Question: *****PLEASE ANSWER ONLY IF YOU ARE SURE - DO NOT COPY AND PASTE THE ALREADY UPLOADED ANSWERS**** Jim is an analyst evaluating Hellenic Water Company

*****PLEASE ANSWER ONLY IF YOU ARE SURE - DO NOT COPY AND PASTE THE ALREADY UPLOADED ANSWERS****

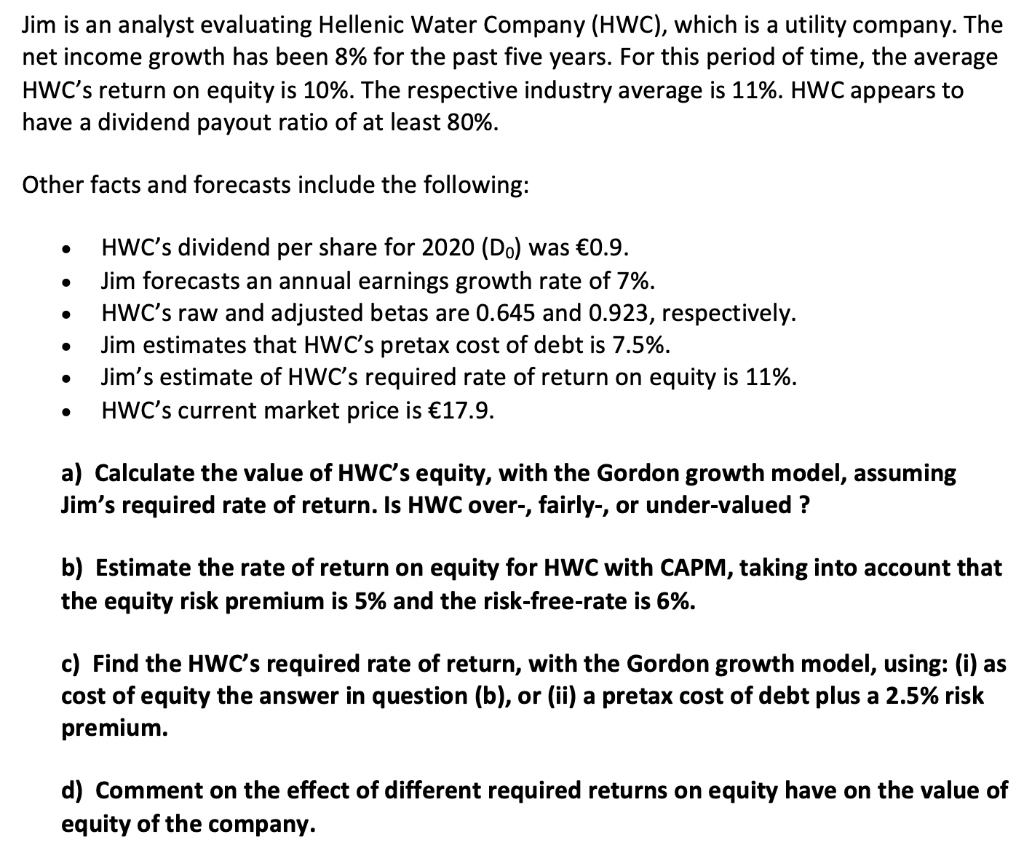

Jim is an analyst evaluating Hellenic Water Company (HWC), which is a utility company. The net income growth has been 8% for the past five years. For this period of time, the average HWC's return on equity is 10%. The respective industry average is 11%. HWC appears to have a dividend payout ratio of at least 80%. Other facts and forecasts include the following: . . HWC's dividend per share for 2020 (Do) was 0.9. Jim forecasts an annual earnings growth rate of 7%. HWC's raw and adjusted betas are 0.645 and 0.923, respectively. Jim estimates that HWC's pretax cost of debt is 7.5%. Jim's estimate of HWC's required rate of return on equity is 11%. HWC's current market price is 17.9. . a) Calculate the value of HWC's equity, with the Gordon growth model, assuming Jim's required rate of return. Is HWC over-, fairly-, or under-valued ? b) Estimate the rate of return on equity for HWC with CAPM, taking into account that the equity risk premium is 5% and the risk-free-rate is 6%. c) Find the HWC's required rate of return, with the Gordon growth model, using: (i) as cost of equity the answer in question (b), or (ii) a pretax cost of debt plus a 2.5% risk premium. d) Comment on the effect of different required returns on equity have on the value of equity of the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts