Question: please answer only Problem 6 psni mba ssadored.vit alsource.com/ #/books, 1 2601 84404/ch/6/36/4/4/71 2/216@0:9.01 3. What are the expected rates of return for Stocks X

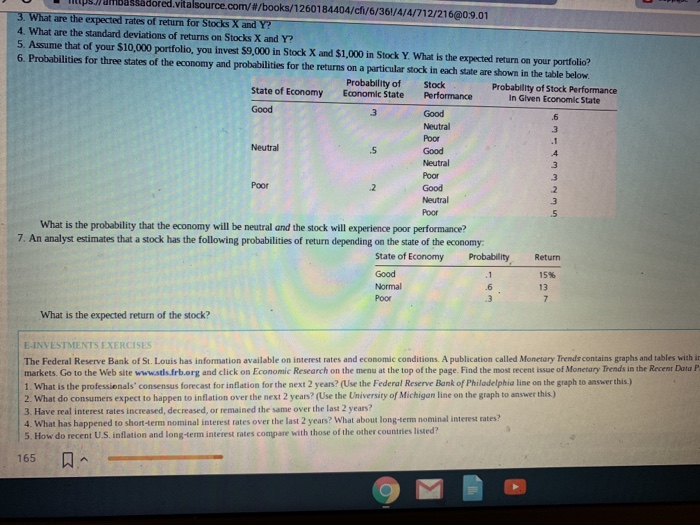

psni mba ssadored.vit alsource.com/ #/books, 1 2601 84404/ch/6/36/4/4/71 2/216@0:9.01 3. What are the expected rates of return for Stocks X and Y? 4. What are the standard deviations of returns on Stocks X and Y? 5. Assume that of your $10,000 portfolio, you invest $9,000 in Stock X and $1,000 in Stock Y What is the expected return on your portfolio? 6. Probabilities for three states of the economy and probabilities for the returns on a particular stock in each state are shown in the table below. Probability of Economic State Stock Performance Probability of Stock Performance In Given Economic State State of Economy Good Good .6 Poor Neutral .2 Good Neutral Poor What is the probability that the economy will be neutral and the stock will experience poor performance? 7. An analyst estimates that a stock has the following probabilities of return depending on the state of the economy State of Economy Probability Return Good 15% 13 Poor What is the expected return of the stock? E-INVESTMENTS EXERCISES The Federal Reserve Bank of St. Louis has information available on interest rates and economic conditions A publication called Monetary Trends contains graphs and tables with in markets. Go to the Web site www.stls.frb.org and click on Economic Research on the menu at the top of the page. Find the most recent issue of Monetary Trends in the Recent Data P 1. What is the professienals consensus forecast for inflation for the next 2 years? (Use the Federal Reserve Bank of Philodelphia line on the graph to answer this) 2. What do consumers expect to happen to inflation over the next 2 years? (Use the University of Michigan line on the graph to answer this.) 3. Have real interest rates increased, decreased, or remained the same over the last 2 years? 4. What has happened to short-tem nominal interest rates over the last 2 years? What about long-tem nominal interest rates? 5. How do recent U.S. inflation and long-term interest rates compare with those of the other countries listed? 165

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts