Question: please answer number 11, i believe you need the answer to number 10 to solve 11 10. You've identified a pure play firm in the

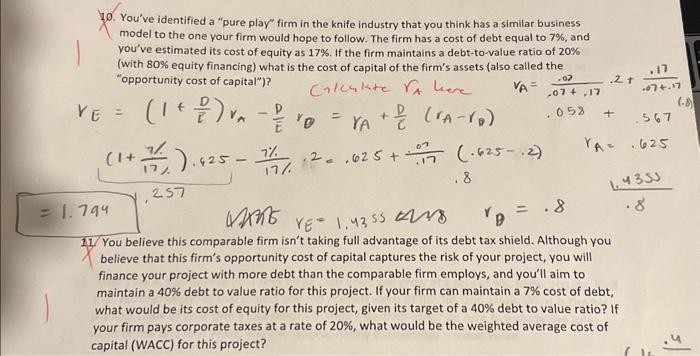

10. You've identified a "pure play" firm in the knife industry that you think has a similar business model to the one your firm would hope to follow. The firm has a cost of debt equal to 7%, and you've estimated its cost of equity as 17%. If the firm maintains a debt-to-value ratio of 20% (with 80% equity financing) what is the cost of capital of the firm's assets (also called the "opportunity cost of capital")? Ca/CGlateVA Lere VA=.07+.17.072+ VE=(1+ED)rAEDr=rA+CD(rAr).058+257(1+177%)).62517%7%.2=.625+.17.07(.625.2)7944.146rE=1.4355.8.8 You believe this comparable firm isn't taking full advantage of its debt tax shield. Although you believe that this firm's opportunity cost of capital captures the risk of your project, you will finance your project with more debt than the comparable firm employs, and you'll aim to maintain a 40% debt to value ratio for this project. If your firm can maintain a 7% cost of debt, what would be its cost of equity for this project, given its target of a 40% debt to value ratio? If your firm pays corporate taxes at a rate of 20%, what would be the weighted average cost of capital (WACC) for this project? 10. You've identified a "pure play" firm in the knife industry that you think has a similar business model to the one your firm would hope to follow. The firm has a cost of debt equal to 7%, and you've estimated its cost of equity as 17%. If the firm maintains a debt-to-value ratio of 20% (with 80% equity financing) what is the cost of capital of the firm's assets (also called the "opportunity cost of capital")? Ca/CGlateVA Lere VA=.07+.17.072+ VE=(1+ED)rAEDr=rA+CD(rAr).058+257(1+177%)).62517%7%.2=.625+.17.07(.625.2)7944.146rE=1.4355.8.8 You believe this comparable firm isn't taking full advantage of its debt tax shield. Although you believe that this firm's opportunity cost of capital captures the risk of your project, you will finance your project with more debt than the comparable firm employs, and you'll aim to maintain a 40% debt to value ratio for this project. If your firm can maintain a 7% cost of debt, what would be its cost of equity for this project, given its target of a 40% debt to value ratio? If your firm pays corporate taxes at a rate of 20%, what would be the weighted average cost of capital (WACC) for this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts