Question: Please answer my question based on question because I post many question but cant get any answer that match with question. TQ! PD Sdn Bhd

Please answer my question based on question because I post many question but cant get any answer that match with question. TQ!

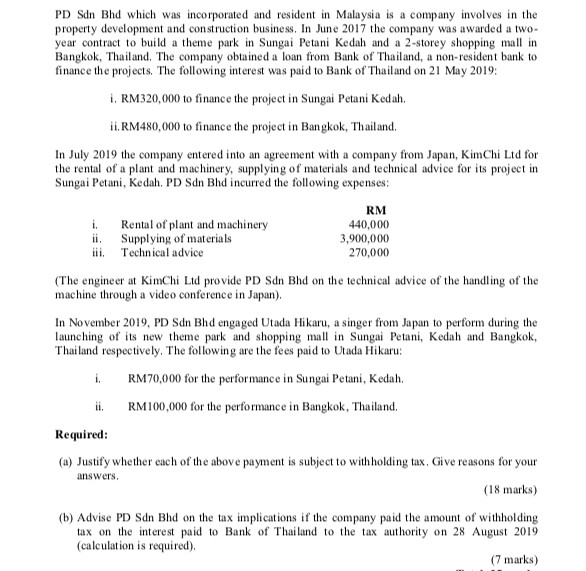

PD Sdn Bhd which was incorporated and resident in Malaysia is a company involves in the property development and construction business. In June 2017 the company was awarded a two- year contract to build a theme park in Sungai Petani Kedah and a 2-storey shopping mall in Bangkok, Thailand. The company obtained a loan from Bank of Thailand, a non-resident bank to finance the projects. The following interest was paid to Bank of Thailand on 21 May 2019: i. RM320,000 to finance the project in Sungai Petani Kedah. ii. RM480,000 to finance the project in Bangkok, Thailand. In July 2019 the company entered into an agreement with a company from Japan, KimChi Ltd for the rental of a plant and machinery, supplying of materials and technical advice for its project in Sungai Petani, Kedah, PD Sdn Bhd incurred the following expenses: RM i. Rental of plant and machinery 440,000 ii. Supplying of materials 3,900,000 iii. Technical advice 270,000 (The engineer at KimChi Ltd provide PD Sdn Bhd on the technical advice of the handling of the machine through a video conference in Japan). In November 2019, PD Sdn Bhd engaged Utada Hikaru, a singer from Japan to perform during the launching of its new theme park and shopping mall in Sungai Petani, Kedah and Bangkok, Thailand respectively. The following are the fees paid to Utada Hikaru: i. RM70,000 for the performance in Sungai Petani, Kedah. ii. RM 100,000 for the performance in Bangkok, Thailand. Required: (a) Justify whether each of the above payment is subject to with holding tax. Give reasons for your answers. (18 marks) (b) Advise PD Sdn Bhd on the tax implications if the company paid the amount of withholding tax on the interest paid to Bank of Thailand to the tax authority on 28 August 2019 (calculation is required) (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts