Question: Please answer only number 6 Consider the following model: ER- Wrinky What is the degree of risk aversion required such that an investor would put

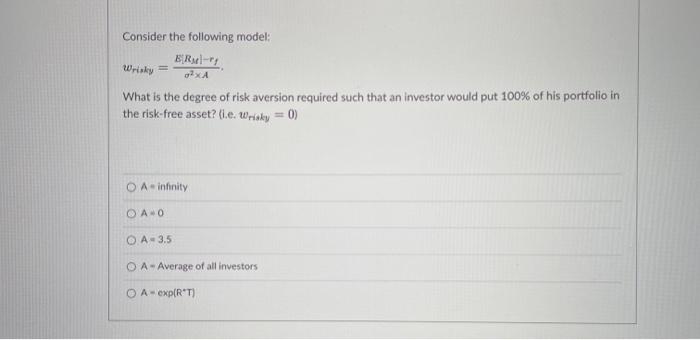

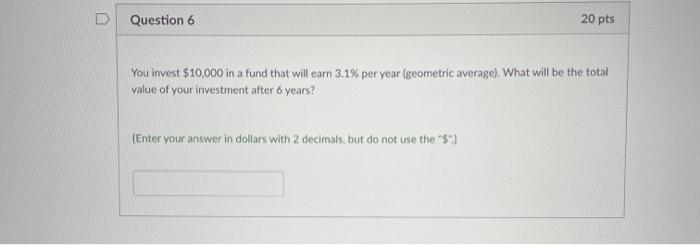

Consider the following model: ER- Wrinky What is the degree of risk aversion required such that an investor would put 100% of his portfolio in the risk-free asset? (.e. Wraky = 0) A infinity OA-3.5 O A- Average of all investors O A exp[R*T) Question 6 20 pts You invest $10,000 in a fund that will earn 3.1% per year (geometric average. What will be the total value of your investment after 6 years? (Enter your answer in dollars with 2 decimals, but do not use the "$")

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts