Question: please answer only questions 3 and 4 3. Options Hedging: On March 15, a US firm is planning to import Indian software worth Rs. 1

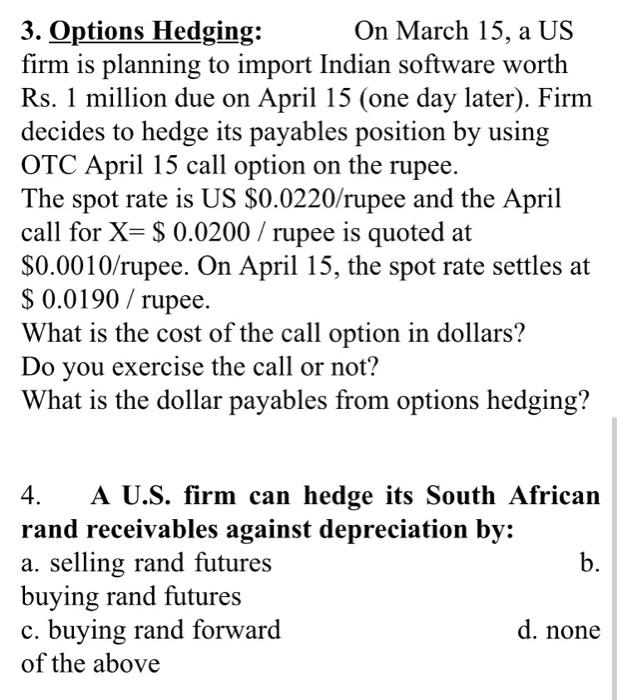

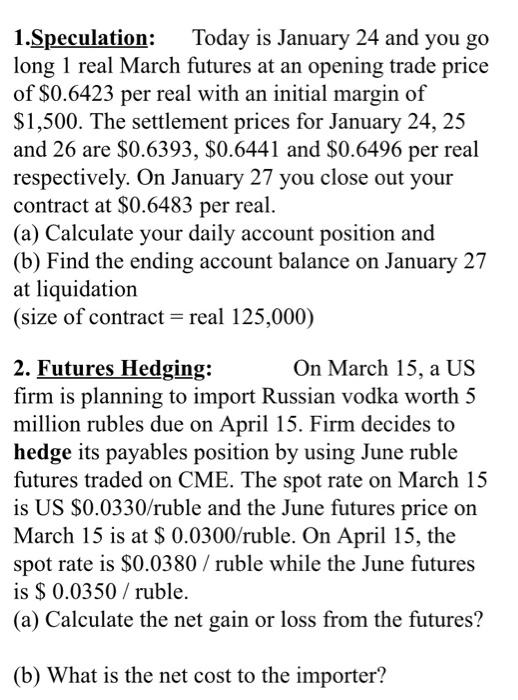

3. Options Hedging: On March 15, a US firm is planning to import Indian software worth Rs. 1 million due on April 15 (one day later). Firm decides to hedge its payables position by using OTC April 15 call option on the rupee. The spot rate is US $0.0220/rupee and the April call for X= $ 0.0200 / rupee is quoted at $0.0010/rupee. On April 15, the spot rate settles at $ 0.0190 / rupee. What is the cost of the call option in dollars? Do you exercise the call or not? What is the dollar payables from options hedging? 4. A U.S. firm can hedge its South African rand receivables against depreciation by: a. selling rand futures b. buying rand futures c. buying rand forward of the above d. none 1.Speculation: Today is January 24 and you go long 1 real March futures at an opening trade price of $0.6423 per real with an initial margin of $1,500. The settlement prices for January 24, 25 and 26 are $0.6393, $0.6441 and $0.6496 per real respectively. On January 27 you close out your contract at $0.6483 per real. (a) Calculate your daily account position and (b) Find the ending account balance on January 27 at liquidation (size of contract = real 125,000) 2. Futures Hedging: On March 15, a US firm is planning to import Russian vodka worth 5 million rubles due on April 15. Firm decides to hedge its payables position by using June ruble futures traded on CME. The spot rate on March 15 is US $0.0330/ruble and the June futures price on March 15 is at $ 0.0300/ruble. On April 15, the spot rate is $0.0380 / ruble while the June futures is $ 0.0350 / ruble. (a) Calculate the net gain or loss from the futures? (b) What is the net cost to the importer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts