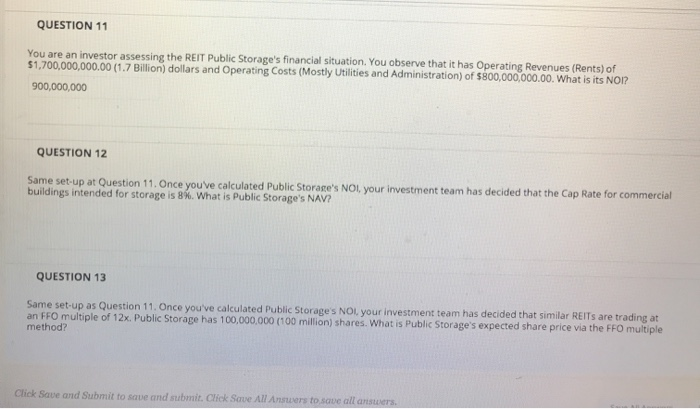

Question: please answer on question 13 QUESTION 11 an investor assessing the REIT Public Storage's financial situation. You observe that it has Operating Revenues (Rents) of

QUESTION 11 an investor assessing the REIT Public Storage's financial situation. You observe that it has Operating Revenues (Rents) of 00,000,000.00. What is its Nom? $1,700,000,000.00 (1.7 Billion) dollars and Operating Costs (Mostly Utilities and Administration) of s8 900,000,000 QUESTION 12 Same set up at Question 11. Once youve calculated Public Storase's NOI, your investment team has decided that the Cap Rate for commercial buildings intended for storage is 8%. What is Public Storage's NAV? QUESTION 13 Same set-up as Question 11. an FFO multiple of 12x. Public Storage has 100,000,000 (100 million) shares. What is Public Storage's expe method? Once you've calculated Public Storage's NOI your investment team has decided that similar REITs are trading at and Submit to save and submit. Click Save All Ansuers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts