Question: Please answer P2A & P2B P2A: Bond Pricing On 1/1/14 Zee Company issued the following bond: par value $1K, term 3 years, stated interest rate

Please answer P2A & P2B

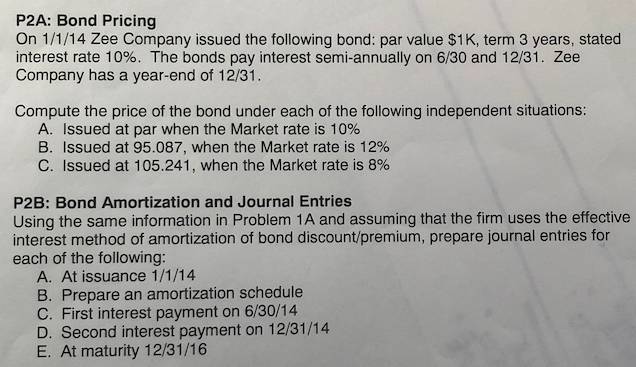

P2A: Bond Pricing On 1/1/14 Zee Company issued the following bond: par value $1K, term 3 years, stated interest rate 10%. The bonds pay interest semi-annually Company has a year-end of 12/31 on 6/30 and 12/31. Zee Compute the price of the bond under each of the following independent situations: A. Issued at par when the Market rate is 10% B. Issued at 95.087, when the Market rate is 12% C. Issued at 105.241, when the Market rate is 8% P2B: Bond Amortization and Journal Entries Using the same information in Problem 1A and assuming that the firm uses the effective interest method of amortization of bond discount/premium, prepare journal entries for each of the following: A. At issuance 1/1/14 B. Prepare an amortization schedule C. First interest payment on 6/30/14 D.Second interest payment on 12/31/14 E. At maturity 12/31/16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts