Question: please answer part 1 and type the answer (no handwriting please) Part I: WACC Qi. Firm A has a target debt-equity ratio of .55. Its

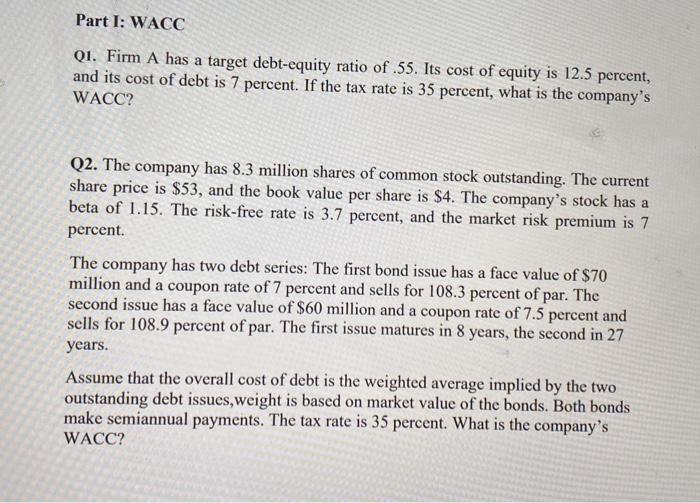

Part I: WACC Qi. Firm A has a target debt-equity ratio of .55. Its cost of equity is 12.5 percent, and its cost of debt is 7 percent. If the tax rate is 35 percent, what is the company's WACC? Q2. The company has 8.3 million shares of common stock outstanding. The current share price is $53, and the book value per share is $4. The company's stock has a beta of 1.15. The risk-free rate is 3.7 percent, and the market risk premium is 7 percent. The company has two debt series: The first bond issue has a face value of $70 million and a coupon rate of 7 percent and sells for 108.3 percent of par. The second issue has a face value of $60 million and a coupon rate of 7.5 percent and sells for 108.9 percent of par. The first issue matures in 8 years, the second in 27 years. Assume that the overall cost of debt is the weighted average implied by the two outstanding debt issues,weight is based on market value of the bonds. Both bonds make semiannual payments. The tax rate is 35 percent. What is the company's WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts