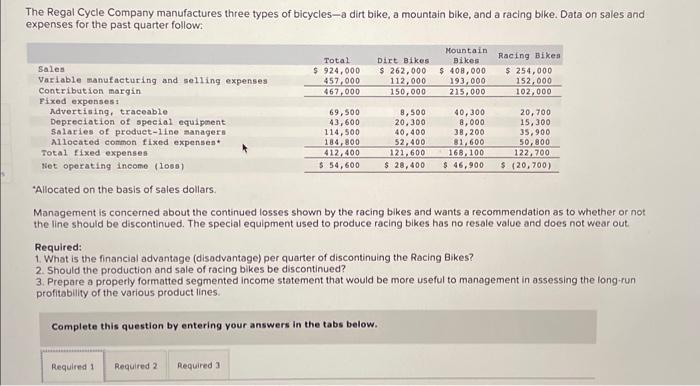

Question: please answer number 1 a. b. c. The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike.

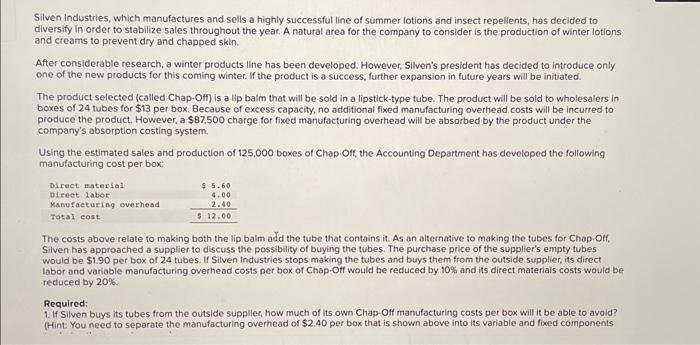

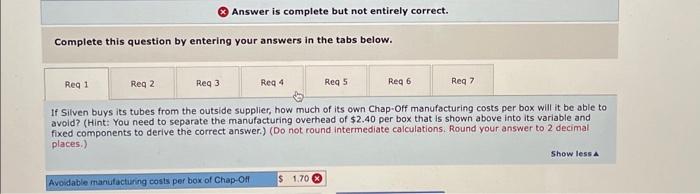

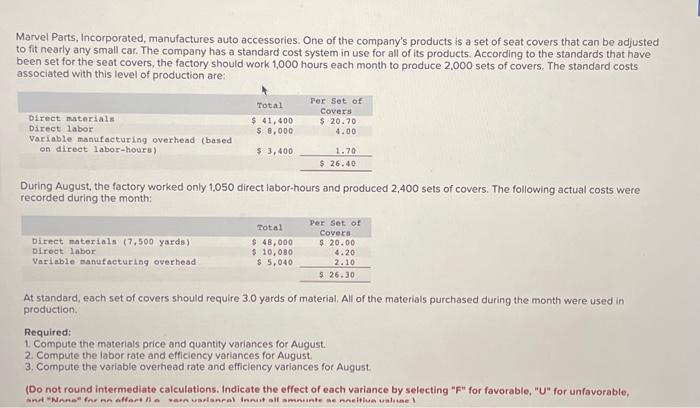

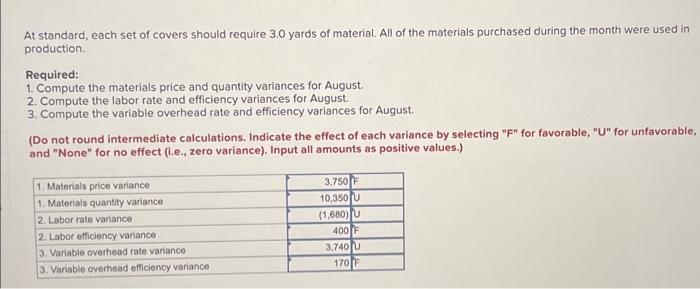

The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: \"Allocated on the basis of sales dollars. Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out. Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production and sale of racing bikes be discontinued? 3. Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long-run profitability of the various product lines. Complete this question by entering your answers in the tabs below. Silven Industries, which manufactures and sells a highly successful line of summer lotions and insect repellents, has decided to dlversify in order to stabilize sales throughout the year. A natural area for the company to consider is the production of winter lotions and creams to prevent dry and chapped skin. After considerable research, a winter products line has been developed. However. Silven's president has decided to introduce only one of the new products for this coming winter. If the product is a success, further expansion in future years will be initiated. The product selected (called Chap-Off) is a lip balm that will be sold in a lipstick-type tube. The product will be sold to wholesalers in boxes of 24 tubes for \\( \\$ 13 \\) per box. Because of excess capacity, no additional fixed manufacturing overhead costs will be incurred to produce the product. However, a \\( \\$ 87,500 \\) charge for fixed manufacturing overhead will be absorbed by the product under the company's absorption costing system. Using the estimated sales and production of 125,000 boxes of Chap.Off, the Accounting Department has developed the following manufacturing cost per box: The costs above relate to making both the lip balm add the tube that contains it. As an alternative to making the tubes for Chap. Off, Silven has approached a supplier to discuss the possibility of buying the tubes. The purchase price of the supplier's empty tubes would be \\( \\$ 1.90 \\) per box of 24 tubes. If Silven Industries stops making the tubes and buys them from the outside supplier, its direct labor and variable manufacturing overhead costs per box of Chap. Off would be reduced by \10 and its direct materials costs would be reduced by \20. Required: Required: 1. If Silven buys its tubes from the outside supplier, how much of its own Chap-Off manufocturing costs per box will it be able to avoid? (Hint You need to separate the manufacturing overhead of \\( \\$ 2.40 \\) per box that is shown above into its variable and fixed components (*) Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. If Silven buys its tubes from the outside supplier, how much of its own Chap-Off manufacturing costs per box will it be able to avoid? (Hint: You need to separate the manufacturing overhead of \\( \\$ 2.40 \\) per box that is shown above into its variable and fixed components to derive the correct answer.) (Do not round intermediate calculations. Round your answer to 2 decimal places.) Marvel Parts, Incorporated, manufactures auto accessories. One of the company's products is a set of seat covers that can be adjusted to fit nearly any small car. The company has a standard cost system in use for all of its products. According to the standards that have been set for the seat covers, the factory should work 1,000 hours each month to produce 2,000 sets of covers. The standard costs associated with this level of production are: During August, the factory worked only 1,050 direct labor-hours and produced 2,400 sets of covers. The following actual costs were recorded during the month: At standard, each set of covers should require 3.0 yards of material. All of the materials purchased during the month were used in production. Required: 1. Compute the materials price and quantity variances for August. 2. Compute the labor rate and efficiency variances for August. 3. Compute the variable overhead rate and efficlency variances for August. (Do not round intermediate calculations. Indicate the effect of each variance by selecting \" \\( F \\) \" for favorable, \" \\( \\mathrm{U} \\) \" for unfavorable, At standard, each set of covers should require 3.0 yards of material. All of the materials purchased during the month were used in production. Required: 1. Compute the materials price and quantity variances for August. 2. Compute the labor rate and efficiency variances for August. 3. Compute the variable overhead rate and efficiency variances for August. (Do not round intermediate calculations. Indicate the effect of each variance by selecting \" \\( F \\) \" for favorable, \"U\" for unfavorable, and \"None\" for no effect (i.e., zero variance). Input all amounts as positive values.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts