Question: please answer part 2 using the instructions provided. Problem 2. You want to deposit money in a Bank Bank A's deposit offers a nominal annual

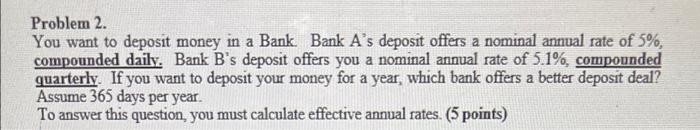

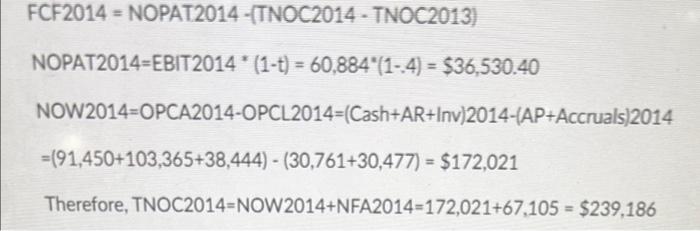

Problem 2. You want to deposit money in a Bank Bank A's deposit offers a nominal annual rate of 5%, compounded daily. Bank B's deposit offers you a nominal annual rate of 5.1%, compounded quarterly. If you want to deposit your money for a year, which bank offers a better deposit deal? Assume 365 days per year. To answer this question, you must calculate effective annual rates. (5 points) FCF2014 - NOPAT2014 - (TNOC2014 - TNOC2013) NOPAT2014-EBIT2014 (1-t) = 60,884(1-4) - $36,530.40 NOW2014=OPCA2014-OPCL2014=(Cash+AR+Inv)2014-AP+Accruals)2014 =191,450+103,365+38,444) - (30,761+30,477) = $172,021 Therefore, TNOC2014=NOW 2014+NFA2014=172,021+67,105 = $239,186

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts