Question: Please answer only (C) CAPITAL BALANCES which I have to write in A, B, C, and D as shown in the screenshot. Please answer clearly.

Please answer only (C) CAPITAL BALANCES which I have to write in A, B, C, and D as shown in the screenshot. Please answer clearly.

Please answer only (C) CAPITAL BALANCES which I have to write in A, B, C, and D as shown in the screenshot. Please answer clearly.

Please KINDLY do not copy-paste previously answered answers. One of the t u t o r s copied and paste the same answer thats why I have to post the question again. That tutor wasted my one question. Also, I cannot see the comment option below the question if I have any doubts. How can I ask if I want to?

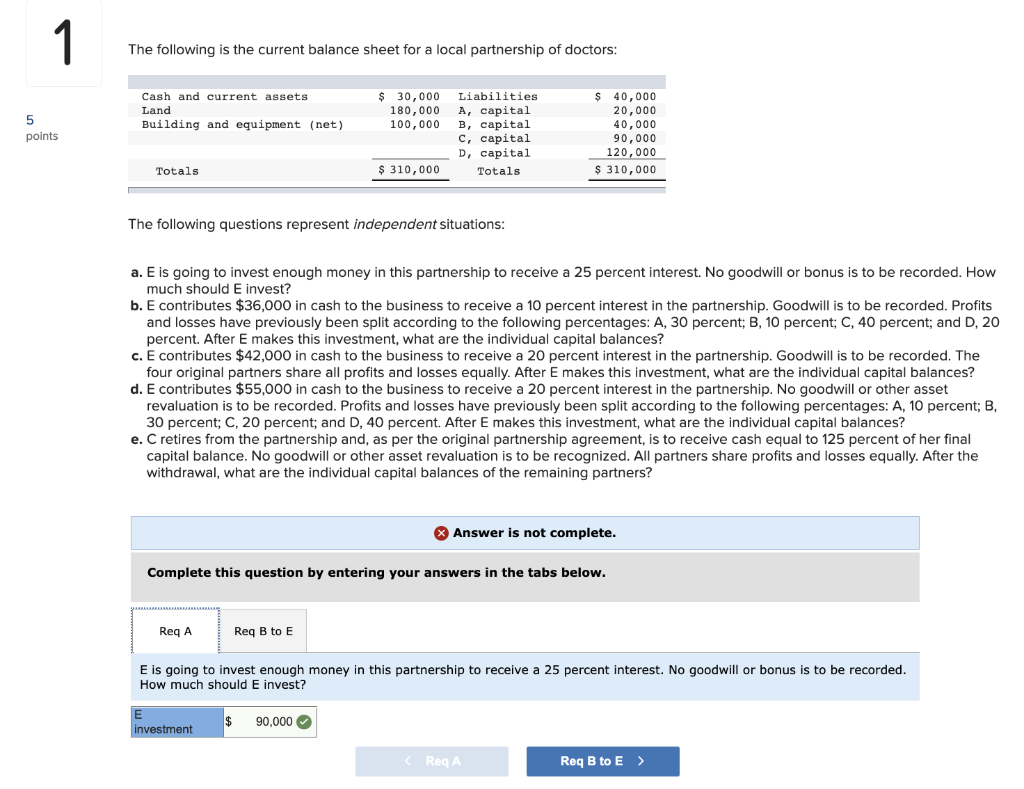

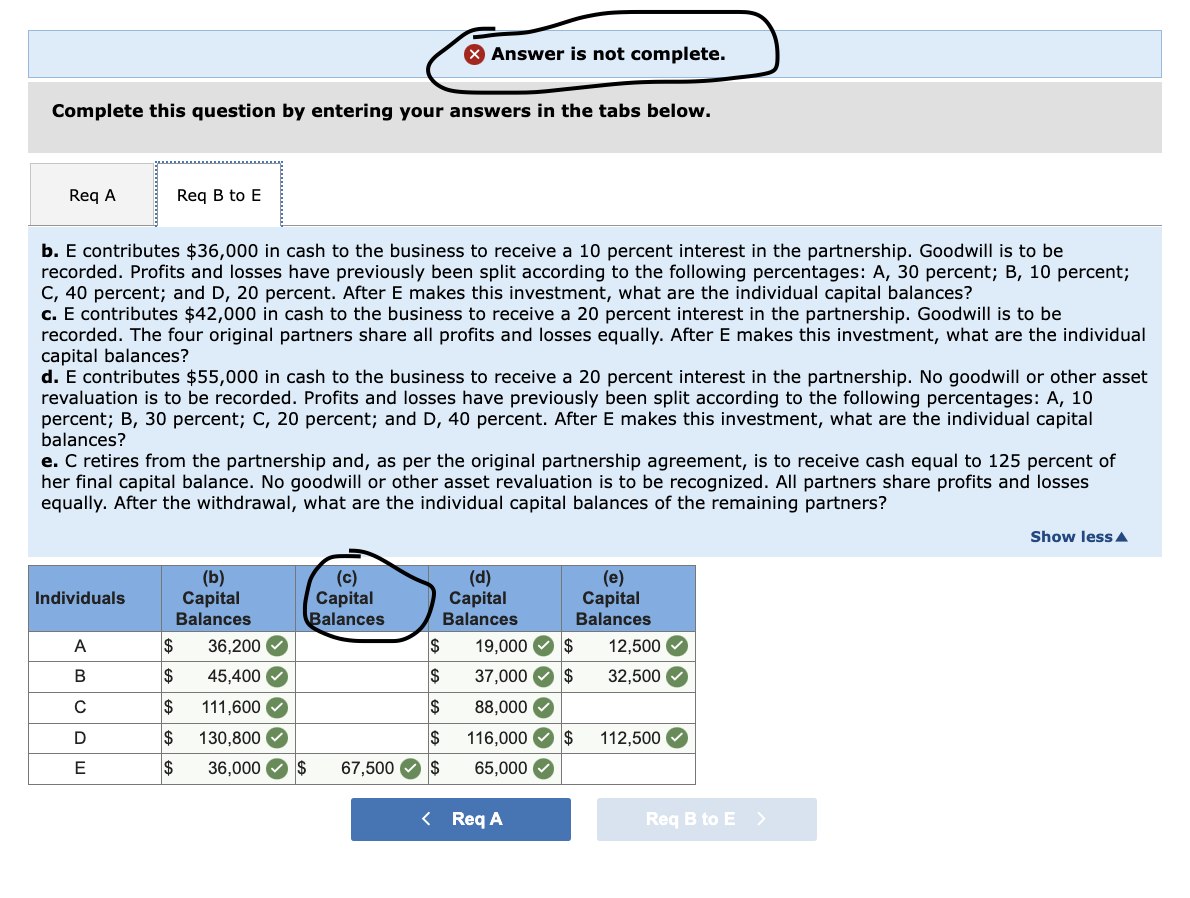

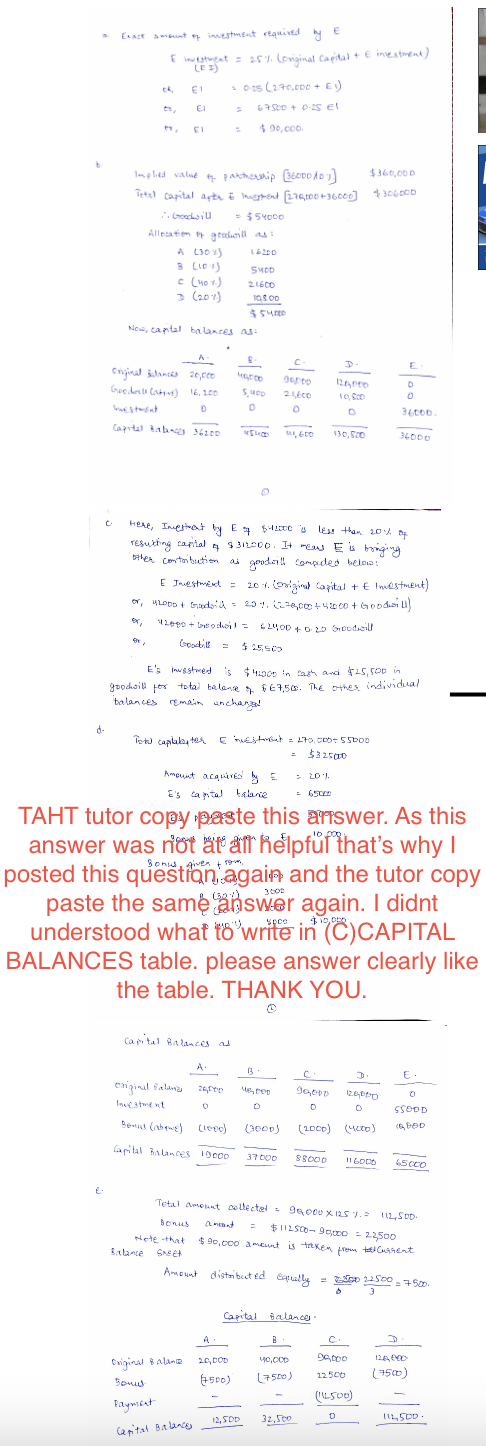

The following is the current balance sheet for a local partnership of doctors: The following questions represent independent situations: a. E is going to invest enough money in this partnership to receive a 25 percent interest. No goodwill or bonus is to be recorded. How much should E invest? b. E contributes $36,000 in cash to the business to receive a 10 percent interest in the partnership. Goodwill is to be recorded. Profits and losses have previously been split according to the following percentages: A, 30 percent; B, 10 percent; C,40 percent; and D,20 percent. After E makes this investment, what are the individual capital balances? c. E contributes $42,000 in cash to the business to receive a 20 percent interest in the partnership. Goodwill is to be recorded. The four original partners share all profits and losses equally. After E makes this investment, what are the individual capital bances? d. E contributes $55,000 in cash to the business to receive a 20 percent interest in the partnership. No goodwill or other asset revaluation is to be recorded. Profits and losses have previously been split according to the following percentages: A, 10 percent; B, 30 percent; C,20 percent; and D, 40 percent. After E makes this investment, what are the individual capital balances? e. C retires from the partnership and, as per the original partnership agreement, is to receive cash equal to 125 percent of her final capital balance. No goodwill or other asset revaluation is to be recognized. All partners share profits and losses equally. After the withdrawal, what are the individual capital balances of the remaining partners? Answer is not complete. Complete this question by entering your answers in the tabs below. E is going to invest enough money in this partnership to receive a 25 percent interest. No goodwill or bonus is to be recorded. How much should E invest? Complete this question by entering your answers in the tabs below. b. E contributes $36,000 in cash to the business to receive a 10 percent interest in the partnership. Goodwill is to be recorded. Profits and losses have previously been split according to the following percentages: A, 30 percent; B,10 percent; C, 40 percent; and D,20 percent. After E makes this investment, what are the individual capital balances? c. E contributes $42,000 in cash to the business to receive a 20 percent interest in the partnership. Goodwill is to be recorded. The four original partners share all profits and losses equally. After E makes this investment, what are the individual capital balances? d. E contributes $55,000 in cash to the business to receive a 20 percent interest in the partnership. No goodwill or other asset revaluation is to be recorded. Profits and losses have previously been split according to the following percentages: A, 10 percent; B, 30 percent; C,20 percent; and D,40 percent. After E makes this investment, what are the individual capital balances? e. C retires from the partnership and, as per the original partnership agreement, is to receive cash equal to 125 percent of her final capital balance. No goodwill or other asset revaluation is to be recognized. All partners share profits and losses equally. After the withdrawal, what are the individual capital balances of the remaining partners? a. Exact smount of investment requived by E E inuteret =25% (onginal capital +E invertment) E. E1 =0.25(270,000+E1) B,E1=67500+0.25E! (1), E1 =$90,000. Implied value of partheralip [36000:07] $360,000 Tital capital apte E merhent [276,00+36000]$306000 Gadwill =$54000 Allestien of perhatll as : A (30x)t6400 8(101)5400 c. (40x)21600 3(20%)$540010800 Now, capital balances as: (1) c. Here, Imestoat by E of \$ilcoe is less thar 20% of resulting captal of $31200. It rew E is briging E Inestment =20 - (eriginal corital +E investment) ex, 42000+b00 dwit =42400+0.20 6rodwill or, coodiu =52550 E's imestreed is \$4:000 in bere and $25, soo in groderill for total talang of 667,50 . The other individual balances cemain unchargas' =532500 Amburt acauivies by E=20% E's cartal talane =650 TAHT tutor copy paste this arrswer. As this answer was n't ant anfl' helpful that's why I posted this questan again and the tutor copy paste the same answer again. I didnt understood what to write in (C)CAPITAL BALANCES table. please answer clearly like the table. THANK YOU. Capital Balances al Tetal areant collecter =9 Ge00 125%=112500. Bonus antunt =$11250090,000=23500 Nete that \$90,000 a maunt is truken from =2500 chirent Balance Sicect Amount distributed equally =0200000322500=7500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts