Question: Please answer only e) Question 1. Derivatives Assume all options are European, and that the underlying asset is a non-dividend paying stock, unless otherwise specified.

Please answer only e)

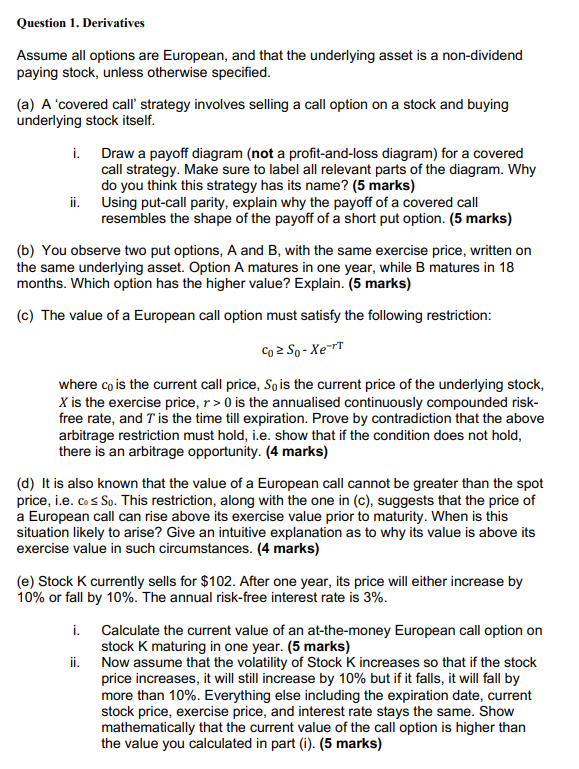

Question 1. Derivatives Assume all options are European, and that the underlying asset is a non-dividend paying stock, unless otherwise specified. (a) A 'covered call strategy involves selling a call option on a stock and buying underlying stock itself. i. Draw a payoff diagram (not a profit-and-loss diagram) for a covered call strategy. Make sure to label all relevant parts of the diagram. Why do you think this strategy has its name? (5 marks) ii. Using put-call parity, explain why the payoff of a covered call resembles the shape of the payoff of a short put option. (5 marks) (b) You observe two put options, A and B, with the same exercise price, written on the same underlying asset. Option A matures in one year, while B matures in 18 months. Which option has the higher value? Explain. (5 marks) (c) The value of a European call option must satisfy the following restriction: Co>So-Xe-TT where co is the current call price, So is the current price of the underlying stock, X is the exercise price, r> 0 is the annualised continuously compounded risk- free rate, and T is the time till expiration. Prove by contradiction that the above arbitrage restriction must hold, i.e. show that if the condition does not hold, there is an arbitrage opportunity. (4 marks) (d) It is also known that the value of a European call cannot be greater than the spot price, i.e. cosso. This restriction, along with the one in (c), suggests that the price of a European call can rise above its exercise value prior to maturity. When is this situation likely to arise? Give an intuitive explanation as to why its value is above its exercise value in such circumstances. (4 marks) (e) Stock K currently sells for $102. After one year, its price will either increase by 10% or fall by 10%. The annual risk-free interest rate is 3%. i. ii. Calculate the current value of an at-the-money European call option on stock K maturing in one year. (5 marks) Now assume that the volatility of Stock K increases so that if the stock price increases, it will still increase by 10% but if it falls, it will fall by more than 10%. Everything else including the expiration date, current stock price, exercise price, and interest rate stays the same. Show mathematically that the current value of the call option is higher than the value you calculated in part (i)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts