Question: Please Answer number 2 quantitative analysis or qualitative reasoning. 1. A firm is considering a new project whose data are shown below. The required equipment

Please Answer number 2

Please Answer number 2

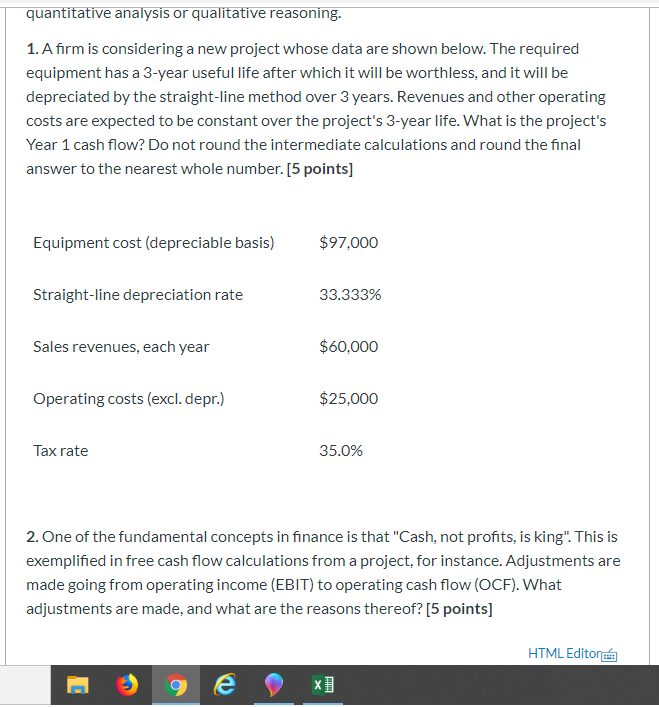

quantitative analysis or qualitative reasoning. 1. A firm is considering a new project whose data are shown below. The required equipment has a 3-year useful life after which it will be worthless, and it will be depreciated by the straight-line method over 3 years. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's Year 1 cash flow? Do not round the intermediate calculations and round the final answer to the nearest whole number. [5 points) Equipment cost (depreciable basis) $97.000 Straight-line depreciation rate 33.333% Sales revenues, each year $60,000 Operating costs (excl. depr.) $25,000 Tax rate 35.0% 2. One of the fundamental concepts in finance is that "Cash, not profits, is king". This is exemplified in free cash flow calculations from a project, for instance. Adjustments are made going from operating income (EBIT) to operating cash flow (OCF). What adjustments are made, and what are the reasons thereof? (5 points) HTML Editora

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts