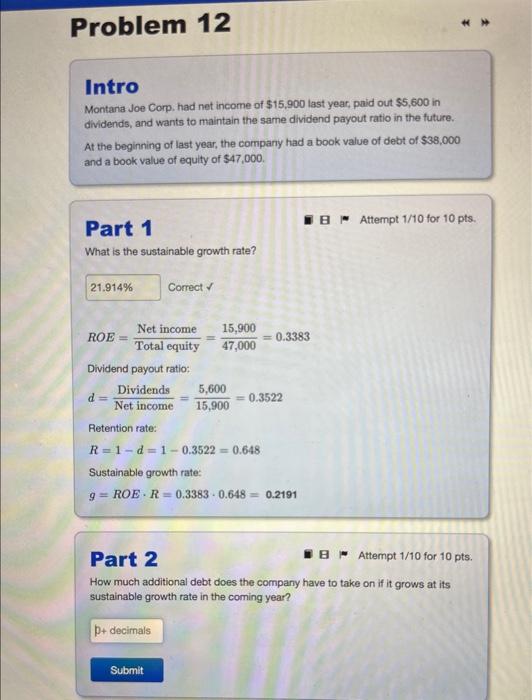

Question: please answer part 2 Intro Montans Joe Corp, had net income of $15,900 last year, paid out $5,600 in dividends, and wants to maintain the

Intro Montans Joe Corp, had net income of $15,900 last year, paid out $5,600 in dividends, and wants to maintain the same dividend payout ratio in the future. At the beginning of last year, the company had a book value of debt of $38,000 and a book value of equity of $47,000. Part 1 A Attempt 1/10 for 10pts. What is the sustainable growth rate? Correct ROE=TotalequityNetincome=47,00015,900=0.3383 Dividend payout ratio: d=NetincomeDividends=15,9005,600=0.3522 Retention rate: R=1d=10.3522=0.648 Sustainable growth rate: g=ROER=0.33830.648=0.2191 Part 2 Attempt 1/10 for 10 pts. How much additional debt does the company have to take on if it grows at its sustainable growth rate in the coming year? Intro Montans Joe Corp, had net income of $15,900 last year, paid out $5,600 in dividends, and wants to maintain the same dividend payout ratio in the future. At the beginning of last year, the company had a book value of debt of $38,000 and a book value of equity of $47,000. Part 1 A Attempt 1/10 for 10pts. What is the sustainable growth rate? Correct ROE=TotalequityNetincome=47,00015,900=0.3383 Dividend payout ratio: d=NetincomeDividends=15,9005,600=0.3522 Retention rate: R=1d=10.3522=0.648 Sustainable growth rate: g=ROER=0.33830.648=0.2191 Part 2 Attempt 1/10 for 10 pts. How much additional debt does the company have to take on if it grows at its sustainable growth rate in the coming year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts