Question: Please answer number 7 Year 3 4.0% 1.0% 5.0% AT 1 16. or LIBOR plus a fixed spread of 1.00%. The LIBOR rate will be

Please answer number 7

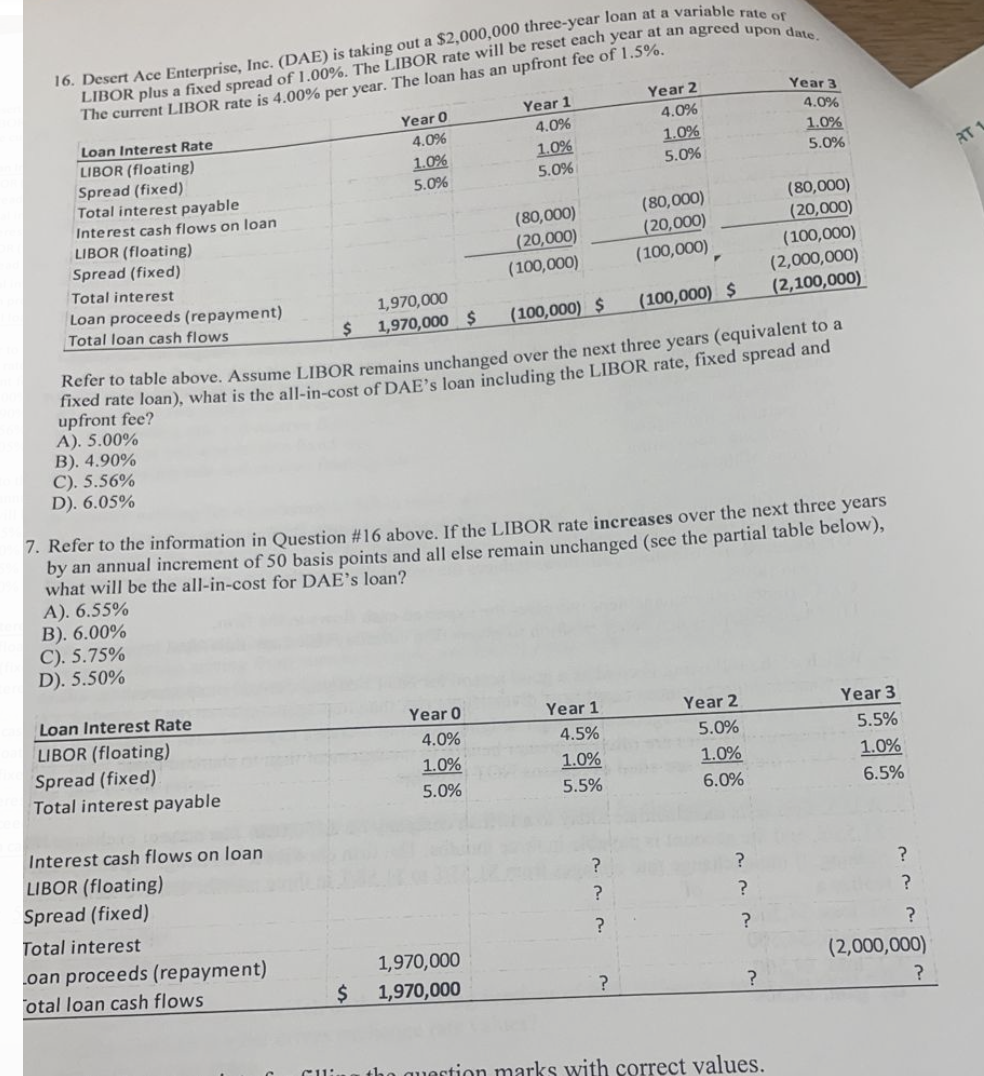

Year 3 4.0% 1.0% 5.0% AT 1 16. or LIBOR plus a fixed spread of 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 1.5%. Year 2 Year 1 Year 0 Loan Interest Rate 4.0% LIBOR (floating) 4.0% 4.0% 1.0% Spread (fixed) 1.0% 1.0% 5.0% Total interest payable 5.0% 5.0% Interest cash flows on loan LIBOR (floating) (80,000) (80,000) (80,000) Spread (fixed) (20,000) (20,000) (20,000) Total interest (100,000) (100,000) (100,000) Loan proceeds (repayment) 1,970,000 (2,000,000) Total loan cash flows $ 1,970,000 $ (100,000) $ (100,000) $ (2,100,000) Refer to table above. Assume LIBOR remains unchanged over the next three years (equivalent to a fixed rate loan), what is the all-in-cost of DAE's loan including the LIBOR rate, fixed spread and upfront fee? A). 5.00% B). 4.90% C). 5.56% D). 6.05% 7. Refer to the information in Question #16 above. If the LIBOR rate increases over the next three years by an annual increment of 50 basis points and all else remain unchanged (see the partial table below), what will be the all-in-cost for DAE's loan? A). 6.55% B). 6.00% C). 5.75% D). 5.50% Loan Interest Rate LIBOR (floating) Spread (fixed) Total interest payable Year o 4.0% 1.0% 5.0% Year 1 4.5% 1.0% 5.5% Year 2 5.0% 1.0% 6.0% Year 3 5.5% 1.0% 6.5% ? ? ? ? ? ? Interest cash flows on loan LIBOR (floating) Spread (fixed) Total interest .oan proceeds (repayment) total loan cash flows ? ? ? (2,000,000) ? 1,970,000 1,970,000 ? ? $ 11: the question marks with correct values. Year 3 4.0% 1.0% 5.0% AT 1 16. or LIBOR plus a fixed spread of 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 1.5%. Year 2 Year 1 Year 0 Loan Interest Rate 4.0% LIBOR (floating) 4.0% 4.0% 1.0% Spread (fixed) 1.0% 1.0% 5.0% Total interest payable 5.0% 5.0% Interest cash flows on loan LIBOR (floating) (80,000) (80,000) (80,000) Spread (fixed) (20,000) (20,000) (20,000) Total interest (100,000) (100,000) (100,000) Loan proceeds (repayment) 1,970,000 (2,000,000) Total loan cash flows $ 1,970,000 $ (100,000) $ (100,000) $ (2,100,000) Refer to table above. Assume LIBOR remains unchanged over the next three years (equivalent to a fixed rate loan), what is the all-in-cost of DAE's loan including the LIBOR rate, fixed spread and upfront fee? A). 5.00% B). 4.90% C). 5.56% D). 6.05% 7. Refer to the information in Question #16 above. If the LIBOR rate increases over the next three years by an annual increment of 50 basis points and all else remain unchanged (see the partial table below), what will be the all-in-cost for DAE's loan? A). 6.55% B). 6.00% C). 5.75% D). 5.50% Loan Interest Rate LIBOR (floating) Spread (fixed) Total interest payable Year o 4.0% 1.0% 5.0% Year 1 4.5% 1.0% 5.5% Year 2 5.0% 1.0% 6.0% Year 3 5.5% 1.0% 6.5% ? ? ? ? ? ? Interest cash flows on loan LIBOR (floating) Spread (fixed) Total interest .oan proceeds (repayment) total loan cash flows ? ? ? (2,000,000) ? 1,970,000 1,970,000 ? ? $ 11: the question marks with correct values

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts