Question: please answer me question 24 and 25 please both because it is link to each other with statement Consider two assets, one consisting of a

please answer me question 24 and 25 please both because it is link to each other with statement

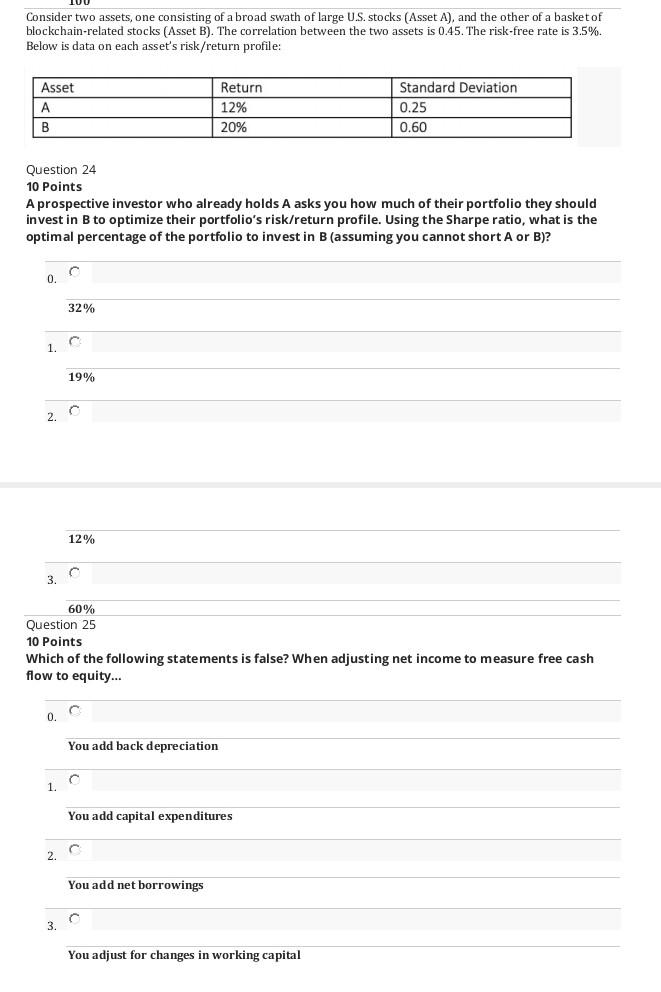

Consider two assets, one consisting of a broad swath of large U.S. stocks (Asset A), and the other of a basket of blockchain-related stocks (Asset B). The correlation between the two assets is 0.45. The risk-free rate is 3.5%. Below is data on each asset's risk/return profile: Asset A Return 12% 20% Standard Deviation 0.25 0.60 B Question 24 10 Points A prospective investor who already holds A asks you how much of their portfolio they should invest in B to optimize their portfolio's risk/return profile. Using the Sharpe ratio, what is the optimal percentage of the portfolio to invest in B (assuming you cannot short A or B)? 0 32% 1. 19% 2. 12% 3. 60% Question 25 10 Points Which of the following statements is false? When adjusting net income to measure free cash flow to equity... C 0. You add back depreciation 1. You add capital expenditures 2. You add net borrowings 3. You adjust for changes in working capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts