Question: Please answer only Question 2 and show relevant steps how you came to your conclusion. Q2: How large of a loan would be needed by

Please answer only Question 2 and show relevant steps how you came to your conclusion.

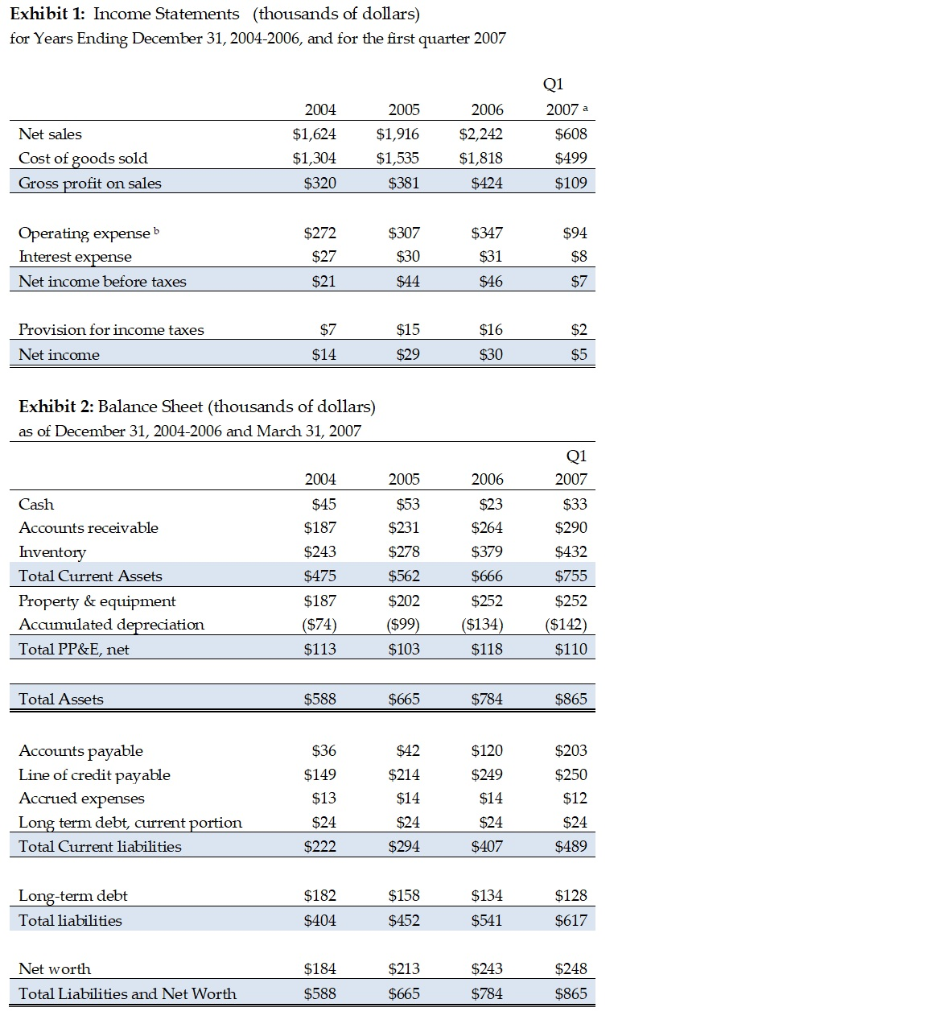

Q2: How large of a loan would be needed by year end 2007 to allow Jones Electrical to take advantage of the discount offered by his suppliers? Consider the impact of these discounts on COGS and Inventory as well. You can assume dividends are $0.

Exhibit 1: Income Statements (thousands of dollars) for Years Ending December 31, 2004-2006, and for the first quarter 2007 2004 $1,624 $1,304 $320 2005 $1,916 $1,535 $381 2006 $2,242 $1,818 $424 2007 a $608 $499 $109 Net sales s solc Gross profit on sales Operating expenseb Interest ex Net income before taxes $272 $27 $307 $30 $347 $94 Provision for income taxes Net income $14 $30 Exhibit 2: Balance Sheet (thousands of dollars) as of December 31, 2004-2006 and March 31, 2007 2004 2005 2006 2007 $187 $243 $475 $187 $74 $113 $231 $278 $562 $202 $264 $379 Accounts receivable Inventory Total Cuurrent Assets Property& equipment Accumulated d Total PP&E, net $290 $432 $755 $252 $142 $110 $252 $134 $118 $103 Total Assets $588 $665 $784 $865 $120 $249 $203 $250 Accounts payable Line of credit payable Accrued expenses Long term debt, current portion Total Current liabilities $36 $149 $42 $214 $24 $222 $24 $489 $294 $407 $182 $158 $452 $134 $541 $128 term debt Total liabilities $404 $617 $248 $865 Net worth $213 $243 Total Liabilities and Net Worth $588 $784 Exhibit 1: Income Statements (thousands of dollars) for Years Ending December 31, 2004-2006, and for the first quarter 2007 2004 $1,624 $1,304 $320 2005 $1,916 $1,535 $381 2006 $2,242 $1,818 $424 2007 a $608 $499 $109 Net sales s solc Gross profit on sales Operating expenseb Interest ex Net income before taxes $272 $27 $307 $30 $347 $94 Provision for income taxes Net income $14 $30 Exhibit 2: Balance Sheet (thousands of dollars) as of December 31, 2004-2006 and March 31, 2007 2004 2005 2006 2007 $187 $243 $475 $187 $74 $113 $231 $278 $562 $202 $264 $379 Accounts receivable Inventory Total Cuurrent Assets Property& equipment Accumulated d Total PP&E, net $290 $432 $755 $252 $142 $110 $252 $134 $118 $103 Total Assets $588 $665 $784 $865 $120 $249 $203 $250 Accounts payable Line of credit payable Accrued expenses Long term debt, current portion Total Current liabilities $36 $149 $42 $214 $24 $222 $24 $489 $294 $407 $182 $158 $452 $134 $541 $128 term debt Total liabilities $404 $617 $248 $865 Net worth $213 $243 Total Liabilities and Net Worth $588 $784

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts