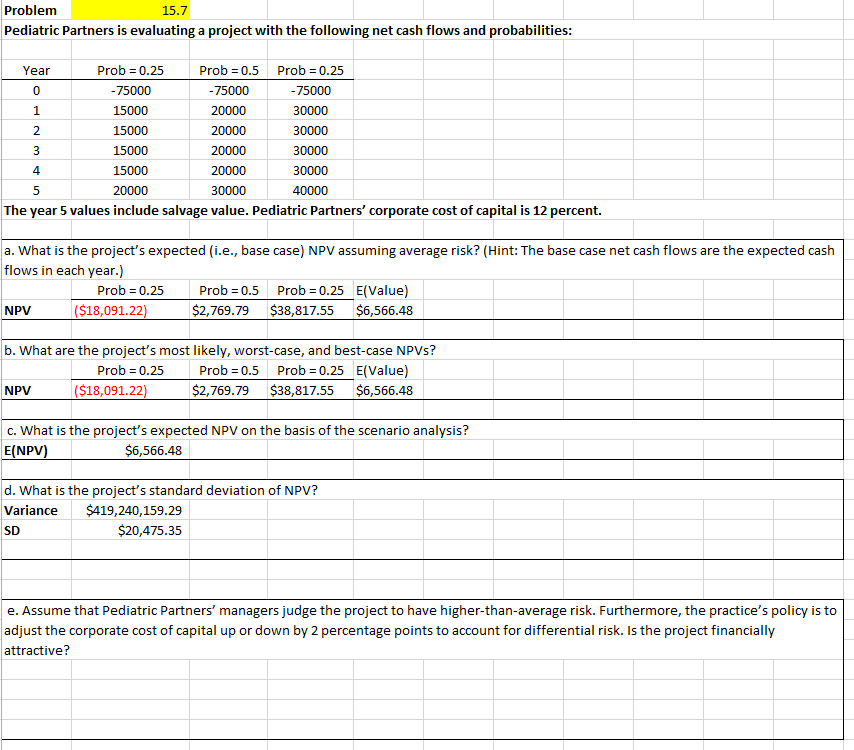

Problem 15.7 Pediatric Partners is evaluating a project with the following net cash flows and probabilities: The year 5 values include salvage value. Pediatric Partners' corporate cost of capital is 12 percent. a. What is the project's expected (i.e., base case) NPV assuming average risk? (Hint: The base case net cash flows are the expected cash flows in each year.) b. What are the project's most likely, worst-case, and best-case NPVs? c. What is the project's expected NPV on the basis of the scenario analysis? E(NPV) $6,566.48 d. What is the project's standard deviation of NPV? e. Assume that Pediatric Partners' managers judge the project to have higher-than-average risk. Furthermore, the practice's policy is to adjust the corporate cost of capital up or down by 2 percentage points to account for differential risk. Is the project financially attractive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts