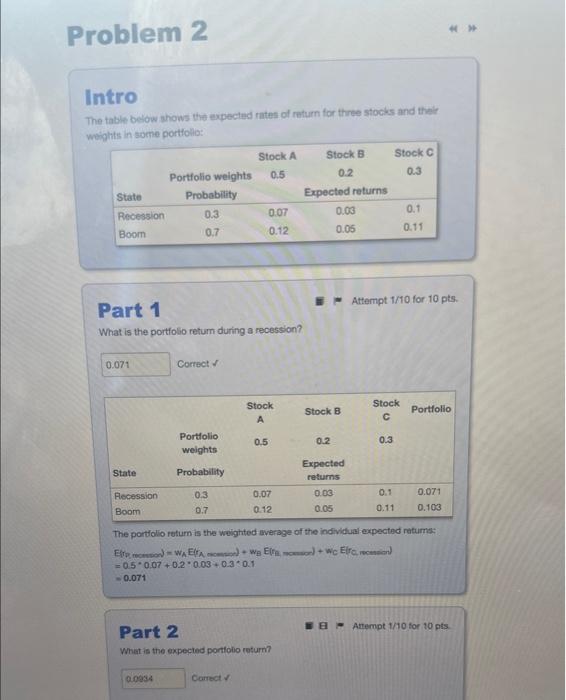

Question: please answer part 3 Intro The table below ahows the expected rates of return for three stocks and their Part 1 Attempt 1/10 for 10pts.

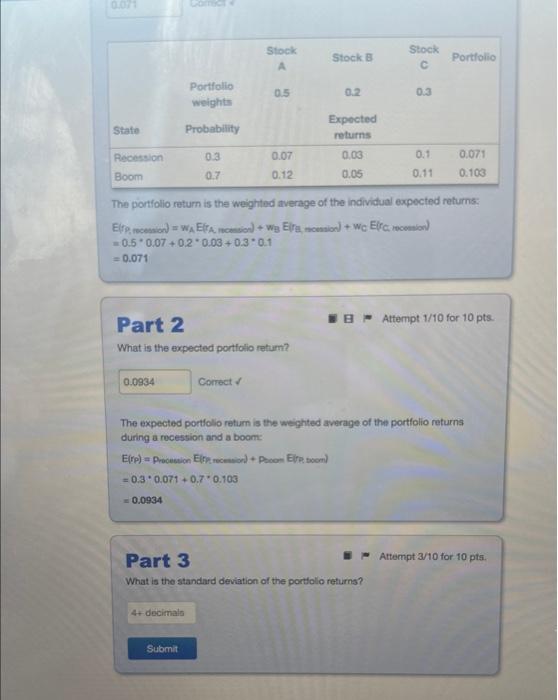

Intro The table below ahows the expected rates of return for three stocks and their Part 1 Attempt 1/10 for 10pts. What is the portfolio retum during a recession? Correct d The portlolio retum is the weighted average of the individual expected ratums: =0.50.07+0.20.03+0.30.1 0.071 Part 2 Antempt 1/10 for 10 pts. What is the expected pontolio returm? caniect The portfolio retum is the weighted average of the individual expected returns: =0.50.07+0.20.03+0.30.1=0.071 Part 2 Attempt 1/10 for 10 pts. What is the expected portiolio retum? Corroct & The expected portfolio retum is the weighted average of the portfolio returns during a rocession and a boom: E(rp)=ProcewionE(rhrecension)+PtoonElresoonl=0.30.071+0.70.103=0.0934 Part 3 Attempt 3/10 for 10 pts. What is the standard deviation of the portfolio returns? Intro The table below ahows the expected rates of return for three stocks and their Part 1 Attempt 1/10 for 10pts. What is the portfolio retum during a recession? Correct d The portlolio retum is the weighted average of the individual expected ratums: =0.50.07+0.20.03+0.30.1 0.071 Part 2 Antempt 1/10 for 10 pts. What is the expected pontolio returm? caniect The portfolio retum is the weighted average of the individual expected returns: =0.50.07+0.20.03+0.30.1=0.071 Part 2 Attempt 1/10 for 10 pts. What is the expected portiolio retum? Corroct & The expected portfolio retum is the weighted average of the portfolio returns during a rocession and a boom: E(rp)=ProcewionE(rhrecension)+PtoonElresoonl=0.30.071+0.70.103=0.0934 Part 3 Attempt 3/10 for 10 pts. What is the standard deviation of the portfolio returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts