Question: please answer numerically and explain it ALL step by step ALE Project #14 Closing Activities Preview of Chapter Closing entries are necessary to close the

please answer numerically and explain it ALL step by step

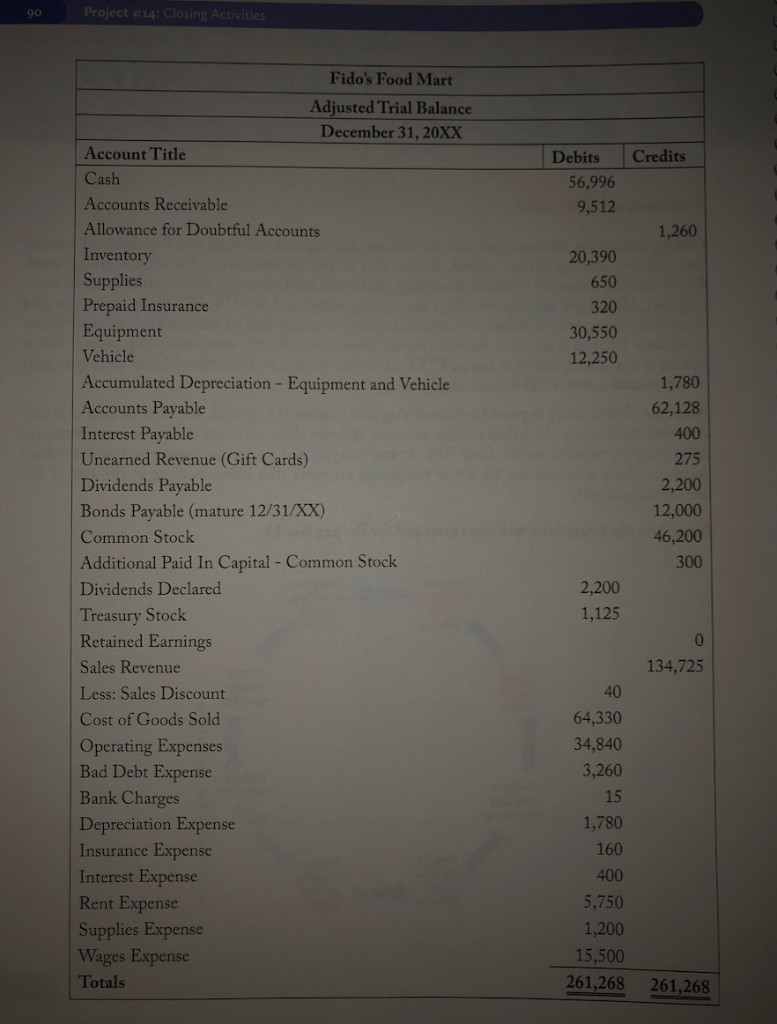

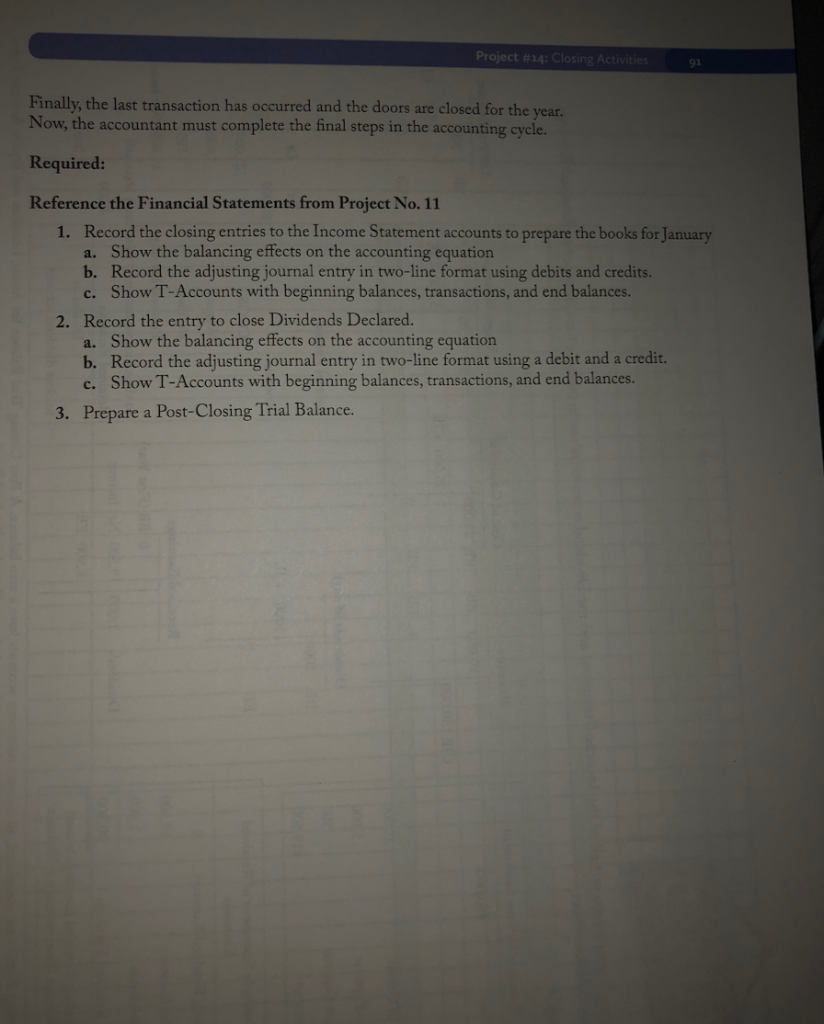

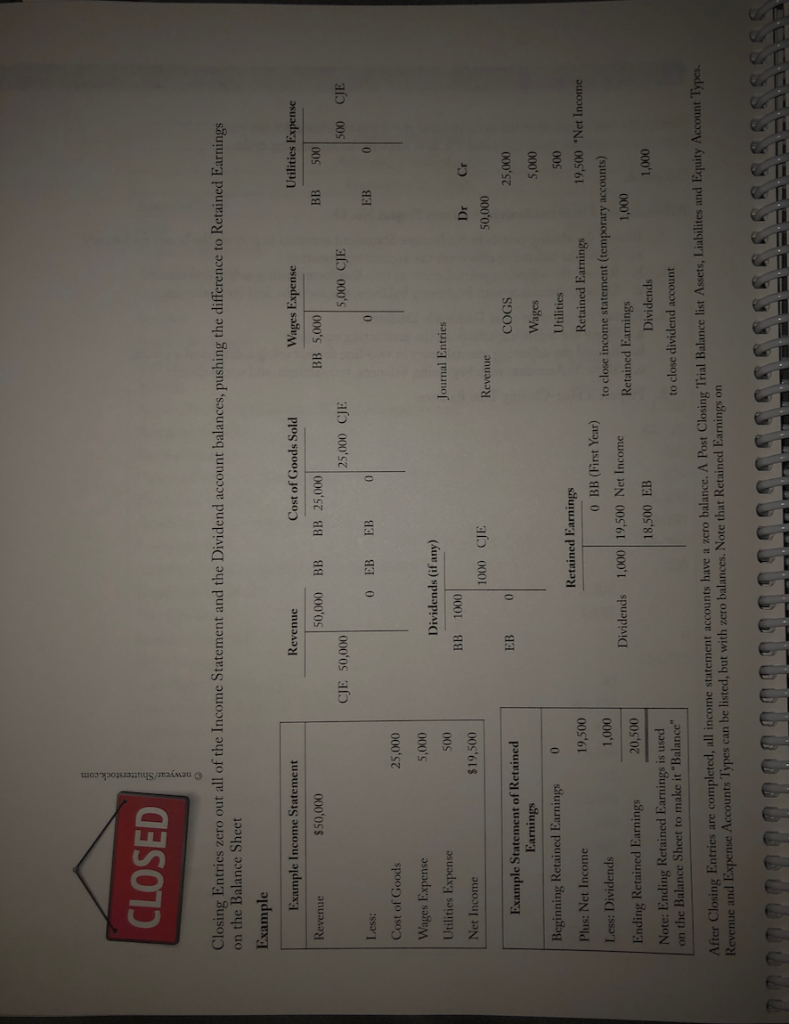

ALE Project #14 Closing Activities Preview of Chapter Closing entries are necessary to close the income and expense accounts and the dividend account into retained earnings for the period. This is what makes the statement of retained earnings work. Recall that the statement of retained earnings starts with the beginning of the period retained earn- ings and ADDS the net income (from the closing entry) and SUBTRACTS any dividends paid (from the closing entry). When an account is closed, it means that its balance is set to zero. When an account balance is zero, it is ready to record information for the new accounting period. This is similar to a paycheck stub that has its YTD balance set to zero on December 31 and is ready to start to accumulate a new YTD balance as of January 1. After the closing entry is posted a post-closing trial balance is prepared. The post-closing trial bal- ance will report only the balance sheet accounts. Balance sheet accounts are known as permanent accounts (the balances never close). The closing entry closed the income statement and dividend accounts, these accounts are known as temporary accounts (the balances close at the end of the accounting period). Note: Use the financial statements prepared for Project No. 11. Prepare Postclosing Trial Balance Analyze and Record Journal Entries Record Closing Journal Entries Post to Ledger Accounts Bantz and Ann Esarco Prepare Financial Statements Prepare Unadjusted Trial Balance Prepare Adjusted Trial Balance Record Adjusting Journal Entries Courtesy of Laura K Project #14: Closing Activities Credits Debits 56,996 9,512 1,260 20,390 650 320 30,550 12,250 Fido's Food Mart Adjusted Trial Balance December 31, 20XX Account Title Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Supplies Prepaid Insurance Equipment Vehicle Accumulated Depreciation - Equipment and Vehicle Accounts Payable Interest Payable Unearned Revenue (Gift Cards) Dividends Payable Bonds Payable (mature 12/31/XX) Common Stock Additional Paid In Capital - Common Stock Dividends Declared Treasury Stock Retained Earnings Sales Revenue Less: Sales Discount Cost of Goods Sold Operating Expenses Bad Debt Expense Bank Charges Depreciation Expense Insurance Expense Interest Expense Rent Expense Supplies Expense Wages Expense Totals 1,780 62,128 400 275 2,200 12,000 46,200 300 2,200 1,125 0 134,725 40 64,330 34,840 3,260 15 1,780 160 400 5,750 1,200 15,500 261,268 261,268 Project #14: Closing Activities 92 Finally, the last transaction has occurred and the doors are closed for the year. Now, the accountant must complete the final steps in the accounting cycle. Required: Reference the Financial Statements from Project No. 11 1. Record the closing entries to the Income Statement accounts to prepare the books for January a. Show the balancing effects on the accounting equation b. Record the adjusting journal entry in two-line format using debits and credits. c. Show T-Accounts with beginning balances, transactions, and end balances. 2. Record the entry to close Dividends Declared. a. Show the balancing effects on the accounting equation b. Record the adjusting journal entry in two-line format using a debit and a credit. c. Show T-Accounts with beginning balances, transactions, and end balances. 3. Prepare a Post-Closing Trial Balance. CLOSED newyear/Shutterstock.com Closing Entries zero out all of the Income Statement and the Dividend account balances, pushing the difference to Retained Earnings on the Balance Sheet Example Example Income Statement Revenue Cost of Goods Sold Wages Expense Utilities Expense Revenue $50,000 50,000 BB BB 25,000 BB 5,000 BB 500 CJE 50,000 25,000 CJE 5,000 CJE 500 CJE Less: 0 EB EB 0 Cost of Goods 25,000 Wages Expense 5,000 Dividends (if any) Utilities Expense 500 Journal Entries BB 1000 Dr Cr Net Income $19,500 1000 CJE Revenue 50,000 Example Statement of Retained COGS 25,000 Earnings Wages 5,000 Beginning Retained Earnings 0 Utilities 500 Retained Earnings Plus: Net Income 19,500 Retained Earnings 19,500 Net Income 0 BB (First Year) Less: Dividends 1,000 to close income statement (temporary accounts) Dividends 1,000 19,500 Net Income Ending Retained Earnings 1,000 Retained Earnings 20,500 18,500 EB Dividends 1,000 Note: Ending Retained Earnings is used on the Balance Sheet to make it "Balance" to close dividend account After Closing Entries are completed, all income statement accounts have a zero balance. A Post Closing Trial Balance list Assets, Liabilites and Equity Account Types. Revenue and Expense Accounts Types can be listed, but with zero balances. Note that Retained Earnings on

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts