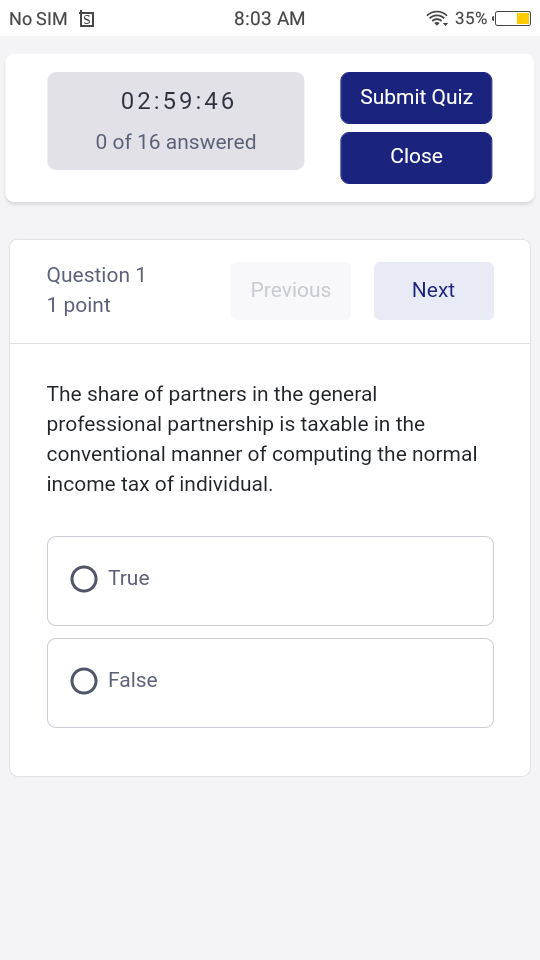

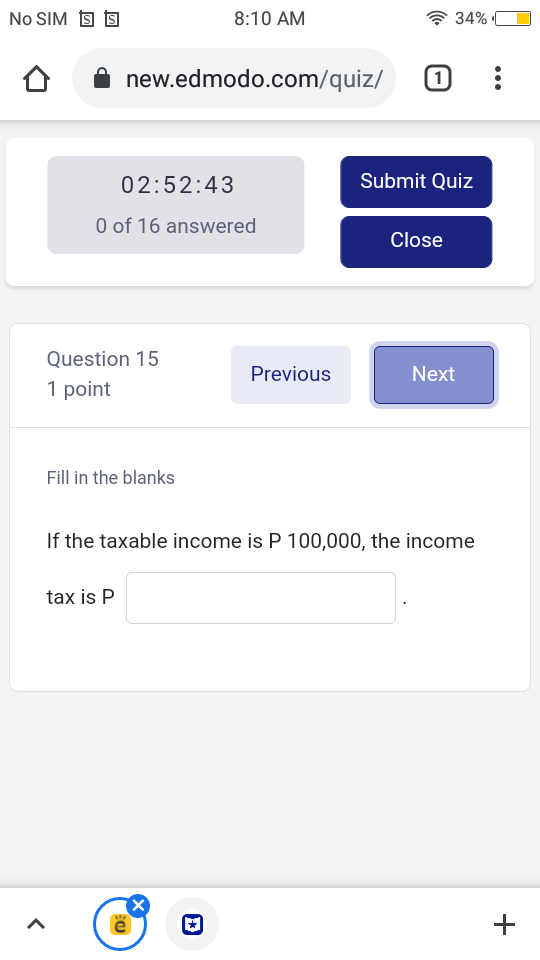

Question: PLEASE ANSWER No SIM S 8:03 AM 35% [ 02:59:46 Submit Quiz 0 of 16 answered Close Question 1 Previous Next 1 point The share

PLEASE ANSWER

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock