Question: please answer my all the 4 questions .. The controller for Oriole Co. is trying to determine the amount of cash to report on the

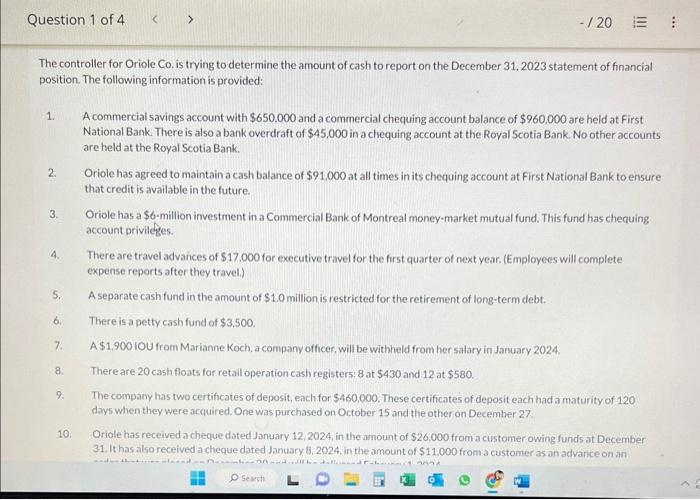

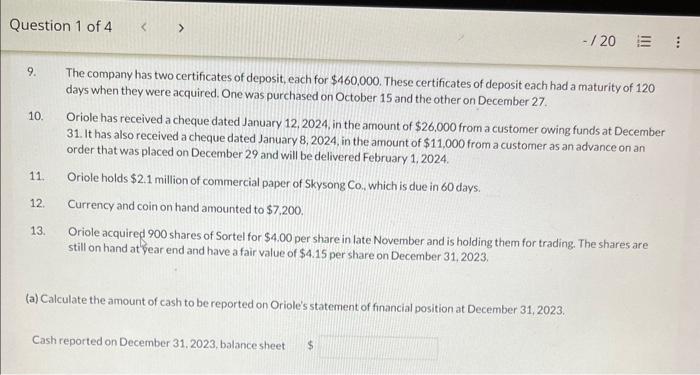

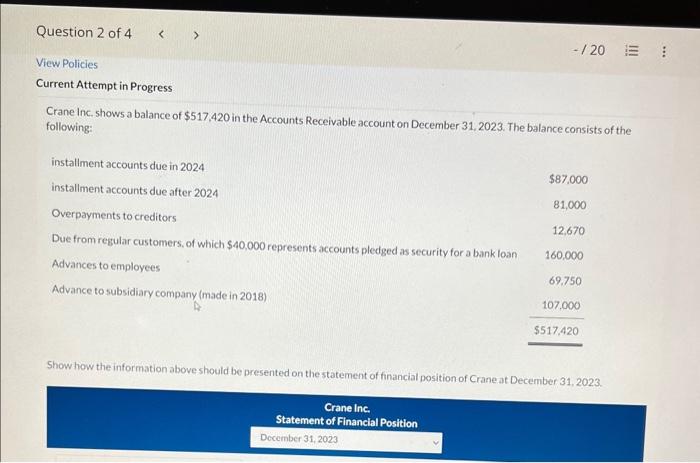

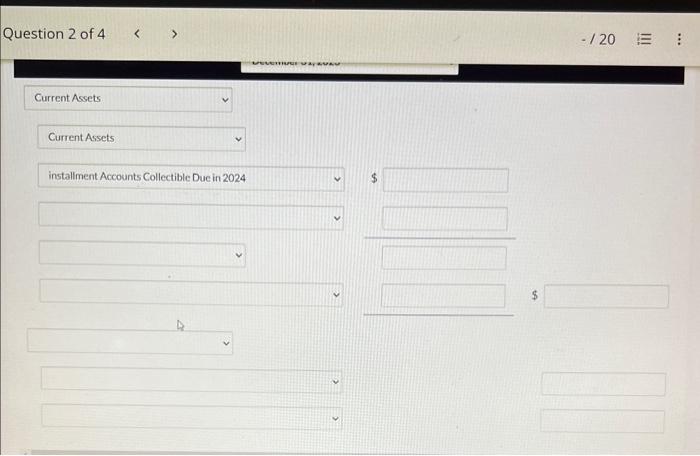

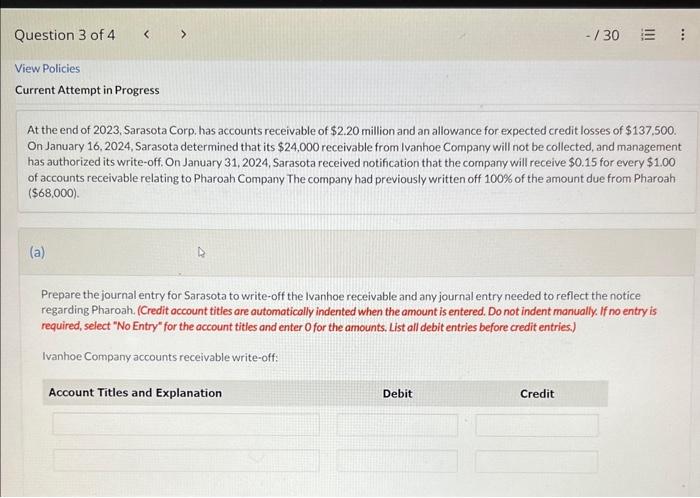

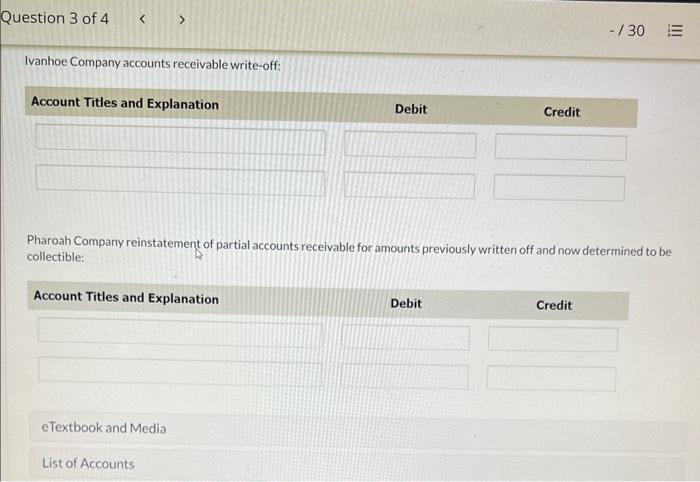

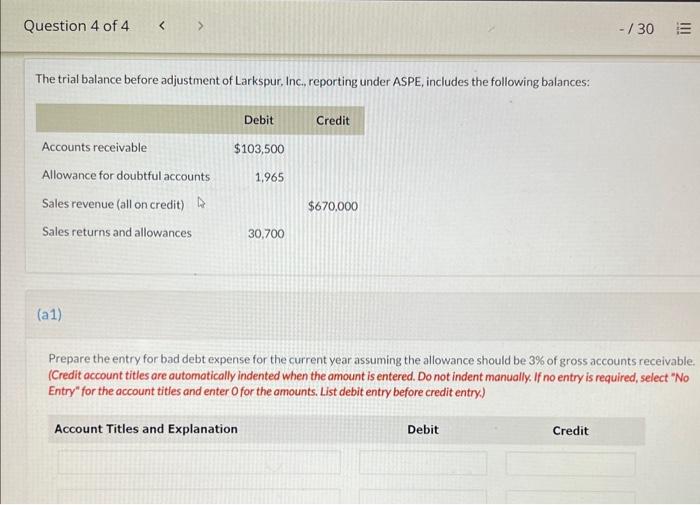

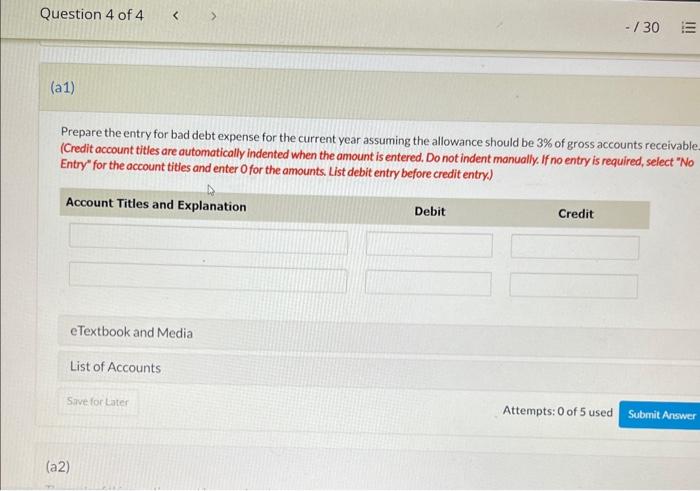

The controller for Oriole Co. is trying to determine the amount of cash to report on the December 31,2023 statement of financial position. The following information is provided: 1. A commercial savings account with $650.000 and a commercial chequing account balance of $960,000 are held at First National Bank. There is also a bank overdraft of $45,000 in a chequing account at the Royal Scotia Bank. No other accounts are held at the Royal Scotia Bank. 2. Oriole has agreed to maintain a cash balance of $91.000 at all times in its chequing account at First National Bank to ensure that credit is available in the future. 3. Oriole has a \$6-million investment in a Commercial Bank of Montreal money-market mutual fund. This fund has chequing account privilefes. 4. There are travel advanices of $17,000 for executive travel for the first quarter of next year. (Employees will complete expense reports after they travel.) 5. A separate cash fund in the amount of $1.0 million is restricted for the retirement of long-term debt. 6. There is a petty cash fund of $3,500. 7. A $1,900 lou from Marianne Koch, a company officer, will be withheld from her salary in January 2024. 8. There are 20 cash floats for retail operation cash registers: 8 at $430 and 12 at $580. 9. The company has two certificates of deposit, each for $460.000. These certificates of deposit each had a maturity of 120 days when they were acquired. One was purchased on October 15 and the other on December 27 10. Oriole has received a cheque dated January 12,2024, in the amount of $26,000 from a customer owing funds at December 31. It has also received a cheque dated January 8, 2024, in the amount of $11,000 from a customer as an advance on an 9. The company has two certificates of deposit, each for $460,000. These certificates of deposit each had a maturity of 120 days when they were acquired. One was purchased on October 15 and the other on December 27. 10. Oriole has received a cheque dated January 12, 2024, in the amount of $26,000 from a customer owing funds at December 31. It has also received a cheque dated January 8,2024 , in the amount of $11,000 from a customer as an advance on an order that was placed on December 29 and will be delivered February 1, 2024. 11. Oriole holds $2.1 million of commercial paper of Skysong Co., which is due in 60 days. 12. Currency and coin on hand amounted to $7,200. 13. Oriole acquired 900 shares of Sortel for $4.00 per share in late November and is holding them for trading. The shares are still on hand at "year end and have a fair value of $4.15 per share on December 31,2023 . (a) Calculate the amount of cash to be reported on Oriole's statement of financial position at December 31,2023. Cash reported on December 31,2023 , balancesheet \$ Crane Inc. shows a balance of $517,420 in the Accounts Receivable account on December 31, 2023. The balance consists of the following: Show how the information above should be presented on the statement of financial position of Crane at December 31,2023 . Question 2 of 4 120 Current Assets Current Assets installment Accounts Collectible Duc in 2024 $ $ At the end of 2023 , Sarasota Corp. has accounts receivable of $2.20 million and an allowance for expected credit losses of $137.500. On January 16, 2024, Sarasota determined that its $24,000 receivable from Ivanhoe Company will not be collected, and management has authorized its write-off. On January 31,2024 , Sarasota received notification that the company will receive $0.15 for every $1.00 of accounts receivable relating to Pharoah Company The company had previously written off 100% of the amount due from Pharoah ($68,000) (a) Prepare the journal entry for Sarasota to write-off the Ivanhoe receivable and any journal entry needed to reflect the notice regarding Pharoah. (Credit occount titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts, List all debit entries before credit entries.) Ivanhoe Company accounts receivable write-off: Ivanhoe Company accounts receivable write-off: Pharoah Company reinstatement of partial accounts receivable for amounts previously written off and now determined to be collectible: The trial balance before adjustment of Larkspur, Inc., reporting under ASPE, includes the following balances: (a1) Prepare the entry for bad debt expense for the current year assuming the allowance should be 3% of gross accounts receivable (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Prepare the entry for bad debt expense for the current year assuming the allowance should be 3% of gross accounts receivabl (Credit account titles are automatically indented when the amount is entered, Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts