Question: Please answer, needed asap. Please include detailed calculations and explanation. Please use Australia Tax rate 2022. Thank you 13 Part B: Case Study ABC Pty

Please answer, needed asap. Please include detailed calculations and explanation.

Please use Australia Tax rate 2022. Thank you

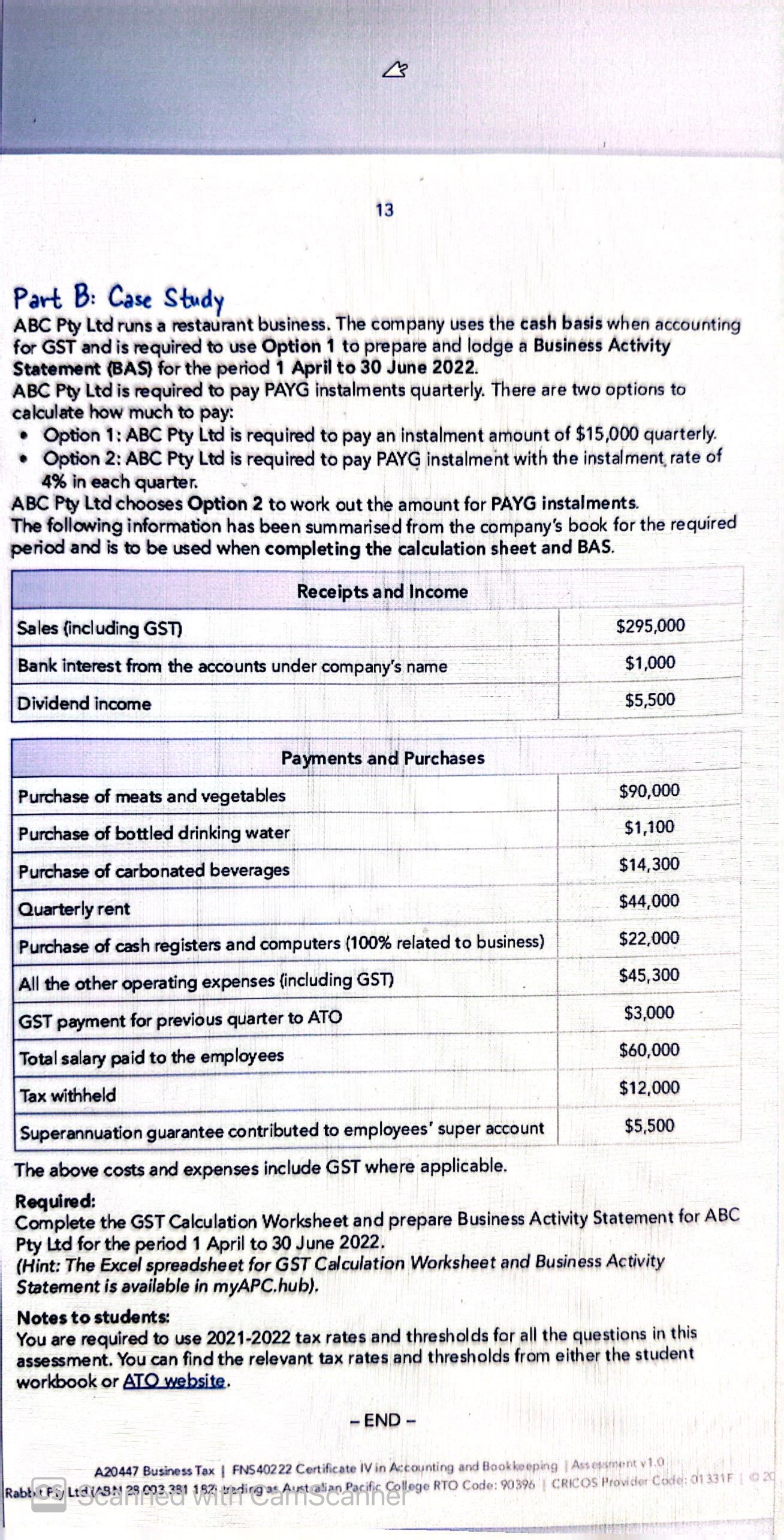

13 Part B: Case Study ABC Pty Led runs a restaurant business. The company uses the cash basis when accounting for GST and is required to use Option 1 to prepare and lodge a Business Activity Statement (BAS) for the period 1 April to 30 June 2022. ABC Pty Led is required to pay PAYG instalments quarterly. There are two options to calculate how much to pay: . Option 1: ABC Pty Ltd is required to pay an instalment amount of $15,000 quarterly. . Option 2: ABC Pty Ltd is required to pay PAYG instalment with the instalment rate of 4% in each quarter. ABC Pty Ltd chooses Option 2 to work out the amount for PAYG instalments. The following information has been summarised from the company's book for the required period and is to be used when completing the calculation sheet and BAS. Receipts and Income Sales (including GST) $295,000 Bank interest from the accounts under company's name $1,000 Dividend income $5,500 Payments and Purchases Purchase of meats and vegetables $90,000 Purchase of bottled drinking water $1,100 Purchase of carbonated beverages $14,300 Quarterly rent $44,000 Purchase of cash registers and computers (100% related to business) $22,000 All the other operating expenses (including GST) $45,300 GST payment for previous quarter to ATO $3,000 Total salary paid to the employees $60,000 Tax withheld $12,000 Superannuateon guarantee contributed to employees' super account $5,500 The above costs and expenses include GST where applicable. Required: Complete the GST Calculation Worksheet and prepare Business Activity Statement for ABC Pty Ltd for the period 1 April to 30 June 2022. (Hint: The Excel spreadsheet for GST Calculation Worksheet and Business Activity Statement is available in myAPC.hub). Notes to students: You are required to use 2021-2022 tax rates and thresholds for all the questions in this assessment. You can find the relevant tax rates and thresholds from either the student workbook or ATO website. - END - A20447 Business Tax | FNS40222 Certificate IV in Accounting and Bookkeeping | Assessment v 1.0 RabbiEFS LIG VAN 29 093 281 182 wedding as Australian Pacific College RTO Code: 9036 | CRICOS Provider Code: 01 331F |0 29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts