Question: please answer my questions Question 1 (25 Marks) SQU LLC is considering purchasing the following new machines which relevant data is presented below. Albana Albanu

please answer my questions

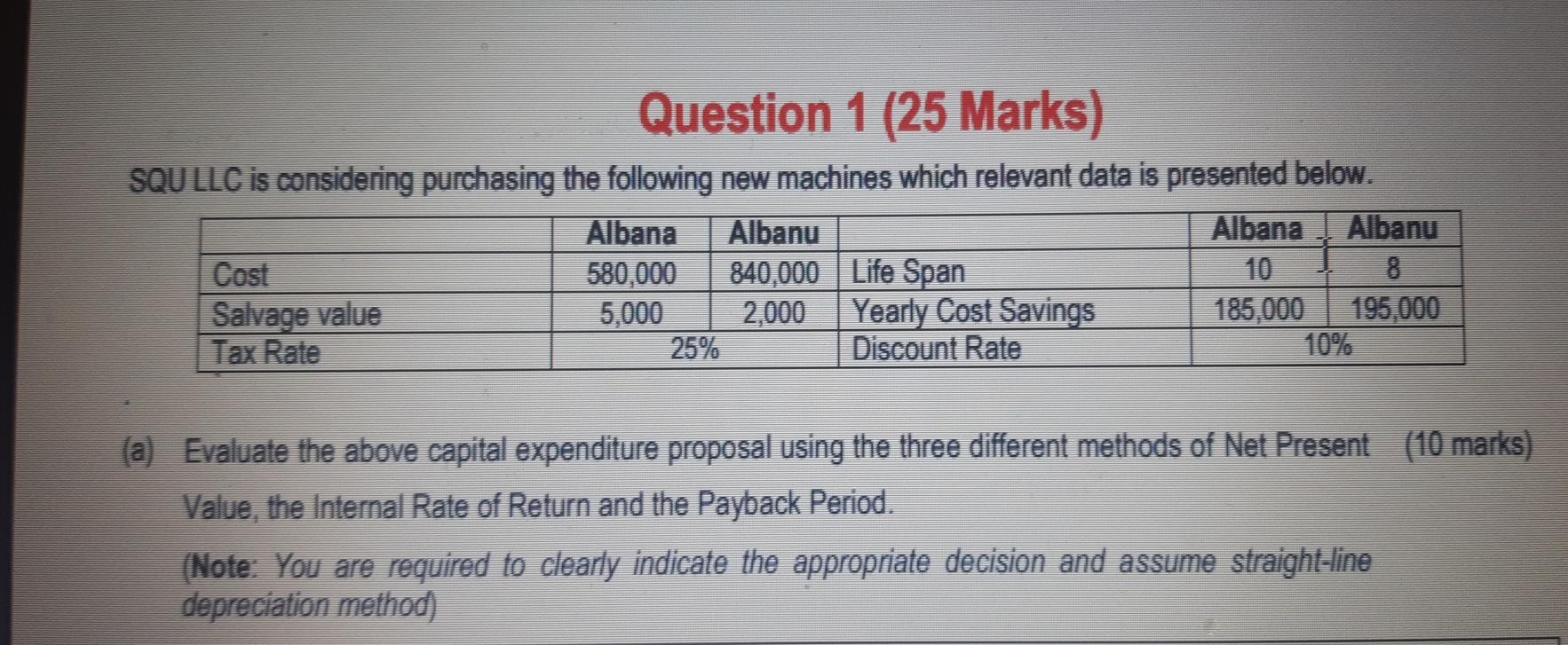

Question 1 (25 Marks) SQU LLC is considering purchasing the following new machines which relevant data is presented below. Albana Albanu Albana Albanu 1 Cost 580,000 840,000 Life Span Salvage value 5,000 2,000 Yearly Cost Savings 185,000 195,000 Tax Rate 25% Discount Rate (a) Evaluate the above capital expenditure proposal using the three different methods of Net Present (10 marks) Value, the Internal Rate of Return and the Payback Period. (Note: You are required to clearly indicate the appropriate decision and assume straight-line depreciation method) (b) Numerical analysis based on the above calculation methods forms only a part of the capital (10 m budgeting strategy. Do you agree? Explain. (c) Given the results in () above, do you agree that the IRR method is superior to the NPV method? (5 Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts