Question: Please answer only correct answer . Or I will downvote 0.6355 0.5674 XYZ Ltd., a company based in India, manufactures very high quality modem furniture

Please answer only correct answer . Or I will downvote

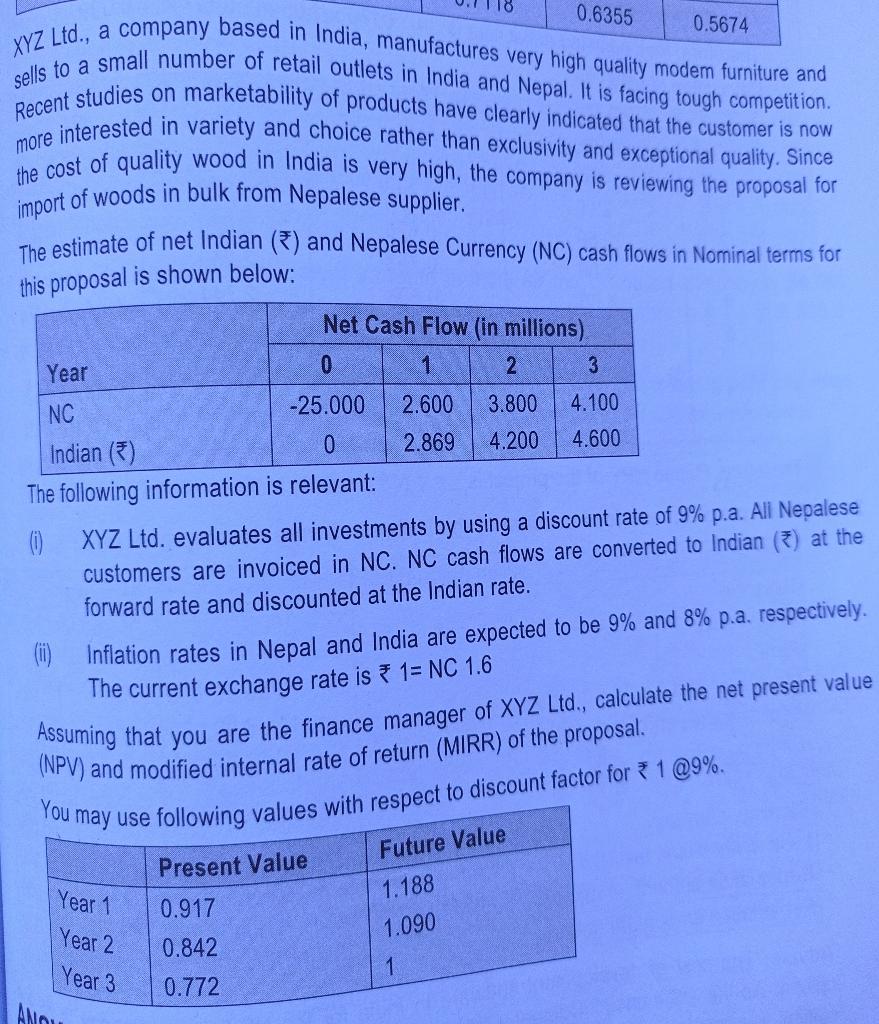

0.6355 0.5674 XYZ Ltd., a company based in India, manufactures very high quality modem furniture and sells to a small number of retail outlets in India and Nepal. It is facing tough competition. Recent studies on marketability of products have clearly indicated that the customer is now more interested in variety and choice rather than exclusivity and exceptional quality. Since the cost of quality wood in India is very high, the company is reviewing the proposal for import of woods in bulk from Nepalese supplier. The estimate of net Indian (T) and Nepalese Currency (NC) cash flows in Nominal terrns for this proposal is shown below: Net Cash Flow (in millions) Year 0 1 2 3 NC -25.000 2.600 3.800 4.100 Indian (5) 0 2.869 4.200 4.600 The following information is relevant: (0) XYZ Ltd. evaluates all investments by using a discount rate of 9% p.a. All Nepalese customers are invoiced in NC. NC cash flows are converted to Indian (5) at the forward rate and discounted at the Indian rate. Inflation rates in Nepal and India are expected to be 9% and 8% p.a. respectively. The current exchange rate is 1= NC 1.6 Assuming that you are the finance manager of XYZ Ltd., calculate the net present value (NPV) and modified internal rate of return (MIRR) of the proposal. You may use following values with respect to discount factor for 1 @9%. Present Value Future Value 1.188 Year 1 0.917 1.090 Year 2 Year 3 0.842 1 0.772 AllowStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock