Question: please answer only 3 & 4 Stock 1 has an expected return of 14% and a standard deviation of 33%. Stock 2 has an expected

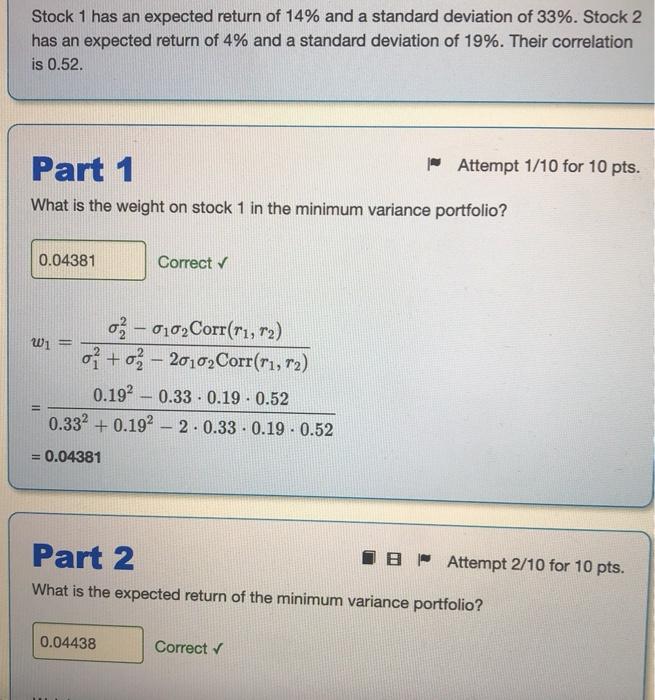

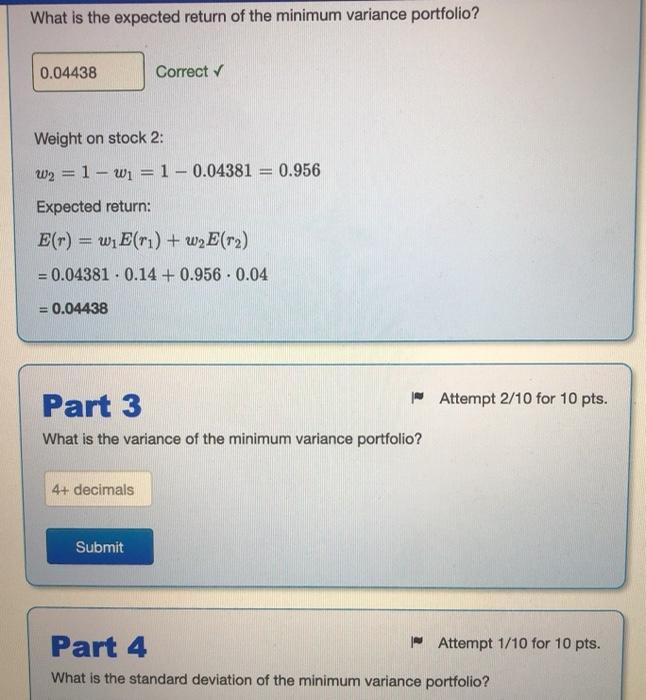

Stock 1 has an expected return of 14% and a standard deviation of 33%. Stock 2 has an expected return of 4% and a standard deviation of 19%. Their correlation is 0.52. Part 1 Attempt 1/10 for 10 pts. What is the weight on stock 1 in the minimum variance portfolio? 0.04381 Correct W1 = 03 - 0102Corr(T1, 12) o + o - 20102Corr(r1, 12) 0.192 - 0.33 0.19 0.52 0.332 +0.192 - 2. 0.33 0.19 - 0.52 0.04381 Part 2 IB Attempt 2/10 for 10 pts. What is the expected return of the minimum variance portfolio? 0.04438 Correct What is the expected return of the minimum variance portfolio? 0.04438 Correct Weight on stock 2: w2 = 1 - W1 = 1 - 0.04381 Expected return: 0.956 E() = wiE(ru) + w2E(+2) = 0.04381 -0.14 +0.956. 0.04 = 0.04438 Part 3 | Attempt 2/10 for 10 pts. What is the variance of the minimum variance portfolio? 4+ decimals Submit Part 4 - Attempt 1/10 for 10 pts. What is the standard deviation of the minimum variance portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts