Question: Please answer only if you are 100%sure. show to calculation properly. Dont post the same answer already posted by someone esle. Thank you 3. Top,

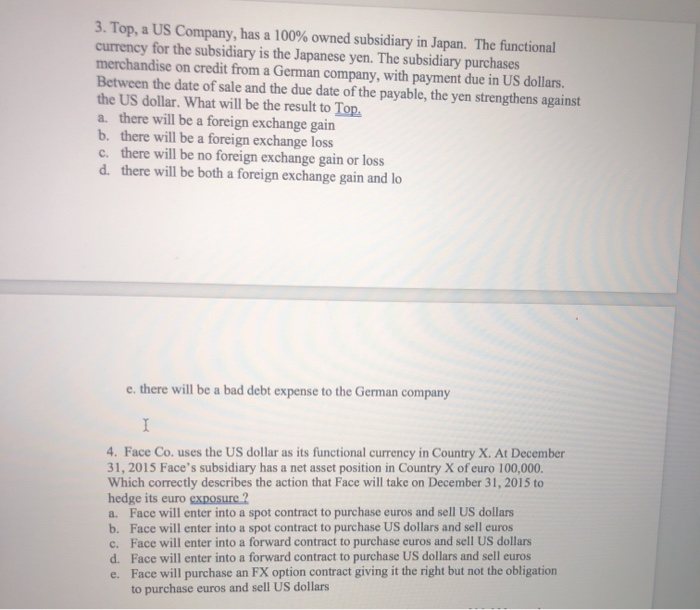

3. Top, a US Company, has a 100% owned subsidiary in Japan. The functional currency for the subsidiary is the Japanese yen. The subsidiary purchases merchandise on credit from a German company, with payment due in US dollars. Between the date of sale and the due date of the payable, the yen strengthens against the US dollar. What will be the result to Top a. there will be a foreign exchange gain b. there will be a foreign exchange loss c. there will be no foreign exchange gain or loss d. there will be both a foreign exchange gain and lo e. there will be a bad debt expense to the German company 1 4. Face Co. uses the US dollar as its functional currency in Country X. At December 31, 2015 Face's subsidiary has a net asset position in Country X of euro 100,000. Which correctly describes the action that Face will take on December 31, 2015 to hedge its euro exposure ? a. Face will enter into a spot contract to purchase euros and sell US dollars b. Face will enter into a spot contract to purchase US dollars and sell euros c. Face will enter into a forward contract to purchase euros and sell US dollars d. Face will enter into a forward contract to purchase US dollars and sell euros e. Face will purchase an FX option contract giving it the right but not the obligation to purchase euros and sell US dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts