Question: Please answer ;( Model A costs $750,000 and Model B $1,300,000, both figures including installation. Model B has three advantages over Model A. First, because

Please answer ;(

Model A costs $750,000 and Model B $1,300,000, both figures including installation. Model B has three advantages over Model A. First, because it is a bit faster its daily production rate is higher, and James is confident he could sell the extra output. Second, labor costs will be lower since it is easier to operate. Finally, Model B should hold its value better because it is a more stateof-the-art press. Still, Model B is nearly twice as expensive and James isn't sure these advantages are worth the extra cost.

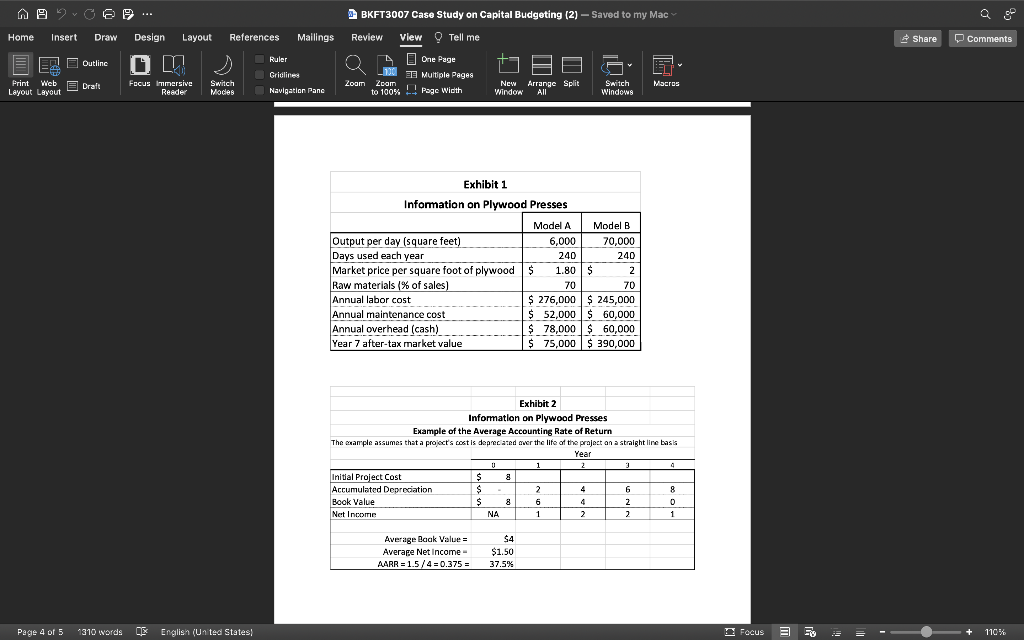

Exhibit 1 shows information on each machine. For the purpose of analysis, straight-line depreciation will be used over the seven-year time horizon of the project. The relevant tax rate is 40 percent.

The purchase of either machine will cause a modest increase in inventory and receivables. James thinks that these increases will be almost completely offset by changes in accounts payable and accruals. Thus, on balance, working capital requirements for both machines will be negligible and can be ignored in any evaluation.

For relatively small investments the company relies exclusively on the payback method. There is no set guideline but James admits that he wants to see a two-year payback. And he defines a "small investment" as a project less than $10,000 and "maybe as much as $15,000." Examples include the replacement of relatively inexpensive equipment and the installation of energy-saving devices.

In order to be acceptable, a relatively large investment must pass two tests. First, the AARR must exceed the firm's target book return. This book return is currently 20 percent, the figure that James uses to evaluate the performance of the firm's plant managers.

In addition, the project must have an "acceptable payback." James explains, "I use my judgment about what is an 'acceptable' payback. There are no strict guidelines." He admits, though, that he doesn't like to see a project's payback exceed five years.

REFLECTIONS

Back at her apartment that evening Mary reflected on her meeting with James. She sees "both good and not so good" with James's capital budgeting procedures. Perhaps the biggest negative is the lack of any discounted cash flow technique. It is clear to Mary, however, that James recognizes that the 20 percent target return is a book and not a market rate. It also appears that James is willing to consider "capital budgeting techniques based on market returns," as he puts it. Conversations with James suggest that a 15 percent market return would be acceptable. That is, Mary thinks that James would undertake a project if he felt that the expected return exceeded 15 percent per year.

Mary is pleased at the responsibility of the assignment and is eager to "make a difference." At the same time, however, she is a bit apprehensive. Mary realizes that James will take her report very seriously, and knows that her recommendations must not only be correct, but must also be clearly justified and explained.

- Calculate Model A and Model B Presss Free Cash Flow (FCF) per year.

- Provide an explanation and calculation of the following capital budgeting methods (include the accept/reject criteria):

- Payback period

- IRR

- NPV

- Profitability index

- Suggest a capital budgeting method West Fraser Timber can use to improve its capital budgeting procedure. Explain why you chose one capital budgeting method over another.

- Based on the calculations from required 4, provide a recommendation of which if any of the two presses West Fraser Timber should purchase. Explain your recommendation using your calculations and rankings from required 3.

A v Go... 8 BKFT3007 Case Study on Capital Budgeting (2) Saved to my Mac Home Insert Draw Design Layout References Mailings Review View Tell me Share Comments Ruler om (A EL Outline Print Web Web Draft Layout Layout Focus Immersive Reader One Page ET Multiple Pages Page Width Gridline Navigation Panc Switch Modes 100 Zoom Zoom to 100% Macros New Arrange Split Windon All Switch Windows Exhibit 1 Information on Plywood Presses Model A Model B Output per day (square feet) 6,000 70,000 Days used each year 240 240 Market price per square foot of plywood $ 1.80$ 2 Raw materials (% of sales) 70 70 Annual labor cost $ 276,000 $ 245,000 Annual maintenance cost $ 52,000$ 60,000 Annual overhead (cash) $ 78,000 $ 60,000 Year 7 after-tax market value $ 75,000 $ 390,000 Exhibit 2 Information on Plywood Presses Example of the Average Accounting Rate of Return The example assumes that a project's cost is deprecated over the life of the praject on a straight line basis Year U 1 i 2 3 Initial Project Cost $ 3 8 Accumulated Depreciation $ $ 2 4 6 8 Book Value $ $ 8 8 6 4 2 0 Net Income NA 1 2 2 2 1 a Average Back Value = Average Net Income AARR = 1.5/4 = 0.375 = $4 $1.50 37.5% Page 4 of 5 1310 words CX English (United States Focus 3 g + 110% A v Go... 8 BKFT3007 Case Study on Capital Budgeting (2) Saved to my Mac Home Insert Draw Design Layout References Mailings Review View Tell me Share Comments Ruler om (A EL Outline Print Web Web Draft Layout Layout Focus Immersive Reader One Page ET Multiple Pages Page Width Gridline Navigation Panc Switch Modes 100 Zoom Zoom to 100% Macros New Arrange Split Windon All Switch Windows Exhibit 1 Information on Plywood Presses Model A Model B Output per day (square feet) 6,000 70,000 Days used each year 240 240 Market price per square foot of plywood $ 1.80$ 2 Raw materials (% of sales) 70 70 Annual labor cost $ 276,000 $ 245,000 Annual maintenance cost $ 52,000$ 60,000 Annual overhead (cash) $ 78,000 $ 60,000 Year 7 after-tax market value $ 75,000 $ 390,000 Exhibit 2 Information on Plywood Presses Example of the Average Accounting Rate of Return The example assumes that a project's cost is deprecated over the life of the praject on a straight line basis Year U 1 i 2 3 Initial Project Cost $ 3 8 Accumulated Depreciation $ $ 2 4 6 8 Book Value $ $ 8 8 6 4 2 0 Net Income NA 1 2 2 2 1 a Average Back Value = Average Net Income AARR = 1.5/4 = 0.375 = $4 $1.50 37.5% Page 4 of 5 1310 words CX English (United States Focus 3 g + 110%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts