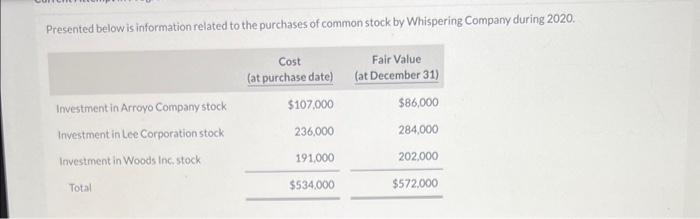

Question: please answer net income/ net loss & journal entry Presented below is information related to the purchases of common stock by Whispering Company during 2020

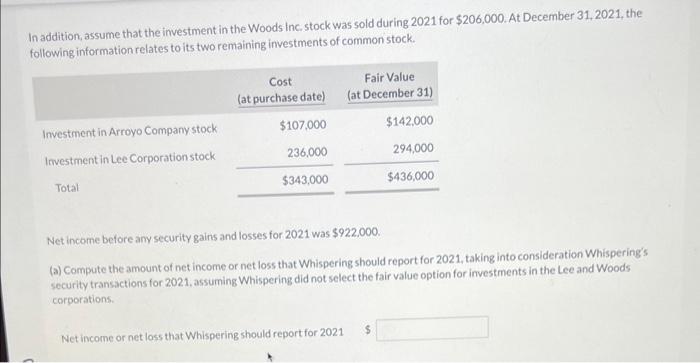

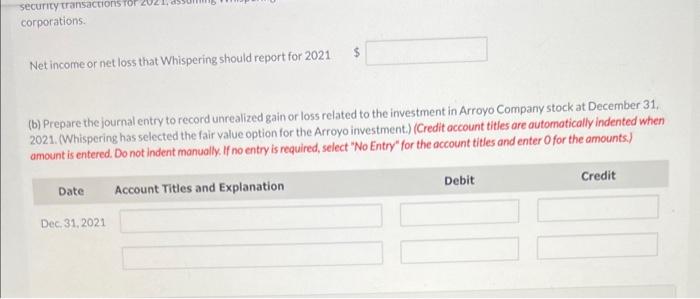

Presented below is information related to the purchases of common stock by Whispering Company during 2020 . In addition, assume that the investment in the Woods inc, stock was sold during 2021 for $206,000. At December 31, 2021, the following information relates to its two remaining investments of common stock. Net income before any security gains and losses for 2021 was $922.000 (a) Compute the amount of net income or net loss that Whispering should report for 2021, taking into consideration Whispering's security transactions for 2021, assuming Whispering did not select the fair value option for investments in the Lee and Woods corporations. Net income or net loss that Whispering should report for 2021 (b) Prepare the journal entry to record unrealized gain or loss related to the investment in Arroyo Company stock at December 31 , 2021. (Whispering has selected the fair value option for the Arroyo investment.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts