Question: Please answer! No work is needed, just final CORRECT answer. A firm has all equity for its capital structure, so it evaluates the NPV of

Please answer! No work is needed, just final CORRECT answer.

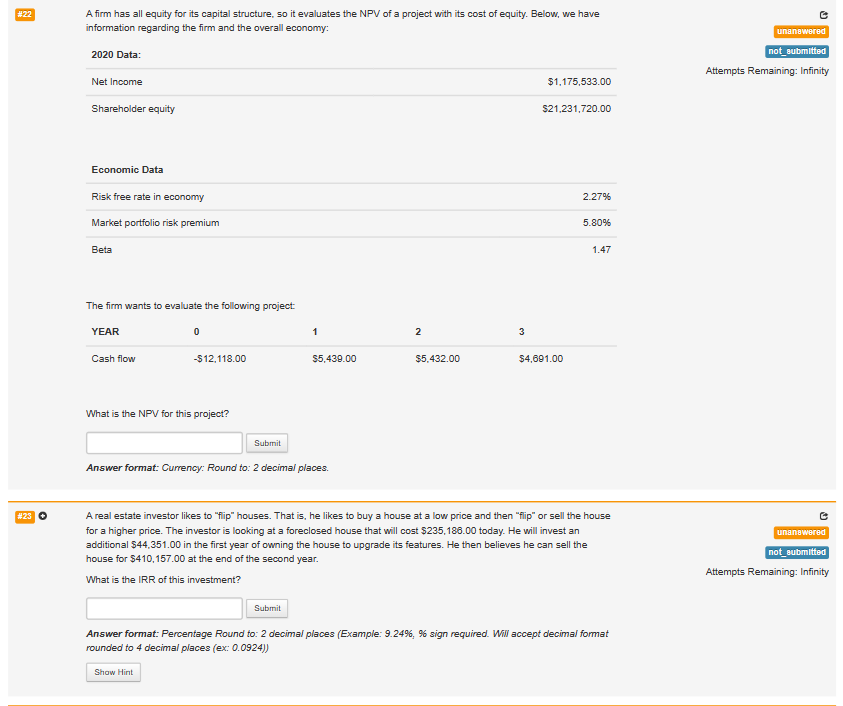

A firm has all equity for its capital structure, so it evaluates the NPV of a project with its cost of equity. Below, we have information regarding the firm and the overall economy: 2020 Data: Attempts Remaining: Infinity Net Income Shareholder equity The firm wants to evaluate the following project What is the NPV for this project? Answer format: Currency: Round to: 2 decimal places. A real estate investor likes to "flip" houses. That is, he likes to buy a house at a low price and then "flip" or sell the house for a higher price. The investor is looking at a foreclosed house that will cost $235,186.00 today. He will invest an additional $44,351.00 in the first year of owning the house to upgrade its features. He then believes he can sell the house for $410,157.00 at the end of the second year. Attempts Remaining: Infinity What is the IRR of this investment? Answer format: Percentage Round to: 2 decimal places (Example: 9.24%,9 sign required. Wil accept decimal format rounded to 4 decimal places (ex: 0.0924))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts