Question: PLEASE ANSWER ONLY THE BLANK LINE SECTION, THEN EXPLAIN. I NEED ANSWERS TO THE BLANK LINE. PLEASE ANSWER IF YOU ARE 100% SURE. Many states

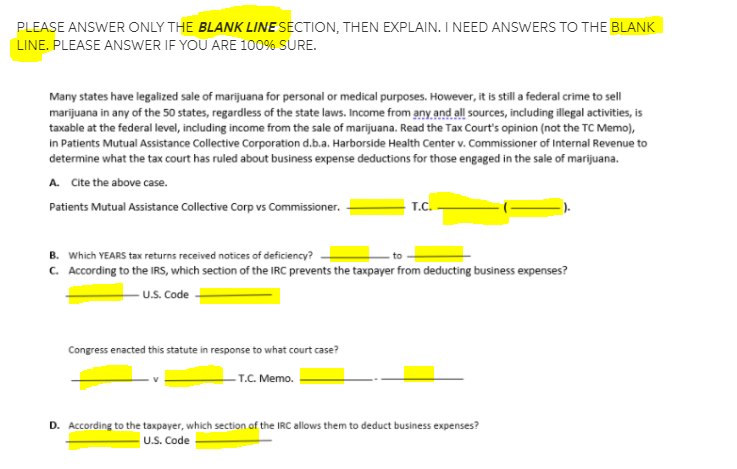

PLEASE ANSWER ONLY THE BLANK LINE SECTION, THEN EXPLAIN. I NEED ANSWERS TO THE BLANK LINE. PLEASE ANSWER IF YOU ARE 100% SURE. Many states have legalized sale of marijuana for personal or medical purposes. However, it is still a federal crime to sell marijuana in any of the 50 states, regardless of the state laws. Income from any and all sources, including illegal activities, is taxable at the federal level, including income from the sale of marijuana. Read the Tax Court's opinion (not the TC Memo), in Patients Mutual Assistance Collective Corporation d.b.a. Harborside Health Center v. Commissioner of Internal Revenue to determine what the tax court has ruled about business expense deductions for those engaged in the sale of marijuana. A. Cite the above case. Patients Mutual Assistance Collective Corp vs Commissioner. T.C. B. Which YEARS tax returns received notices of deficiency? C. According to the IRS, which section of the IRC prevents the taxpayer from deducting business expenses? U.S. Code Congress enacted this statute in response to what court case? T.C. Memo. D. According to the taxpayer, which section of the IRC allows them to deduct business expenses? U.S. Code

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts