Question: Please answer only if you know correct answer or else I will dislike your answer 2 A USA based company is planning to set up

Please answer only if you know correct answer or else I will dislike your answer

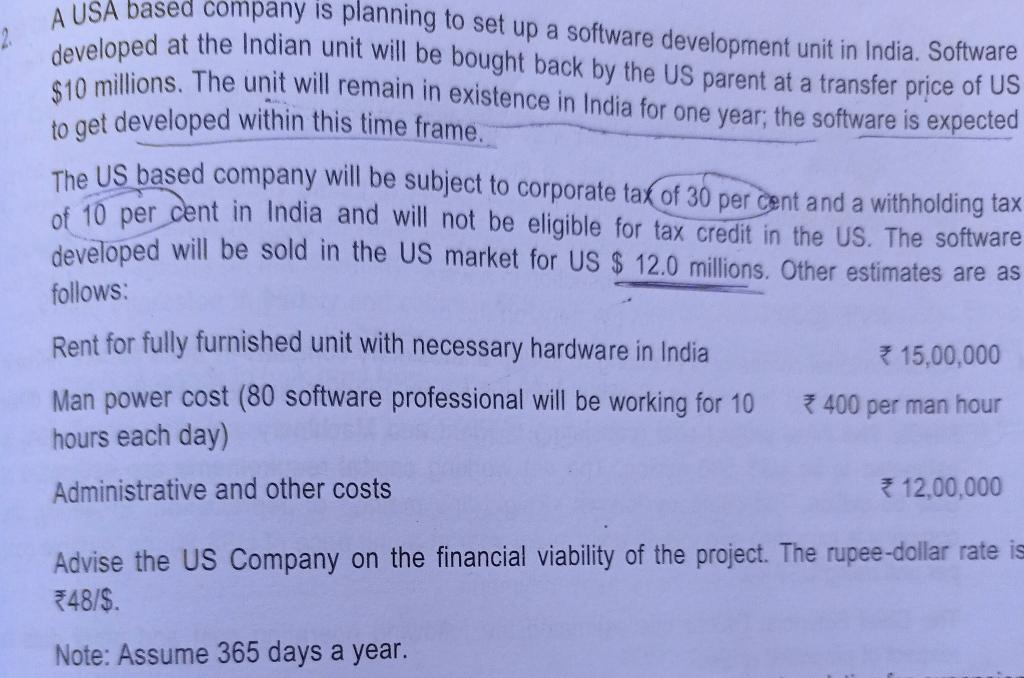

2 A USA based company is planning to set up a software development unit in India. Software developed at the Indian unit will be bought back by the US parent at a transfer price of US $10 millions. The unit will remain in existence in India for one year, the software is expected to get developed within this time frame. The US based company will be subject to corporate tax of 30 per cent and a withholding tax of 10 per cent in India and will not be eligible for tax credit in the US. The software developed will be sold in the US market for US $ 12.0 millions. Other estimates are as follows: Rent for fully furnished unit with necessary hardware in India * 15,00,000 Man power cost (80 software professional will be working for 10 *400 per man hour hours each day) Administrative and other costs * 12,00,000 Advise the US Company on the financial viability of the project. The rupee-dollar rate is 48/$. Note: Assume 365 days a yearStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock