Question: please answer only this question Refer to Question 1. What is the ROIC for the Year 5? 1- Using the data below, you are responsible

please answer only this question Refer to Question 1. What is the ROIC for the Year 5?

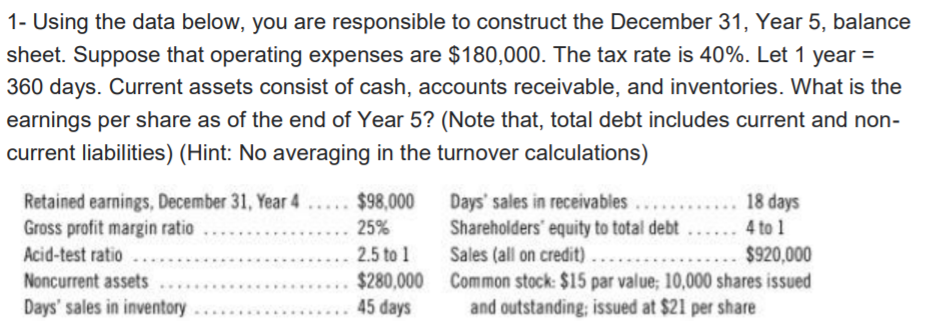

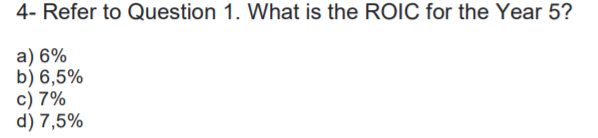

1- Using the data below, you are responsible to construct the December 31, Year 5, balance sheet. Suppose that operating expenses are $180,000. The tax rate is 40%. Let 1 year = 360 days. Current assets consist of cash, accounts receivable, and inventories. What is the earnings per share as of the end of Year 5? (Note that, total debt includes current and non- current liabilities) (Hint: No averaging in the turnover calculations) Retained earnings, December 31, Year 4 Gross profit margin ratio .... Acid-test ratio Noncurrent assets Days' sales in inventory... $98,000 Days' sales in receivables ...... 18 days 25% Shareholders' equity to total debt...... 4 to 1 2.5 to 1 Sales (all on credit) $920,000 $280,000 Common stock: $15 par value; 10,000 shares issued 45 days and outstanding, issued at $21 per share 4- Refer to Question 1. What is the ROIC for the Year 5? a) 6% b) 6,5% c) 7% d) 7,5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts