Question: PLEASE ANSWER ONLY PART C a) Business School Ltd. is an active participant in both the currency and ammonia markets. Although it is a Dutch

PLEASE ANSWER ONLY PART C

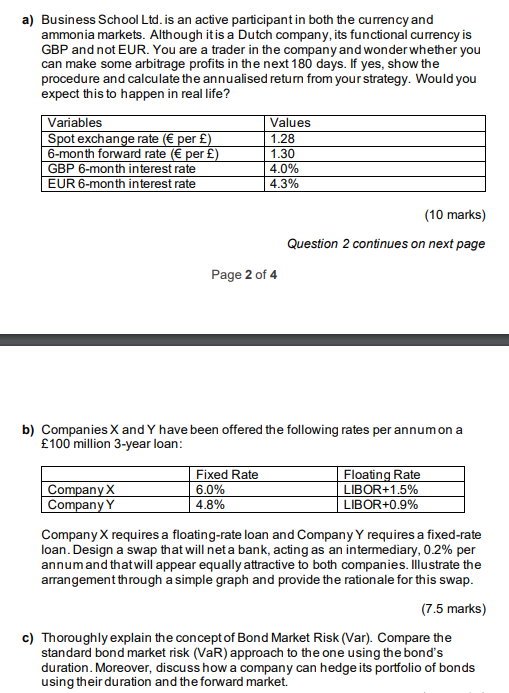

a) Business School Ltd. is an active participant in both the currency and ammonia markets. Although it is a Dutch company, its functional currency is GBP and not EUR. You are a trader in the company and wonder whether you can make some arbitrage profits in the next 180 days. If yes, show the procedure and calculate the annualised return from your strategy. Would you expect this to happen in real life? Variables Values Spot exchange rate ( per ) 1.28 6-month forward rate ( per ) 1.30 GBP 6-month interest rate 4.0% EUR 6-month interest rate 4.3% (10 marks) Question 2 continues on next page Page 2 of 4 b) Companies X and Y have been offered the following rates per annumon a 100 million 3-year loan: Fixed Rate Floating Rate Company X 6.0% LIBOR+1.5% Company Y 4.8% LIBOR+0.9% Company X requires a floating-rate loan and Company Y requires a fixed-rate loan. Design a swap that will net a bank, acting as an intermediary, 0.2% per annum and that will appear equally attractive to both companies. Illustrate the arrangement through a simple graph and provide the rationale for this swap. (7.5 marks) c) Thoroughly explain the concept of Bond Market Risk (Var). Compare the standard bond market risk (VaR) approach to the one using the bond's duration. Moreover, discuss how a company can hedge its portfolio of bonds using their duration and the forward market. a) Business School Ltd. is an active participant in both the currency and ammonia markets. Although it is a Dutch company, its functional currency is GBP and not EUR. You are a trader in the company and wonder whether you can make some arbitrage profits in the next 180 days. If yes, show the procedure and calculate the annualised return from your strategy. Would you expect this to happen in real life? Variables Values Spot exchange rate ( per ) 1.28 6-month forward rate ( per ) 1.30 GBP 6-month interest rate 4.0% EUR 6-month interest rate 4.3% (10 marks) Question 2 continues on next page Page 2 of 4 b) Companies X and Y have been offered the following rates per annumon a 100 million 3-year loan: Fixed Rate Floating Rate Company X 6.0% LIBOR+1.5% Company Y 4.8% LIBOR+0.9% Company X requires a floating-rate loan and Company Y requires a fixed-rate loan. Design a swap that will net a bank, acting as an intermediary, 0.2% per annum and that will appear equally attractive to both companies. Illustrate the arrangement through a simple graph and provide the rationale for this swap. (7.5 marks) c) Thoroughly explain the concept of Bond Market Risk (Var). Compare the standard bond market risk (VaR) approach to the one using the bond's duration. Moreover, discuss how a company can hedge its portfolio of bonds using their duration and the forward market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts